Cisco 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Welcome to the Human Network

Lit# 930030706 • SKU# 1028-AR-06 Printed on recycled paper.

Corporate Headquarters • Cisco Systems, Inc. • 170 West Tasman Drive • San Jose, CA 95134-1706 • USA • Tel: 408 526-4000 • 800 553-NETS (6387) • www.cisco.com

Cisco Systems, Inc. 2006 Annual Report

Table of contents

-

Page 1

Welcome to the Human Network Cisco Systems, Inc. 2006 Annual Report -

Page 2

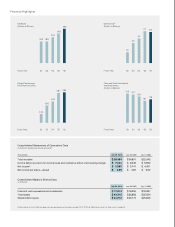

... of Operations Data (in millions, except per-share amounts) Years Ended July 29, 2006 July 30, 2005 July 31, 2004 Total net sales Income before provision for income taxes and cumulative effect of accounting change Net income(1) Net income per share-diluted $ 28,484 $ 7,633 $ 5,580 $ 0.89 $ 24... -

Page 3

... more powerful together than we ever could be apart. Welcome to the human network. Introduction 1 Letter to Shareholders 12 Reports of Management 16 Report of Independent Registered Public Accounting Firm 17 Selected Financial Data 18 Management's Discussion and Analysis of Financial Condition and... -

Page 4

...The Cisco connected home coordinates all the connections. So whether you take the cliffhanger, the arias, and the numbers with you or enjoy them at home, the experiences are endless. Cartoons on the phone. Mozart in the shower. Stock ticker in the kitchen. 2 Cisco Systems, Inc. 2006 Annual Report 3 -

Page 5

... Students use a Cisco IP network to access curriculum online and tap into a universe of up-to-date resources on the Internet. Homework is done right on the laptop. And children have connections to other classrooms-and to experiences from around the world. 4 Cisco Systems, Inc. 2006 Annual Report 5 -

Page 6

... talking. Cisco Unified Communications delivers a rich experience of voice, video, and data communications for businesses of all sizes, reducing frustration and boosting productivity. And that sounds good in any language. More Guten Tag, less phone tag. 6 Cisco Systems, Inc. 2006 Annual Report 7 -

Page 7

... customers, associates, and suppliers from around the world into your conference room-with no jet lag. And once you see and hear each other, TelePresence communicates with more than just words. Because sometimes, even the smallest gesture can speak volumes. 8 Cisco Systems, Inc. 2006 Annual Report... -

Page 8

... a satellite, this integrated solution delivers highly secure Internet access, a wireless hotspot, mobile radio, video, and more. It's portable and sets up in minutes to open the channels of communication and connect the lifeline. 10 Cisco Systems, Inc. Open box, save lives. 2006 Annual Report 11 -

Page 9

... applications and services to our customers and by enabling greater productivity, new business models, and expanded forms of entertainment. Internet traffic continues to grow, driven in part by the rapid expansion of video traffic over the network. Our successful acquisition of Scientific Atlanta... -

Page 10

... year. Of particular interest in fiscal 2006 was the service provider acceptance and business momentum of our CRS-1 Carrier Routing System. Our unified communications advanced technology, formerly enterprise IP communications, has positioned Cisco as the market share leader in the enterprise voice... -

Page 11

...success and trust as a corporate citizen. Cisco's products promote collaboration and communication of information that is used not only to power businesses, but to modernize governments, support education, and foster economic development as well. We partner with Lawrence Berkeley National Laboratory... -

Page 12

... new challenges and state-of-the-art applications. At this year's annual meeting in November 2006, John Morgridge will step down from his day-to-day responsibilities as chairman of the board. We thank John for his many years of service to Cisco, and for his invaluable contributions to our business... -

Page 13

... by Cisco's Board of Directors, has established and maintains a strong ethical climate so that our affairs are conducted to the highest standards of personal and corporate conduct. Management also has established an effective system of internal control over financial reporting. Cisco's policies... -

Page 14

... Cisco Systems, Inc.'s 2006 and 2005 consolidated financial statements and of its internal control over financial reporting as of July 29, 2006, and an audit of its 2004 consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 15

... was no stock-based compensation expense related to employee stock options and employee stock purchases under Statement of Financial Accounting Standards No. 123, "Accounting for Stock-Based Compensation" ("SFAS 123"), prior to fiscal 2006 because the Company did not adopt the recognition provisions... -

Page 16

... network infrastructures that support tools and applications that allow them to communicate with key stakeholders, including customers, prospects, business partners, suppliers, and employees. Our product offerings fall into several categories: our core technologies, routing and switching; advanced... -

Page 17

... Financial Statements were included for fiscal 2005 (in millions, except per-share amounts): Years Ended July 29, 2006 July 30, 2005 Net income-as reported for fiscal 2005(1) Stock-based compensation expense related to employee stock options and employee stock purchases Tax benefit Stock... -

Page 18

...as of July 29, 2006 and July 30, 2005, respectively. We make sales to distributors and retail partners and recognize revenue based on a sell-through method using information provided by them. Our distributors and retail partners participate in various cooperative marketing and other programs, and we... -

Page 19

... volume of product returns within the warranty period and the cost to repair or replace the equipment. Technical support labor cost is estimated based primarily upon historical trends in the rate of customer cases and the cost to support the customer cases within the warranty period. Overhead cost... -

Page 20

... restructuring, disposing of, or otherwise exiting businesses, which could result in an impairment of goodwill. Beginning in fiscal 2006, the reportable segments were changed to the following theaters: United States and Canada; European Markets; Emerging Markets; Asia Pacific; and Japan. As a result... -

Page 21

... evaluate current information available to us to determine whether such accruals should be adjusted and whether new accruals are required. Financial Data for Fiscal 2006, 2005, and 2004 Net Sales The following table presents the breakdown of net sales between product and service revenue (in... -

Page 22

... table presents the breakdown of net product sales by theater (in millions, except percentages): Variance in Dollars Variance in Percent Variance in Dollars Variance in Percent Years Ended July 29, 2006 July 30, 2005 July 30, 2005 July 31, 2004 Net product sales: United States and Canada... -

Page 23

...increased information technology-related capital spending in our enterprise, service provider, commercial, and consumer markets, and the acquisition of Scientific-Atlanta. Net sales for fiscal 2006 include Scientific-Atlanta's contribution for the five-month period subsequent to the acquisition date... -

Page 24

...IP communications solutions to service providers and the contribution of net product sales related to Scientific-Atlanta. Net product sales for mobile wireless products previously classified in this category in fiscal 2005 was included in high-end router sales in fiscal 2006. Factors That May Impact... -

Page 25

... in the communications and information technology industry, introduction and market acceptance of new technologies and products, adoption of new networking standards, and financial difficulties experienced by our customers. We may, from time to time, experience manufacturing issues that create... -

Page 26

...compensation expense related to employee stock options and employee stock purchases under SFAS 123(R), and Scientific-Atlanta contributed $90 million of additional R&D expenses. We have also continued to purchase or license technology in order to bring a broad range of products to market in a timely... -

Page 27

..., rapidly changing customer markets, uncertain standards for new products, and significant competitive threats. The nature of the efforts to develop these technologies into commercially viable products consists primarily of planning, designing, experimenting, and testing activities necessary to... -

Page 28

... tax credits, state taxes, and the tax impact of foreign operations. The tax provision rate for fiscal 2006 included a benefit of approximately $124 million from the favorable settlement of a tax audit in a foreign jurisdiction. On October 22, 2004, the American Jobs Creation Act of 2004 (the "Jobs... -

Page 29

... of our wireless and wired router businesses. Unified communications sales increased by approximately $220 million primarily due to sales of IP phones and associated software as our customers transitioned from an analog-based to an IP-based infrastructure. Sales of security products increased by... -

Page 30

...highly specialized employees. As we add personnel and resources to support growth in this business, our service margins will typically be adversely affected in the near term. We also added investments in our technical support business during fiscal 2005. Research and Development, Sales and Marketing... -

Page 31

... 2001 through January 2004). This charge was reported as a separate line item in the Consolidated Statements of Operations as a cumulative effect of accounting change, net of tax. The charge was based on the value of the Andiamo employee stock and options and their vesting from the adoption of FIN... -

Page 32

... employee stock and options. See Note 3 to the Consolidated Financial Statements. The amount of deferred stock-based compensation was fixed at the date of acquisition and was being amortized over the vesting period of the Andiamo employee stock and options of approximately two years. A summary... -

Page 33

... service provider customers. Manufacturing finished goods consist primarily of build-to-order and build-to-stock products. Service-related spares consist of reusable equipment related to our technical support and warranty activities. All inventories are accounted for at the lower of cost or market... -

Page 34

..., shipment linearity, accounts receivable collections, inventory management, excess tax benefits from stock-based compensation, and the timing and amount of tax and other payments. As a result, the impact of contractual obligations on our liquidity and capital resources in future periods should be... -

Page 35

... Australia, Belgium, Canada, China, France, Germany, India, Italy, Japan, and the United Kingdom. Operating lease amounts include future minimum lease payments under all our noncancelable operating leases with an initial term in excess of one year. Purchase Commitments with Contract Manufacturers... -

Page 36

... paid-in capital. Issuance of common stock and the tax benefit related to employee stock option plans are recorded as an increase to common stock and additional paid-in capital. As a result of future repurchases, we may continue to report an accumulated deficit included in shareholders' equity in... -

Page 37

... About Market Risk Investments We maintain an investment portfolio of various holdings, types, and maturities. See Note 6 to the Consolidated Financial Statements. These securities are classified as available-for-sale and consequently are recorded in the Consolidated Balance Sheets at fair value... -

Page 38

... because of our limited currency exposure to date, the effect of foreign currency fluctuations has not been material to our Consolidated Financial Statements. The effect of foreign currency fluctuations, net of hedging, decreased total research and development, sales and marketing, and general and... -

Page 39

... and Qualitative Disclosures About Market Risk Foreign exchange forward and option contracts as of July 29, 2006 and July 30, 2005 are summarized as follows (in millions): July 29, 2006 Notional Amount Fair Value Forward contracts: Purchased Sold Option contracts: Purchased Sold $ 1,376 $ 554... -

Page 40

... was no stock-based compensation expense related to employee stock options and employee stock purchases under Statement of Financial Accounting Standards No. 123, "Accounting for Stock-Based Compensation" ("SFAS 123"), in fiscal 2005 and fiscal 2004 because the Company did not adopt the recognition... -

Page 41

...29, 2006 and $162 at July 30, 2005 Inventories Deferred tax assets Prepaid expenses and other current assets Total current assets Property and equipment, net Goodwill Purchased intangible assets, net Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable... -

Page 42

... stock purchases Stock-based compensation expense related to acquisitions and investments Provision for doubtful accounts Provision for inventory Deferred income taxes Tax benefits from employee stock option plans Excess tax benefits from stock-based compensation In-process research and development... -

Page 43

... of common stock and the tax benefit related to employee stock option plans are recorded in shareholders' equity as an increase to common stock and additional paid-in capital. The stock repurchases since the inception of this program are summarized in the table below (in millions): Shares of Common... -

Page 44

... to Consolidated Financial Statements 1. Description of Business Cisco Systems, Inc. (the "Company" or "Cisco") designs, manufactures, and sells networking and other products related to the communications and information technology industry and provides services associated with these products and... -

Page 45

...its two-tier system of sales to the end customer. Revenue from distributors and retail partners is recognized based on a sell-through method using information provided by them. Distributors and retail partners participate in various cooperative marketing and other programs, and the Company maintains... -

Page 46

... average share price for each fiscal period using the treasury stock method. Under the treasury stock method, the amount the employee must pay for exercising stock options, the amount of compensation cost for future service that the Company has not yet recognized, and the amount of tax benefits that... -

Page 47

... value method, no stock-based compensation expense had been recognized in the Company's Consolidated Statement of Operations, other than as related to acquisitions and investments, because the exercise price of the Company's stock options granted to employees and directors equaled the fair market... -

Page 48

... provider market. Pursuant to the terms of the merger agreement, the Company paid a cash amount of $43.00 per share in exchange for each outstanding share of Scientific-Atlanta common stock and assumed each Scientific-Atlanta stock option which was outstanding immediately prior to the effective time... -

Page 49

..., trade secrets, and computer software that represent the foundation for current and planned new products. The following table presents details of the purchased intangible assets acquired as part of the acquisition of Scientific-Atlanta (in millions, except years): WeightedAverage Useful Life... -

Page 50

... Scientific-Atlanta's historical results of operations during February 2006. The pro forma financial information for each fiscal year presented also includes the purchase accounting adjustments on historical Scientific-Atlanta inventory, adjustments to depreciation on acquired property and equipment... -

Page 51

..., a new class of server networking equipment that is designed to help improve resource utilization and reduce equipment and management costs, to the Company's switching product portfolio consisting of network and storage switches. Purchased Intangible Assets Fiscal 2004 Shares Issued Purchase... -

Page 52

...Scientific-Atlanta accounted for $88 million of the in-process R&D during fiscal 2006, which related primarily to projects associated with Scientific-Atlanta's advanced models of digital set-top boxes, network software enhancements and upgrades, and data products and transmission products. Purchased... -

Page 53

... to Consolidated Financial Statements The following table presents details of the amortization expense of purchased intangible assets as reported in the Consolidated Statements of Operations (in millions): Years Ended July 29, 2006 July 30, 2005 July 31, 2004 Reported as: Cost of sales Operating... -

Page 54

... compensation was fixed at the date of acquisition and was being amortized over the vesting period of the Andiamo employee stock and options of approximately two years. A summary of the accounting of the initial consolidation under FIN 46(R) and the subsequent purchase of Andiamo, after stock price... -

Page 55

... vesting periods. The balance for deferred stock-based compensation was reflected as a reduction to additional paid-in capital in the Consolidated Statements of Shareholders' Equity. The following table presents the activity of deferred stock-based compensation for the fiscal years ended July... -

Page 56

...in process Finished goods: Distributor inventory and deferred cost of sales Manufacturing finished goods Total finished goods Service-related spares Demonstration systems Total Property and equipment, net: Land, buildings, and leasehold improvements Computer equipment and related software Production... -

Page 57

... to Consolidated Financial Statements 5. Lease Receivables, Net Lease receivables represent sales-type and direct-financing leases resulting from the sale of the Company's and complementary third-party products and services. These lease arrangements typically have terms from two to three years and... -

Page 58

... and extent to which fair value has been less than the cost basis, the financial condition and near-term prospects of the investee, and the Company's intent and ability to hold the investment for a period of time sufficient to allow for any anticipated recovery in market value. Substantially all of... -

Page 59

...Statements of Operations. Cash paid for interest during fiscal 2006 was $6 million. 8. Commitments and Contingencies Operating Leases The Company leases office space in several U.S. locations. Outside the United States, larger sites include Australia, Belgium, Canada, China, France, Germany, India... -

Page 60

... for warranties issued Fair value of warranty liability acquired from Scientific-Atlanta Payments Balance at end of fiscal year $ 259 395 44 (389) $ 309 $ 239 411 - (391) $ 259 The Company accrues for warranty costs as part of its cost of sales based on associated material product costs, labor... -

Page 61

... two years related to long-term customer financings. The foreign exchange contracts related to investments generally have maturities of less than one year. The Company periodically hedges certain foreign currency forecasted transactions related to certain operating expenses with currency options and... -

Page 62

...the California Corporations Code, is based upon allegations of wrongdoing in connection with option grants and compensation to officers and directors, the timing of option grants, and the Company's share repurchase plan, and seeks unspecified compensation and other damages, rescission of options and... -

Page 63

... maximum number of shares issuable over the term of the 2005 Plan is limited to 350 million shares. The 2005 Plan permits the granting of stock options, stock grants, stock units and stock appreciation rights to employees (including employee directors and officers) and consultants of the Company and... -

Page 64

... issued to eligible employees. Officers and members of the Company's Board of Directors are not eligible to participate in the Supplemental Plan. Nine million shares have been reserved for issuance under the Supplemental Plan. All stock option grants have an exercise price equal to the fair market... -

Page 65

... table summarizes significant ranges of outstanding and exercisable options as of July 29, 2006 (in millions, except years and per-share amounts): STOCK OPTIONS OUTSTANDING WeightedAverage Remaining Contractual Life (in Years) STOCK OPTIONS EXERCISABLE Range of Exercise Prices Number Outstanding... -

Page 66

... Consolidated Financial Statements The following table presents the option exercises for the year ended July 29, 2006, and option values as of that date for the Named Executive Officers (in millions): NUMBER OF SECURITIES UNDERL YING UNEXERCISED OPTIONS AT JUL Y 29, 2006 Number of Shares Acquired on... -

Page 67

... 2004 (in millions except per-share amounts): Years Ended July 29, 2006 July 30, 2005 July 31, 2004 Net income-as reported for prior fiscal years(1) Tax benefit Stock-based compensation expense related to employee stock options and employee stock purchases, net of tax(2) Net income, including the... -

Page 68

... to 2006 Pro forma information regarding option grants made to the Company's employees and directors and employee stock purchases is as follows (in millions, except per-share amounts): Years Ended July 30, 2005 July 31, 2004 Net income-as reported Stock-based compensation expense Tax benefit Stock... -

Page 69

... salary contributions for eligible employees. The Plan allows employees to contribute from 1% to 25% of their annual compensation to the Plan on a pretax and after-tax basis. Employee contributions are limited to a maximum annual amount as set periodically by the Internal Revenue Code. The Company... -

Page 70

... an international investment component. The fixed income portfolio is managed by utilizing intermediate-term instruments of high credit quality. The Company's periodic pension cost related to the defined benefit pension plans and post retirement benefits was not material for fiscal 2006. The Company... -

Page 71

...fiscal 2006 included a benefit of approximately $124 million from the favorable settlement of a tax audit in a foreign jurisdiction. During the fourth quarter of fiscal 2005, the Internal Revenue Service completed its examination of the Company's federal income tax returns for the fiscal years ended... -

Page 72

...in millions): July 29, 2006 July 30, 2005 ASSETS Allowance for doubtful accounts and returns Sales-type and direct-financing leases Inventory allowances and capitalization Investment provisions In-process R&D, goodwill, and purchased intangible assets Deferred revenue Credits and net operating loss... -

Page 73

... Financial Statements 12. Segment Information and Major Customers The Company's operations involve the design, development, manufacturing, marketing, and technical support of networking and other products and services related to the communications and other information technology industry. Cisco... -

Page 74

... and equipment, net: United States International Total $ 3,082 358 $ 3,440 $ 2,959 361 $ 3,320 $ 2,919 371 $ 3,290 13. Net Income per Share The following table presents the calculation of basic and diluted net income per share (in millions, except per-share amounts): Years Ended July 29, 2006... -

Page 75

Notes to Consolidated Financial Statements 14. Subsequent Events Acquisition of Meetinghouse Data Communications, Inc. As of July 29, 2006, the Company announced a definitive agreement to acquire privately held Meetinghouse Data Communications, Inc. The aggregate announced purchase price for this ... -

Page 76

...did not adopt the recognition provisions of SFAS 123. Stock Market Information Cisco common stock is traded on the NASDAQ Global Select Market under the symbol CSCO. The following table lists the high and low sales prices for each period indicated: 2006 Fiscal High Low High 2005 Low First quarter... -

Page 77

... NASDAQ Global Select Market under the ticker symbol CSCO. Investor Relations For further information about Cisco, additional copies of this report, Form 10-K, or other financial information without charge, contact: Investor Relations Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706... -

Page 78

... San Jose, California, USA European Headquarters Amsterdam, Netherlands Americas Headquarters San Jose, California, USA Asia Pacific Headquarters Singapore Cisco Systems has offices in the following countries and regions. Addresses, phone numbers, and fax numbers are listed on the Cisco Website... -

Page 79

Corporate Headquarters • Cisco Systems, Inc. • 170 West Tasman Drive • San Jose, CA 95134-1706 • USA • Tel: 408 526-4000 • 800 553-NETS (6387) • www.cisco.com Lit# 930030706 • SKU# 1028-AR-06 Printed on recycled paper.