Cigna 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

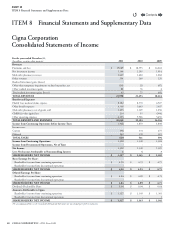

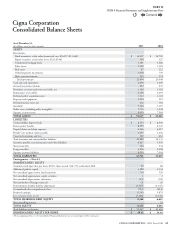

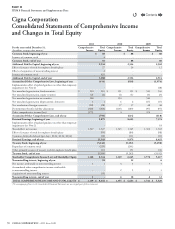

77CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

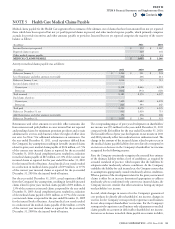

N. Health Care Medical Claims Payable

Medical claims payable for the Health Care segment include both

reported claims and estimates for losses incurred but not yet reported.

e Company develops estimates for Health Care medical claims

payable using actuarial principles and assumptions consistently applied

each reporting period, and recognizes the actuarial best estimate of the

ultimate liability within a level of condence, as required by actuarial

standards of practice, which require that the liabilities be adequate

under moderately adverse conditions.

e liability is primarily calculated using “completion factors” (a measure

of the time to process claims), which are developed by comparing the

date claims were incurred, generally the date services were provided,

to the date claims were paid. e Company uses historical completion

factors combined with an analysis of current trends and operational

factors to develop current estimates of completion factors. e Company

estimates the liability for claims incurred in each month by applying

the current estimates of completion factors to the current paid claims

data. is approach implicitly assumes that historical completion rates

will be a useful indicator for the current period. It is possible that the

actual completion rates for the current period will develop dierently

from historical patterns, which could have a material impact on the

Company’s medical claims payable and shareholders’ net income.

Completion factors are impacted by several key items including changes

in: 1) electronic (auto-adjudication) versus manual claim processing,

2) provider claims submission rates, 3) membership and 4) the mix of

products. As noted, the Company uses historical completion factors

combined with an analysis of current trends and operational factors

to develop current estimates of completion factors.

In addition, for the more recent months, the Company also relies on

medical cost trend analysis, which reects expected claim payment

patterns and other relevant operational considerations. Medical cost

trend is primarily impacted by medical service utilization and unit costs,

which are aected by changes in the level and mix of medical benets

oered, including inpatient, outpatient and pharmacy, the impact of

copays and deductibles, changes in provider practices and changes in

consumer demographics and consumption behavior.

Despite reecting both historical and emerging trends in setting reserves,

it is possible that the actual medical trend for the current period will

develop dierently from expectations, which could have a material

impact on the Company’s medical claims payable and shareholders’

net income.

For each reporting period, the Company evaluates key assumptions

by comparing the assumptions used in establishing the medical claims

payable to actual experience. When actual experience diers from the

assumptions used in establishing the liability, medical claims payable are

increased or decreased through current period shareholders’ net income.

Additionally, the Company evaluates expected future developments and

emerging trends which may impact key assumptions. e estimation

process involves considerable judgment, reecting the variability inherent

in forecasting future claim payments. ese estimates are highly sensitive

to changes in the Company’s key assumptions, specically completion

factors, and medical cost trends.

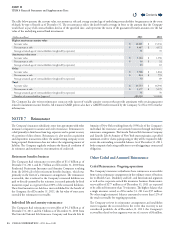

O. Unearned Premiums and Fees

Premiums for life, accident and health insurance are recognized as

revenue on a pro rata basis over the contract period. Fees for mortality

and contract administration of universal life products are recognized

ratably over the coverage period. e unrecognized portion of these

amounts received is recorded as unearned premiums and fees.

P. Accounts Payable, Accrued Expenses

and Other Liabilities

Accounts payable, accrued expenses and other liabilities consist principally

of liabilities for pension, other postretirement and postemployment

benets (see Note9), self-insured exposures, management compensation

and various insurance-related items, including experience rated refunds,

the minimum medical loss ratio rebate accrual under Health Care

Reform, amounts related to reinsurance contracts and insurance-related

assessments that management can reasonably estimate. Accounts payable,

accrued expenses and other liabilities also include certain overdraft

positions and the loss position of certain derivatives, primarily for GMIB

contracts (see Note12). Legal costs to defend the Company’s litigation

and arbitration matters are expensed when incurred in cases that the

Company cannot reasonably estimate the ultimate cost to defend. In

cases that the Company can reasonably estimate the cost to defend,

these costs are recognized when the claim is reported.

Q. Translation of Foreign Currencies

e Company generally conducts its international business through foreign

operating entities that maintain assets and liabilities in local currencies,

which are generally their functional currencies. e Company uses

exchange rates as of the balance sheet date to translate assets and liabilities

into U.S. dollars. Translation gains or losses on functional currencies, net

of applicable taxes, are recorded in accumulated other comprehensive

income (loss). e Company uses average monthly exchange rates during

the year to translate revenues and expenses into U.S. dollars.

R. Premiums and Fees, Revenues

and Related Expenses

Premiums for group life, accident and health insurance and managed

care coverages are recognized as revenue on a pro rata basis over the

contract period. Benets and expenses are recognized when incurred.

Premiums and fees include revenue from experience-rated contracts

that is based on the estimated ultimate claim, and in some cases,

administrative cost experience of the contract. For these contracts,

premium revenue includes an adjustment for experience-rated refunds

which is calculated according to contract terms and using the customer’s

experience (including estimates of incurred but not reported claims).

Beginning in 2011, premium revenue also includes an adjustment

to reect the estimated eect of rebates due to customers under the

minimum medical loss ratio provisions of Health Care Reform.

Premiums for individual life, accident and health insurance and annuity

products, excluding universal life and investment-related products, are

recognized as revenue when due. Benets and expenses are matched

with premiums.

Contents

Q