Cigna 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cash ows from operating activities increased by $998million in 2010

compared with 2009. Excluding the results of the GMDB equity hedge

program (that did not aect net income), cash ows from operating

activities increased by $873million. is increase in 2010 primarily

reects premium growth in the Health Care segment’s risk businesses

as noted above and earnings growth in the Health Care, Disability and

Life and International segments as well as lower contributions to the

qualied domestic pension plan ($212million in 2010, compared with

$410million in 2009). ese favorable eects were partially oset by

higher management compensation and income tax payments in 2010

compared with 2009.

Investing activities

Cash used in investing activities was $1.3billion. is use of cash

primarily consisted of net purchases of investments of $503million,

cash used to fund acquisitions (net of cash acquired) of $344million,

net cash used to transfer the run-o workers’ compensation and personal

accident assumed reinsurance business via a reinsurance transaction

of $190million, and net purchases of property and equipment of

$300million.

Financing activities

Cash provided from nancing activities primarily consisted of net

proceeds from the issuance of long-term debt of $543million, partially

oset by debt repayments of $270million primarily to retire a portion

of the 8.5% Notesdue 2019 and the 6.35% Notesdue 2018 as a result

of the tender oers to bondholders. See the Capital Resources section

for more information. Financing activities also included net deposits to

contractholder deposit funds of $90million and proceeds on issuances

of common stock of $64million. ese inows were partially oset

by common stock repurchases of $201million.

Interest Expense

Interest expense on long-term debt, short-term debt and capital leases

was as follows:

(In millions)

2011 2010 2009

Interest expense $ 202 $ 182 $ 166

e increase in interest expense in 2011 was primarily due to higher average borrowings in 2011 from issuing debt in Marchand November2011.

Capital Resources

e Company’s capital resources (primarily retained earnings and

the proceeds from the issuance of debt and equity securities) provide

protection for policyholders, furnish the nancial strength to underwrite

insurance risks and facilitate continued business growth.

Management, guided by regulatory requirements and rating agency

capital guidelines, determines the amount of capital resources that

the Company maintains. Management allocates resources to new

long-term business commitments when returns, considering the risks,

look promising and when the resources available to support existing

business are adequate.

e Company prioritizes its use of capital resources to:

•

provide capital necessary to support growth and maintain or improve

the nancial strength ratings of subsidiaries;

•

consider acquisitions that are strategically and economically

advantageous; and

•return capital to investors through share repurchase.

e availability of capital resources will be impacted by equity and

credit market conditions. Extreme volatility in credit or equity market

conditions may reduce the Company’s ability to issue debt or equity

securities.

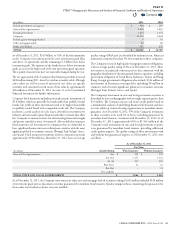

Sources of Capital

Debt Financings

During 2011 and 2010, the Company entered into the following

debt nancings. For further information on these debt nancings, see

Note15 to the Consolidated Financial Statements.

•

On November10,2011, the Company issued $2.1billion of long-term

debt to fund the HealthSpring acquisition as follows: $600million

of 5-Year Notesat 2.75%, $750million of 10-Year Notesat 4%, and

$750million of 30-Year Notesat 5.375%.

•

In June2011, the Company entered into a new ve-year revolving

credit and letter of credit agreement for $1.5billion that permits up

to $500million to be used for letters of credit. e credit agreement

includes options that are subject to consent by the administrative agent

and the committing banks, to increase the commitment amount to

$2billion and to extend the term past June2016.

•

In March2011, the Company issued $300million of 10-Year Notesat

4.5% and $300million of 30-Year Notesat 5.875%. e proceeds

were used for general corporate purposes, including the repayment

of maturing debt in 2011.

•

In December2010, the Company issued $250million of 10-Year

Notesat 4.375%. e proceeds of this debt were used to fund the

tender oer for the Company’s 8.5% Senior Notesdue 2019 and

the 6.35% Senior Notesdue 2018 (described further below under

uses of capital).

•

In May2010, the Company issued $300million of 10-Year Notesat

5.125%. e proceeds of this debt were used for general corporate

purposes.

Equity Financing

On November16,2011, the Company issued 15.2million shares of

its common stock at $42.75 per share. Proceeds were $650million

($629million net of underwriting discount and fees). e proceeds

were used to fund the HealthSpring acquisition in January2012.

Contents

Q