Cigna 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 CIGNA CORPORATION2011 Form10K

PART II

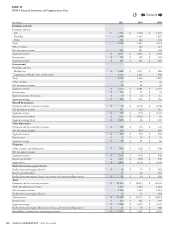

ITEM 8 Financial Statements and Supplementary Data

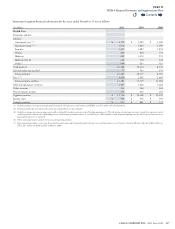

NOTE 22 Segment Information

e Company’s operating segments generally reect groups of related

products, except for the International segment which is generally based

on geography. In accordance with GAAP, operating segments that do not

require separate disclosure were combined in “Other Operations”. e

Company measures the nancial results of its segments using “segment

earnings (loss)”, which is dened as shareholders’ income (loss) from

continuing operations before after-tax realized investment results.

Consolidated pre-tax income from continuing operations is primarily

attributable to domestic operations. Consolidated pre-tax income from

continuing operations generated by the Company’s foreign operations

was approximately 15% in 2011, 13% in 2010 and 9% in 2009.

e Company determines segment earnings (loss) consistent with

accounting policies used in preparing the consolidated nancial

statements, except that amounts included in Corporate are not allocated

to segments. e Company allocates certain other operating expenses,

such as systems and other key corporate overhead expenses, on systematic

bases. Income taxes are generally computed as if each segment were

ling a separate income tax return. e Company does not report total

assets by segment since this is not a metric used to allocate resources

or evaluate segment performance.

e Company presents segment information as follows:

Health Care oers insured and self-insured medical, dental, behavioral

health, vision, and prescription drug benet plans, health advocacy

programs and other products and services that may be integrated to

provide comprehensive health care benet programs. Cigna HealthCare

companies oer these products and services in all 50 states, the District

of Columbia and the U.S. Virgin Islands. ese products and services

are oered through a variety of funding arrangements such as guaranteed

cost, retrospectively experience-rated and administrative services only

arrangements.

Disability and Life includes group disability, life, accident and specialty

insurance.

International includes supplemental health, life and accident

insurance products; and international health care products and services

including those oered to individuals and globally mobile employees

of multinational companies and organizations.

Run-o Reinsurance is predominantly comprised of GMDB, GMIB,

workers’ compensation and personal accident reinsurance products.

On December31,2010, the Company essentially exited from its

workers’ compensation and personal accident reinsurance business

by purchasing retrocessional coverage from a Bermuda subsidiary of

Enstar Group Limited and transferring the ongoing administration of

this business to the reinsurer.

e Company also reports results in two other categories.

Other Operations consist of:

•corporate-owned life insurance (“COLI”);

•

deferred gains recognized from the 1998 sale of the individual life

insurance and annuity business and the 2004 sale of the retirement

benets business; and

•run-o settlement annuity business.

Corporate reects amounts not allocated to other segments, such as net

interest expense (dened as interest on corporate debt less net investment

income on investments not supporting segment operations), interest

on uncertain tax positions, certain litigation matters, intersegment

eliminations, compensation cost for stock options and certain corporate

overhead expenses such as directors’ expenses.

In 2010, the Company began reporting the expense associated with

its frozen pension plans in Corporate. Prior periods were not restated

as the eect on prior periods was not material.

Contents

Q