Cigna 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

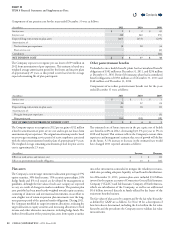

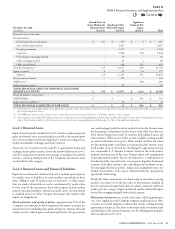

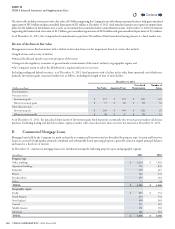

Separate account assets

Fair values and changes in the fair values of separate account assets generally accrue directly to the policyholders and are excluded from the

Company’s revenues and expenses. At December31,separate account assets were as follows:

2011

(In millions)

Quoted Prices in

Active Markets for

Identical Assets

(Level1)

Signicant Other

Observable Inputs

(Level2)

Signicant

Unobservable

Inputs

(Level3) Total

Guaranteed separate accounts (See Note23) $ 249 $ 1,439 $ - $ 1,688

Non-guaranteed separate accounts(1) 1,804 3,851 750 6,405

TOTAL SEPARATE ACCOUNT ASSETS $ 2,053 $ 5,290 $ 750 $ 8,093

(1) Non-guaranteed separate accounts include $3.0billion in assets supporting the Company’s pension plan, including $702million classified in Level3.

2010

(In millions)

Quoted Prices in

Active Markets for

Identical Assets

(Level1)

Signicant Other

Observable Inputs

(Level2)

Signicant

Unobservable

Inputs

(Level3) Total

Guaranteed separate accounts (See Note23) $ 286 $ 1,418 $ - $ 1,704

Non-guaranteed separate accounts(1) 1,947 3,663 594 6,204

TOTAL SEPARATE ACCOUNT ASSETS $ 2,233 $ 5,081 $ 594 $ 7,908

(1) Non-guaranteed separate accounts include $2.8billion in assets supporting the Company’s pension plan, including $557million classified in Level3.

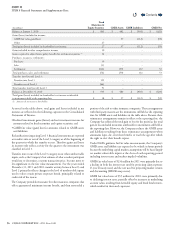

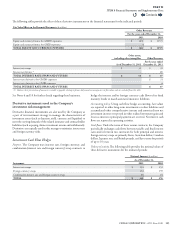

Separate account assets in Level1 include exchange-listed equity

securities. Level2 assets primarily include:

•

corporate and structured bonds valued using recent trades of similar

securities or pricing models that discount future cash ows at estimated

market interest rates as described above; and

•

actively-traded institutional and retail mutual fund investments and separate

accounts priced using the daily net asset value which is the exit price.

Separate account assets classied in Level3 include investments primarily

in securities partnerships, real estate and hedge funds generally valued

based on the separate account’s ownership share of the equity of the

investee including changes in the fair values of its underlying investments.

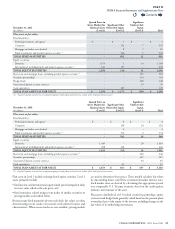

e following tables summarize the change in separate account assets

reported in Level3 for the years ended December31,2011 and 2010.

(In millions)

Balance at January1,2011 $ 594

Policyholder gains(1) 114

Purchases, issuances, settlements:

Purchases 257

Sales (51)

Settlements (152)

Total purchases, sales and settlements 54

Transfers into/(out of) Level3:

Transfers into Level3 4

Transfers out of Level3 (16)

Total transfers into/(out of) Level3: (12)

Balance at December31,2011 $ 750

(1) Included in this amount are gains of $96million attributable to instruments still held at the reporting date.

Contents

Q