Cigna 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

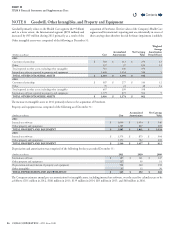

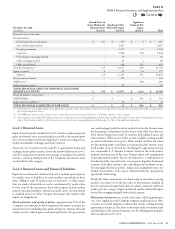

NOTE 8 Goodwill, Other Intangibles, and Property and Equipment

Goodwill primarily relates to the Health Care segment ($2.9billion)

and, to a lesser extent, the International segment ($290million) and

increased by $45million during 2011 primarily as a result of the

acquisition of FirstAssist. e fair values of the Company’s Health Care

segment and International’s reporting unit are substantially in excess of

their carrying values therefore the risk for future impairment is unlikely.

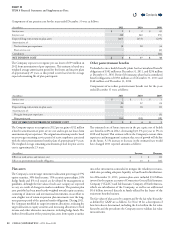

Other intangible assets were comprised of the following at December31:

(Dollars in millions)

Cost

Accumulated

Amortization

Net Carrying

Value

Weighted

Average

Amortization

Period(Years)

2011

Customer relationships $ 583 $ 313 $ 270 13

Other 127 27 100 12

Total reported in other assets, including other intangibles 710 340 370

Internal-use software reported in property and equipment 1,600 1,054 546 5

TOTAL OTHER INTANGIBLE ASSETS $ 2,310 $ 1,394 $ 916

2010

Customer relationships $ 587 $ 277 $ 310 12

Other 70 22 48 14

Total reported in other assets, including other intangibles 657 299 358

Internal-use software reported in property and equipment 1,379 875 504 5

TOTAL OTHER INTANGIBLE ASSETS $ 2,036 $ 1,174 $ 862

e increase in intangible assets in 2011 primarily relates to the acquisition of FirstAssist.

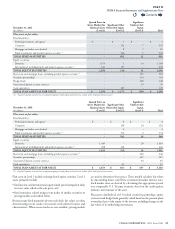

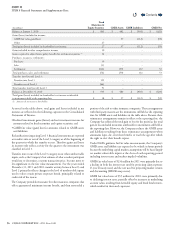

Property and equipment was comprised of the following as of December31:

(Dollars in millions)

Cost

Accumulated

Amortization

Net Carrying

Value

2011

Internal-use software $ 1,600 $ 1,054 $ 546

Other property and equipment 1,285 807 478

TOTAL PROPERTY AND EQUIPMENT $ 2,885 $ 1,861 $ 1,024

2010

Internal-use software $ 1,379 $ 875 $ 504

Other property and equipment 1,190 782 408

TOTAL PROPERTY AND EQUIPMENT $ 2,569 $ 1,657 $ 912

Depreciation and amortization was comprised of the following for the years ended December31:

(Dollars in millions)

2011 2010 2009

Internal-use software $ 187 $ 161 $ 147

Other property and equipment 117 99 91

Depreciation and amortization of property and equipment 304 260 238

Other intangibles 41 32 30

TOTAL DEPRECIATION AND AMORTIZATION $ 345 $ 292 $ 268

e Company estimates annual pre-tax amortization for intangible assets, including internal-use software, over the next ve calendar years to be

as follows: $231million in 2012, $186million in 2013, $139million in 2014, $83million in 2015, and $68million in 2016.

Contents

Q