Cigna 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

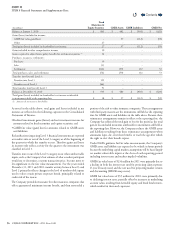

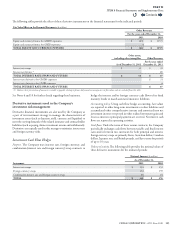

e following tables provide the eect of these derivative instruments on the nancial statements for the indicated periods:

Fair Value Eect on the Financial Statements (In millions)

Other Revenues

For the years ended December31,

2011 2010

Equity and currency futures for GMDB exposures $ (45) $ (157)

Equity and currency futures for GMIB exposures 4

TOTAL EQUITY AND CURRENCY FUTURES $41 $ 157

Other assets,

including other intangibles Other Revenues

As of December31,2011

For the year ended

December31,2011

Interest rate swaps $ 33 $ 39

Interest rate futures(1) - (2)

TOTAL INTEREST RATE SWAPS AND FUTURES $ 33 $ 37

Interest rate derivatives for GMDB exposures $ 31

Interest rate derivatives for GMIB exposures 6

TOTAL INTEREST RATE SWAPS AND FUTURES $ 37

(1) Balance sheet presentation of amounts receivable or payable relating to futures daily variation margin are not fair values and are excluded from this table.

See Notes6 and 10 for further details regarding these businesses.

Derivative instruments used in the Company’s

investment risk management

Derivative nancial instruments are also used by the Company as

a part of its investment strategy to manage the characteristics of

investment assets (such as duration, yield, currency and liquidity) to

meet the varying demands of the related insurance and contractholder

liabilities (such as paying claims, investment returns and withdrawals).

Derivatives are typically used in this strategy to minimize interest rate

and foreign currency risks.

Investment Cash Flow Hedges

Purpose. e Company uses interest rate, foreign currency, and

combination (interest rate and foreign currency) swap contracts to

hedge the interest and/or foreign currency cash ows of its xed

maturity bonds to match associated insurance liabilities.

Accounting policy. Using cash ow hedge accounting, fair values

are reported in other long-term investments or other liabilities and

accumulated other comprehensive income and amortized into net

investment income or reported in other realized investment gains and

losses as interest or principal payments are received. Net interest cash

ows are reported in operating activities.

Cash ows. Under the terms of these various contracts, the Company

periodically exchanges cash ows between variable and xed interest

rates and/or between two currencies for both principal and interest.

Foreign currency swaps are primarily Euros, Australian dollars, Canadian

dollars, Japanese yen, and British pounds, and have terms for periods

of up to 10years.

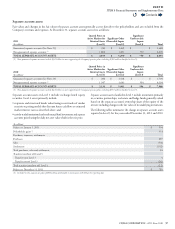

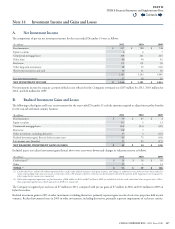

Volume of activity. e following table provides the notional values of

these derivative instruments for the indicated periods:

Instrument

Notional Amount (In millions)

As of December31,

2011 2010

Interest rate swaps $ 134 $ 153

Foreign currency swaps 134 159

Combination interest rate and foreign currency swaps 64 64

TOTAL $ 332 $ 376

Contents

Q