Cigna 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

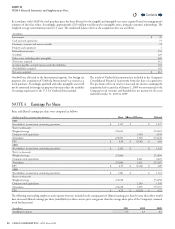

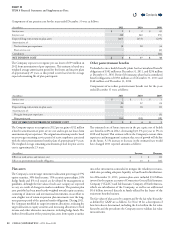

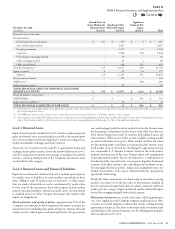

e table below presents the account value, net amount at risk and average attained age of underlying contractholders for guarantees in the event

of death, by type of benet as of December31. e net amount at risk is the death benet coverage in force or the amount that the Company

would have to pay if all contractholders died as of the specied date, and represents the excess of the guaranteed benet amount over the fair

value of the underlying mutual fund investments.

(Dollars in millions)

2011 2010

Highest anniversary annuity value

Account value $ 10,801 $ 13,336

Net amount at risk $ 4,487 $ 4,372

Average attained age of contractholders (weighted by exposure) 71 70

Anniversary value reset

Account value $ 1,184 $ 1,396

Net amount at risk $ 56 $ 52

Average attained age of contractholders (weighted by exposure) 63 63

Other

Account value $ 1,768 $ 1,864

Net amount at risk $ 834 $ 755

Average attained age of contractholders (weighted by exposure) 70 69

Total

Account value $ 13,753 $ 16,596

Net amount at risk $ 5,377 $ 5,179

Average attained age of contractholders (weighted by exposure) 71 70

Number of contractholders (approx.) 480,000 530,000

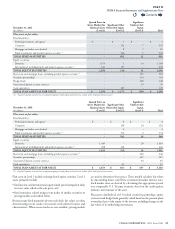

e Company has also written reinsurance contracts with issuers of variable annuity contracts that provide annuitants with certain guarantees

related to minimum income benets. All reinsured GMIB policies also have a GMDB benet reinsured by the Company. See Note10 for further

information.

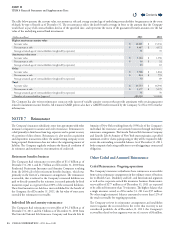

NOTE 7 Reinsurance

e Company’s insurance subsidiaries enter into agreements with other

insurance companies to assume and cede reinsurance. Reinsurance is

ceded primarily to limit losses from large exposures and to permit recovery

of a portion of direct losses.Reinsurance is also used in acquisition

and disposition transactions where the underwriting company is not

being acquired. Reinsurance does not relieve the originating insurer of

liability. e Company regularly evaluates the nancial condition of

its reinsurers and monitors its concentrations of credit risk.

Retirement benefits business

e Company had reinsurance recoverables of $1.6billion as of

December31,2011, and $1.7billion as of December31,2010 from

Prudential Retirement Insurance and Annuity Company resulting

from the 2004 sale of the retirement benets business, which was

primarily in the form of a reinsurance arrangement. e reinsurance

recoverable, that is reduced as the Company’s reinsured liabilities are

paid or directly assumed by the reinsurer, is secured primarily by xed

maturities equal to or greater than 100% of the reinsured liabilities.

ese xed maturities are held in a trust established for the benet of

the Company.As of December31,2011, the fair value of trust assets

exceeded the reinsurance recoverable.

Individual life and annuity reinsurance

e Company had reinsurance recoverables of $4.2billion as of

December31,2011 and $4.3billion as of December31,2010 from

e Lincoln National Life Insurance Company and Lincoln Life&

Annuity of New York resulting from the 1998 sale of the Company’s

individual life insurance and annuity business through indemnity

reinsurance arrangements. e Lincoln National Life Insurance Company

and Lincoln Life& Annuity of New York must maintain a specied

minimum credit or claims paying rating or they will be required to fully

secure the outstanding recoverable balance. As of December31,2011,

both companies had ratings sucient to avoid triggering a contractual

obligation.

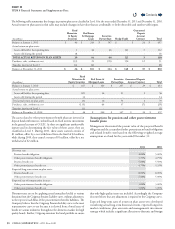

Other Ceded and Assumed Reinsurance

Ceded Reinsurance: Ongoing operations

e Company’s insurance subsidiaries have reinsurance recoverables

from various reinsurance arrangements in the ordinary course of business

for its Health Care, Disability and Life, and International segments

as well as the corporate-owned life insurance business. Reinsurance

recoverables of $277million as of December31,2011 are expected

to be collected from more than 70 reinsurers. e highest balance that

a single reinsurer carried as of December31,2011 was $57million.

No other single reinsurer’s balance amounted to more than 12% of

the total recoverable for ongoing operations.

e Company reviews its reinsurance arrangements and establishes

reserves against the recoverables in the event that recovery is not

considered probable. As of December31,2011, the Company’s

recoverables related to these segments were net of a reserve of $4million.

Contents

Q