Cigna 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

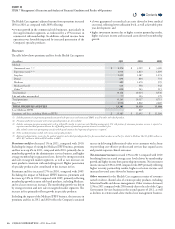

Summarized below is adjusted income from operations by segment:

Adjusted Income (Loss) From Operations

(In millions)

2011 2010 2009

Health Care $ 990 $ 861 $ 729

Disability and Life 282 291 279

International 289 243 182

Run-o Reinsurance (48) (27) (24)

Other Operations 85 85 85

Corporate (170) (176) (154)

TOTAL $ 1,428 $ 1,277 $ 1,097

Overview of 2011 Consolidated Results

of Operations

Shareholders’ income from continuing operations decreased 1% in

2011 compared with 2010, due to signicantly higher GMIB losses

principally reecting lower interest rates, substantially oset by higher

adjusted income from operations as explained further below. See the

Run-o Reinsurance section of the MD&A beginning on page51 for

additional information on GMIB results.

Adjusted income from operations increased 12% in 2011 compared

with 2010 primarily due to higher earnings contributions from the

Company’s Health Care and International segments. ese results

reect solid business growth in strategically targeted markets and

continued low medical services utilization trend. See the individual

segment sections of this MD&A for further discussion.

Overview of 2010 Consolidated Results

of Operations

Shareholders’ income from continuing operations increased 3% in

2010 compared with 2009, reecting strong growth in adjusted

income from operations as well as signicant improvement in realized

investment results, partially oset by a loss in the GMIB business in

2010 compared with a signicant gain in 2009.

Adjusted income from operations increased 16% in 2010 compared

with 2009 primarily due to strong earnings growth in the ongoing

business segments (Health Care, Disability and Life and International),

reecting focused execution of the Company’s strategy, which includes

a growing global customer base as well as higher net investment income

reecting improved economic conditions and asset growth.

Special Items and GMIB

Management does not believe that the special items noted in the

table above are representative of the Company’s underlying results

ofoperations. Accordingly, the Company excluded these special

items from adjusted income from operations in order to facilitate an

understanding and comparison of results of operations and permit

analysis of trends in underlying revenue, expenses and shareholders’

income from continuing operations.

Special items for 2011 included:

•

after-tax costs incurred in the fourth quarter of 2011 associated with

the January2012 acquisition of HealthSpring and the November2011

acquisition of FirstAssist; and

•

tax benets associated with the completion of the 2007 and 2008 IRS

examinations (see Note19 to the Consolidated Financial Statements

for additional information regarding this special item).

Special items for 2010 included:

•

a gain resulting from the resolution of a federal income tax matter,

consisting of a $97million release of a deferred tax valuation allowance

and $4million of accrued interest. See Note19 to the Consolidated

Financial Statements for further information;

•

a loss on the extinguishment of debt resulting from the decision of

certain holders of the Company’s 8.5% Notesdue 2019 and 6.35%

Notesdue 2018 to accept the Company’s tender oer to redeem these

Notesfor cash. See Note15 to the Consolidated Financial Statements

for further information; and

•

a loss on reinsurance of the run-o workers’ compensation and

personal accident reinsurance businesses to Enstar. See Note3 to the

Consolidated Financial Statements for further information.

Special items for 2009 included a curtailment gain resulting from the

decision to freeze the pension plan (see Note9 to the Consolidated

Financial Statements for additional information), cost reduction charges

related to the 2008 cost reduction program, and benets resulting from

the completion of the 2005 and 2006 IRS examinations (see Note19

to the Consolidated Financial Statements for additional information).

e Company also excludes the results of the GMIB business, including

the results of the related hedges starting in 2011, from adjusted income

from operations because the fair value of GMIB assets and liabilities

must be recalculated each quarter using updated capital market

assumptions. e resulting changes in fair value, which are reported

in shareholders’ net income, are volatile and unpredictable. See the

Critical Accounting Estimates section of the MD&A beginning on

page41 of the Company’s 2011 Form10-K for more information on

the eects of capital market assumption changes on shareholders’ net

income. Because of this volatility, and since the GMIB business is in

run-o, management does not believe that its results are meaningful

in assessing underlying results of operations.

Outlook for 2012

e Company expects 2012 consolidated adjusted income from

operations to be higher than 2011 results. is outlook reects strong

organic growth, an expected increase in medical services utilization

and contributions from the HealthSpring acquisition. is outlook

assumes break-even results for GMDB (also known as “VADBe”) for

2012, which assumes that actual experience, including capital market

Contents

Q