Cigna 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

the actual account value in the underlying mutual funds and the level

of interest rates when the contractholders elect to receive minimum

income payments. e Company has purchased retrocessional coverage

for a portion of these contracts to reduce a portion of the risks assumed

(“GMIB assets”).

Accounting policy. Because cash ows are aected by equity markets

and interest rates, but are without signicant life insurance risk and are

settled in lump sum payments, the Company accounts for these GMIB

liabilities and assets as written and purchased options at fair value.

ese derivatives are not designated as hedges and their fair values are

reported in other liabilities (GMIB liability) and other assets (GMIB

asset), with changes in fair value reported in GMIB fair value (gain) loss.

Cash ows. Under the terms of these written and purchased contracts,

the Company periodically receives and pays fees based on either

contractholders’ account values or deposits increased at a contractual

rate. e Company will also pay and receive cash depending on changes

in account values and interest rates when contractholders rst elect

to receive minimum income payments. ese cash ows are reported

in operating activities.

Volume of activity. e potential undiscounted future payments for

the written options (GMIB liability, as dened in Note23) was

$1,244million as of December31,2011 and $1,134million as

of December31,2010. e potential undiscounted future receipts

for the purchased options (GMIB asset) was $684million as of

December31,2011 and $624million as of December31,2010.

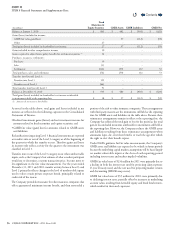

e following table provides the eect of these derivative instruments

on the nancial statements for the indicated periods:

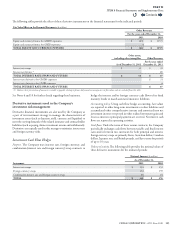

Fair Value Eect on the Financial Statements (In millions)

Instrument

Other Assets,

including other intangibles

Accounts Payable, Accrued Expenses

and Other Liabilities GMIB Fair Value (Gain) Loss

As of December31, As of December31, For the years ended December31,

2011 2010 2011 2010 2011 2010

Written options (GMIB liability) $ 1,333 $ 903 $ 504 $ 112

Purchased options (GMIB asset) $ 712 $ 480 (270) (57)

TOTAL $ 712 $ 480 $ 1,333 $ 903 $ 234 $ 55

GMDB and GMIB Hedge Programs

Purpose. e Company also uses derivative nancial instruments under

a dynamic hedge program designed to substantially reduce domestic

and international equity market exposures resulting from changes in

variable annuity account values based on underlying mutual funds for

certain reinsurance contracts that guarantee minimum death benets

(“GMDB”). During the rst quarter of 2011, the Company expanded

this hedge program to include a portion (approximately one-quarter)

of the equity market exposures associated with its GMIB business

(“GMDB and GMIB equity hedge program”). e Company also

implemented a dynamic hedge program to reduce the exposure to changes

in interest rate levels on the growth rate for approximately one-third

of its GMDB and one-quarter of its GMIB businesses (“GMDB and

GMIB growth interest rate hedge program”). ese hedge programs

are dynamic because the Company will regularly rebalance the hedging

instruments within established parameters as equity and interest rate

exposures of these businesses change.

e Company manages these hedge programs using exchange-traded

equity, foreign currency, and interest rate futures contracts, as well as

interest rate swap contracts. ese contracts are generally expected to

rise in value as equity markets and interest rates decline, and decline

in value as equity markets and interest rates rise.

Accounting policy. ese hedge programs are not designated as accounting

hedges. Although these hedge programs eectively reduce equity

market, foreign currency, and interest rate exposures, changes in the

fair values of these futures and swap contracts may not exactly oset

changes in the portions of the GMDB and GMIB liabilities covered by

these hedges, in part because the market does not oer contracts that

exactly match the targeted exposure prole. Changes in fair value of

these futures contracts, as well as interest income and interest expense

relating to the swap contracts are reported in other revenues. e fair

values of the interest rate swaps are reported in other assets and other

liabilities. Amounts reecting corresponding changes in liabilities for

GMDB contracts are included in benets and expenses.

Cash ows. e Company receives or pays cash daily in the amount

of the change in fair value of the futures contracts. e Company

periodically exchanges cash ows between variable and xed interest

rates under the interest rate swap contracts. Cash ows relating to these

contracts are included in operating activities.

Volume of activity. e notional value of the equity and currency

futures contracts used in the GMDB and GMIB equity hedge program

was $994million as of December31,2011, and $878million as of

December31,2010. Equity futures consist primarily of S&P500,

S&P400, Russell 2000, NASDAQ, TOPIX (Japanese), EUROSTOXX

and FTSE (British) equity indices. Currency futures consist of Euros,

Japanese yen and British pounds. e notional value of the interest rate

swaps used in the GMDB and GMIB growth interest rate hedge program

was $240million as of December31,2011. e notional value was

$29 million for U.S. Treasury and $598 million for Eurodollar interest

rate futures contracts used by this program as of December31,2011.

Contents

Q