Cigna 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Estimates

e preparation of consolidated nancial statements in accordance

with GAAP requires management to make estimates and assumptions

that aect reported amounts and related disclosures in the consolidated

nancial statements. Management considers an accounting estimate

to be critical if:

•

it requires assumptions to be made that were uncertain at the time

the estimate was made; and

•

changes in the estimate or dierent estimates that could have been

selected could have a material eect on the Company’s consolidated

results of operations or nancial condition.

Management has discussed the development and selection of its critical

accounting estimates with the Audit Committee of the Company’s Board

of Directors and the Audit Committee has reviewed the disclosures

presented below.

In addition to the estimates presented in the following table, there are

other accounting estimates used in the preparation of the Company’s

consolidated nancial statements, including estimates of liabilities for

future policy benets other than those identied in the following table,

as well as estimates with respect to goodwill, unpaid claims and claim

expenses, postemployment and postretirement benets other than

pensions, certain compensation accruals, and income taxes.

Management believes the current assumptions used to estimate amounts

reected in the Company’s consolidated nancial statements are

appropriate. However, if actual experience diers from the assumptions

used in estimating amounts reected in the Company’s consolidated

nancial statements, the resulting changes could have a material

adverse eect on the Company’s consolidated results of operations,

and in certain situations, could have a material adverse eect on the

Company’s liquidity and nancial condition.

See Note2 to the Consolidated Financial Statements for further

information on signicant accounting policies that impact the Company.

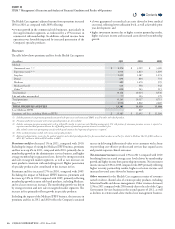

Balance Sheet Caption/Nature of Critical Accounting Estimate Eect if Dierent Assumptions Used

Future policy benets – Guaranteed minimum death benets (“GMDB”

also known as “VADBe”)

ese liabilities are estimates of the present value of net amounts expected

to be paid, less the present value of net future premiums expected to be

received. e amounts to be paid represent the excess of the guaranteed

death benet over the values of contractholders’ accounts. e death benet

coverage in force at December31,2011 (representing the amount payable if

all of approximately 480,000 contractholders had submitted death claims as

of that date) was approximately $5.4billion.

Liabilities for future policy benets for these contracts as of December31

were as follows (inmillions):

•2011 – $1,170

•2010 – $1,138

Current assumptions and methods used to estimate these liabilities are

detailed in Note6 to the Consolidated Financial Statements.

Based on current and historical market, industry and Company-specic

experience and management’s judgment, the Company believes that it is

reasonably likely that the unfavorable changes in the key assumptions and/

or conditions described below could occur. If these unfavorable assumption

changes were to occur, the approximate after-tax decrease in shareholders’

net income would be as follows:

•5% increase in claim mortality rates – $30million

•10% decrease in lapse rates – $20million

•10% increase in election rates for future partial surrenders – $2million

•50basis point decrease in interest rates:

- Unhedged Mean Investment Performance – $20million

- Discount Rate – $30million

•10% increase in volatility – $20million

As of December31,2011, if contractholder account values invested in

underlying equity mutual funds declined by 10% due to equity market

performance, the after-tax decrease in shareholders’ net income resulting

from an increase in the unhedged provision for partial surrenders would be

approximately $5million.

As of December31,2011, if contractholder account values invested in

underlying bond/money market mutual funds declined by 3% due to bond/

money market performance, the after-tax decrease in shareholders’ net

income resulting from an increase in the provision for partial surrenders and

an increase in unhedged exposure would be approximately $10million.

e amounts would be reected in the Run-o Reinsurance segment.

Contents

Q