Cigna 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Consolidated Financial Statements for further information on pension

and other postretirement benet obligations).

e above table also does not contain $52million of gross liabilities

for uncertain tax positions because the Company cannot reasonably

estimate the timing of their resolution with the respective taxing

authorities. See Note19 to the Consolidated Financial Statements

for the year ended December31,2011 for further information.

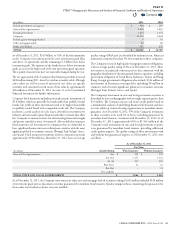

Off-Balance Sheet:

•

Purchase obligations. As of December31,2011, purchase obligations consisted of estimated payments required under contractual arrangements

for future services and investment commitments as follows:

(In millions)

Fixed maturities $ 16

Commercial mortgage loans 162

Real estate 9

Limited liability entities (other long-term investments) 407

Total investment commitments 594

Future service commitments 523

TOTAL PURCHASE OBLIGATIONS $ 1,117

e Company had commitments to invest in limited liability entities

that hold real estate, loans to real estate entities or securities. See

Note11(D) to the Consolidated Financial Statements for additional

information.

Future service commitments include an agreement with IBM for

various information technology (IT) infrastructure services. e

Company’s remaining commitment under this contract is approximately

$162million over the next 2 years. e Company has the ability to

terminate this agreement with 90days notice, subject to termination

fees.

e Company’s remaining estimated future service commitments

primarily represent contracts for certain outsourced business processes

and IT maintenance and support. e Company generally has the

ability to terminate these agreements, but does not anticipate doing so

at this time. Purchase obligations exclude contracts that are cancelable

without penalty and those that do not specify minimum levels of

goods or services to be purchased.

•

Operating leases. For additional information, see Note21 to the

Consolidated Financial Statements.

Guarantees

e Company, through its subsidiaries, is contingently liable for

various nancial and other guarantees provided in the ordinary course

of business. See Note23 to the Consolidated Financial Statements for

additional information on guarantees.

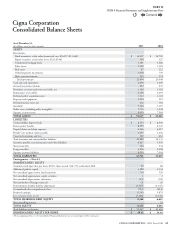

Investment Assets

e Company’s investment assets do not include separate account

assets. Additional information regarding the Company’s investment

assets and related accounting policies is included in Notes2, 10, 11,

12, 13, 14 and 17 to the Consolidated Financial Statements.

Fixed Maturities

Investments in xed maturities include publicly traded and privately

placed debt securities, mortgage and other asset-backed securities,

preferred stocks redeemable by the investor, hybrid and trading securities.

Fair values are based on quoted market prices when available. When

market prices are not available, fair value is generally estimated using

discounted cash ow analyses, incorporating current market inputs for

similar nancial instruments with comparable terms and credit quality.

In instances where there is little or no market activity for the same or

similar instruments, the Company estimates fair value using methods,

models and assumptions that the Company believes a hypothetical

market participant would use to determine a current transaction price.

e prices the Company used to value investment assets are representative

of prices that would be received to sell the assets at the measurement

date (exit prices) and are classied appropriately in the fair value

hierarchy. e Company performs ongoing analyses of prices used

to value invested assets to determine that they represent appropriate

estimates of fair value. is process involves quantitative and qualitative

analysis that is overseen by the Company’s investment professionals,

including reviews of pricing methodologies, judgments of valuation

inputs, and assessments of the signicance of any unobservable inputs,

pricing statistics and trends. ese reviews are also designed to ensure

prices do not become stale, have reasonable explanations as to why

they have changed from prior valuations, or require additional review

of other anomalies. e Company also performs sample testing of sales

values to conrm the accuracy of prior fair value estimates. Exceptions

identied during these processes indicate that adjustments to prices

are infrequent and result in immaterial adjustments to the valuations.

e Company’s xed maturity portfolio continues to be diversied by

issuer and industry type, with no single industry constituting more

than 10% of total invested assets as of December31,2011.

Contents

Q