Cigna 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

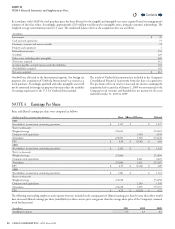

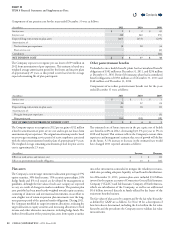

NOTE 3 Acquisitions and Dispositions

e Company may from time to time acquire or dispose of assets,

subsidiaries or lines of business. Signicant transactions are described below.

A. Acquisition of HealthSpring, Inc.

On January31,2012 the Company acquired all of the outstanding

shares of HealthSpring,Inc. (“HealthSpring”) for $55 per share in cash

and Cigna stock awards, representing an estimated cost of approximately

$3.8billion. HealthSpring provides Medicare Advantage coverage in

11 states and the District of Columbia, as well as a large, national

stand-alone Medicare prescription drug business. e Company

funded the acquisition with internal cash resources, including cash

generated from the issuance of commercial paper in 2012, as well as

$2.1billion of additional debt and $650million of new equity issued

during the fourth quarter of 2011 ($629million net of underwriting

discount and fees).

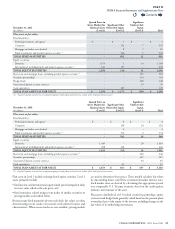

B. Acquisition of FirstAssist

In November2011, the Company acquired FirstAssist Group Holdings

Limited (“FirstAssist”) for approximately $115million, using available

cash on hand. FirstAssist is based in the United Kingdom and provides

travel and protection insurance services that the Company expects will

enhance its individual business in the U.K. and around the world.

In accordance with GAAP, the total purchase price has been allocated to

the tangible and intangible net assets acquired based on management’s

preliminary estimates of their fair values and may change when appraisals

are nalized and as additional information becomes available over

the next several months. Accordingly, approximately $58million was

allocated to intangible assets, while $56million has been allocated to

goodwill and is reported in the International segment.

e results of FirstAssist are included in the Company’s Consolidated

Financial Statements from the date of acquisition. e pro forma eect

on total revenues and net income assuming the acquisition had occurred

as of January1,2010 were not material to the Company’s total revenues

and shareholders’ net income for the years ended December31,2011

and 2010.

C. Reinsurance of Run-off Workers’

Compensation and Personal Accident

Business

On December31,2010, the Company essentially exited from its

workers’ compensation and personal accident reinsurance business

by purchasing retrocessional coverage from a Bermuda subsidiary of

Enstar Group Limited and transferring administration of this business

to the reinsurer. Under the reinsurance agreement, Cigna is indemnied

for liabilities with respect to its workers’ compensation and personal

accident reinsurance business to the extent that these liabilities do not

exceed 190% of the December31,2010 net reserves. e Company

believes that the risk of loss beyond this maximum aggregate is remote.

e reinsurance arrangement is secured by assets held in trust. Cash

consideration paid to the reinsurer was $190million. e net eect

of this transaction was an after-tax loss of $20million ($31million

pre-tax), primarily reported in other operating expenses in the Run-o

Reinsurance segment.

D. Sale of Workers’ Compensation and Case

Management Business

On December1,2010 the Company completed the sale of its workers’

compensation and case management business to GENEX Holdings,Inc.

e Company recognized an after-tax gain on sale of $11million

($18million pre-tax) which was reported in other revenues in the

Disability and Life segment. Proceeds of the sale were received in

preferred stock of GENEX Holdings,Inc., resulting in the Company

becoming a minority shareholder in GENEX Holdings,Inc. is

investment is classied in other long-term investments and accounted

for using the equity method of accounting.

E. Acquisition of Vanbreda International

On August31,2010, the Company acquired 100% of the voting stock

of Vanbreda International NV (Vanbreda International), based in

Antwerp, Belgium for a cash purchase price of $412million. Vanbreda

International specializes in providing worldwide medical insurance

and employee benets to intergovernmental and non-governmental

organizations, including international humanitarian operations, as well

as corporate clients. Vanbreda International’s market leadership in the

intergovernmental segment complements the Company’s position in

providing global health benets primarily to multinational companies

and organizations and their globally mobile employees in North America,

Europe, the Middle East and Asia.

Contents

Q