Cigna 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

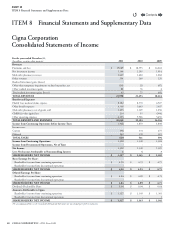

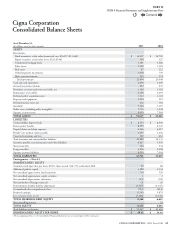

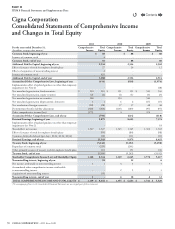

73CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

Troubled debt restructurings

Eective July1,2011, the Company adopted the FASB’s updated

guidance (ASU 2011-02) to clarify for lenders that a troubled debt

restructuring occurs when a debt modication is a concession to

the borrower and the borrower is experiencing nancial diculties.

This guidance was required to be applied retrospectively for

restructuringsoccurring on or after January1,2011. e amendment

also required new disclosures to be providedbeginning in thethird

quarter of 2011 addressing certain troubled debt restructurings. Adoption

of the new guidance did not have a material eect to the Company’s

results of operations or nancial condition. See Note11 for additional

information related to commercial mortgage loans.

Fair value measurements

In May2011, the FASB amended guidance (ASU2011-04) to improve

the comparability of fair value measurements presented and disclosed

in nancial statements prepared in accordance with U.S. GAAP and

International Financial Reporting Standards. e amendments are

eective January1,2012 and are to be applied prospectively.e

Company expects no material eects at implementation.

e Company adopted the FASB’s updated guidance on fair value

measurements (ASU 2010-06) in the rst quarter of 2010, which

requires separate disclosures of signicant transfers between levels in

the fair value hierarchy. See Note10 for additional information.

Amendments to the FASB’s fair value guidance in 2009 had no eect

on the Company’s Consolidated Financial Statements. See Note10

for additional information.

Other-than-temporary impairments

On April1,2009, the Company adopted the FASB’s updated guidance

for evaluating whether an impairment is other than temporary for xed

maturities with declines in fair value below amortized cost (ASC 320).

A reclassication adjustment from retained earnings to accumulated

other comprehensive income was required for previously impaired

xed maturities that had a non-credit loss as of the date of adoption,

net of related tax eects.

e cumulative eect of adoption increased the Company’s retained

earnings in 2009 with an osetting decrease to accumulated other

comprehensive income of $18million, with no overall change to

shareholders’ equity. See Note11 (A) for information on the Company’s

other-than-temporary impairments including additional required

disclosures.

C. Investments

e Company’s accounting policies for investment assets are discussed

below:

Fixed maturities and equity securities

Fixed maturities primarily include bonds, mortgage and other asset-

backed securities and preferred stocks redeemable by the investor.

Equity securities include common stocks and preferred stocks that are

non-redeemable or redeemable only at the option of the issuer. ese

investments are primarily classied as available for sale and are carried

at fair value with changes in fair value recorded in accumulated other

comprehensive income (loss) within shareholders’ equity. Beginning

April1,2009, for xed maturities with declines in fair value below

amortized cost, the Company assesses its intent to sell or whether it

is more likely than not to be required to sell such xed maturities

before their fair values recover. If so, an impairment loss is recognized

in net income for the excess of their amortized cost over fair value. In

addition, when the Company determines it does not expect to recover

the amortized cost basis of xed maturities with declines in fair value

(even if it does not intend to sell or will not be required to sell these

xed maturities), the credit portion of the impairment loss is recognized

in net income and the non-credit portion, if any, is recognized in a

separate component of shareholders’ equity. e credit portion is the

dierence between the amortized cost basis of the xed maturity and

the net present value of its projected future cash ows. Projected future

cash ows are based on qualitative and quantitative factors, including

probability of default, and the estimated timing and amount of recovery.

For mortgage and asset-backed securities, estimated future cash ows

are based on assumptions about the collateral attributes including

prepayment speeds, default rates and changes in value. Equity securities

and, prior to April1,2009, xed maturities were considered impaired,

and their cost basis was written down to fair value through earnings,

when management did not expect to recover the amortized cost, or if

the Company could not demonstrate its intent or ability to hold the

investment until full recovery. Fixed maturities and equity securities

also include trading and certain hybrid securities that are carried at fair

value with changes in fair value reported in realized investment gains and

losses. e Company has irrevocably elected the fair value option for

these securities to simplify accounting and mitigate volatility in results

of operations and nancial condition. Hybrid securities include certain

preferred stock and debt securities with call or conversion options.

Commercial mortgage loans

Mortgage loans held by the Company are made exclusively to commercial

borrowers. Generally, commercial mortgage loans are carried at unpaid

principal balances and are issued at a xed rate of interest. Commercial

mortgage loans are considered impaired when it is probable that the

Company will not collect amounts due according to the terms of

the original loan agreement. e Company monitors credit risk and

assesses the impairment of loans individually and on a consistent basis

for all loans in the portfolio. Impaired loans are carried at the lower of

unpaid principal or fair value of the underlying real estate. Valuation

reserves reect any changes in fair value. e Company estimates the

fair value of the underlying real estate using internal valuations generally

based on discounted cash ow analyses. Certain commercial mortgage

loans without valuation reserves are considered impaired because the

Company will not collect all interest due according to the terms of the

original agreements, however, the Company expects to recover their

remaining carrying value primarily because it is less than the fair value

of the underlying real estate.

Policy loans

Policy loans are carried at unpaid principal balances plus accumulated

interest. e loans are collateralized by insurance policy cash values

and therefore have no exposure to credit loss.

Contents

Q