Cigna 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

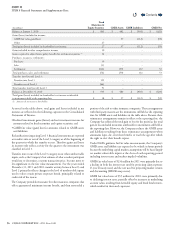

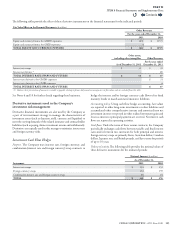

e following table provides the eect of these derivative instruments on the nancial statements for the indicated periods:

Fair Value Eect on the Financial Statements (In millions)

Instrument

Other Long-Term Investments

Accounts Payable, Accrued Expenses

and Other Liabilities

Gain (Loss) Recognized in Other

Comprehensive Income(1)

As of December31, As of December31, For the years ended December31,

2011 2010 2011 2010 2011 2010

Interest rate swaps $ 7 $ 10 $ - $ - $ (3) $ 2

Foreign currency swaps 3 6 19 20 (1) 10

Combination interest rate and

foreign currency swaps - - 11 12 1 (7)

TOTAL $ 10 $ 16 $ 30 $ 32 $ 3 $ 5

(1) Other comprehensive income for foreign currency swaps excludes amounts required to adjust future policy benefits for the run-off settlement annuity business.

For the years ended December31,2011 and 2010, the amount of gains (losses) reclassied from accumulated other comprehensive income into

income was not material. No gains (losses) were recognized due to ineectiveness and there were no amounts excluded from the assessment of

hedge ineectiveness.

NOTE 13 Variable Interest Entities

When the Company becomes involved with a variable interest entity

and when the nature of the Company’s involvement with the entity

changes, in order to determine if the Company is the primary beneciary

and must consolidate the entity, it evaluates:

•the structure and purpose of the entity;

•the risks and rewards created by and shared through the entity; and

•

the entity’s participants’ ability to direct its activities, receive its benets

and absorb its losses. Participants include the entity’s sponsors, equity

holders, guarantors, creditors and servicers.

In the normal course of its investing activities, the Company makes

passive investments in securities that are issued by variable interest

entities for which the Company is not the sponsor or manager. ese

investments are predominantly asset-backed securities primarily

collateralized by foreign bank obligations or mortgage-backed securities.

e asset-backed securities largely represent xed-rate debt securities

issued by trusts that hold perpetual oating-rate subordinated notes

issued by foreign banks. e mortgage-backed securities represent senior

interests in pools of commercial or residential mortgages created and

held by special-purpose entities to provide investors with diversied

exposure to these assets. e Company owns senior securities issued by

several entities and receives xed-rate cash ows from the underlying

assets in the pools. e Company is not the primary beneciary and

does not consolidate any of these entities because either:

•

it had no power to direct the activities that most signicantly impact

the entities’ economic performance; or

•

it had neither the right to receive benets nor the obligation to absorb

losses that could be signicant to these variable interest entities.

e Company has not provided, and does not intend to provide,

nancial support to these entities. e Company performs ongoing

qualitative analyses of its involvement with these variable interest entities

to determine if consolidation is required. e Company’s maximum

potential exposure to loss related to these entities is limited to the

carrying amount of its investment reported in xed maturities and

equity securities, and its aggregate ownership interest is insignicant

relative to the total principal amount issued by these entities.

Contents

Q