Cigna 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Financial Summary

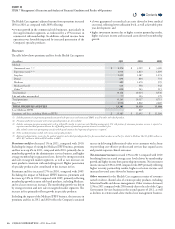

(In millions)

2011 2010 2009

SEGMENT LOSS $ (184) $ (211) $ (142)

Less: special items (after-tax) included in segment loss:

Cost associated with HealthSpring acquisition (28) - -

Resolution of Federal Tax Matter (See Note19 to the Consolidated Financial Statements) - 4 -

Loss on early extinguishment of debt (See Note15 to the Consolidated Financial Statements) - (39) -

Completion of IRS examination (See Note19 to the Consolidated Financial Statements) 14 - 12

ADJUSTED LOSS FROM OPERATIONS $ 170 $ 176 $ 154

Corporate’s segment loss was lower in 2011 compared with 2010

primarily reecting a tax benet from completing the IRS examination

and absence of the 2010 loss on debt extinguishment, partially oset

by costs associated with the HealthSpring acquisition, all of which

were reported as special items.

Corporate’s adjusted loss from operations was lower in 2011 compared

with 2010 primarily reecting decreased pension expense and lower

tax adjustments related to postretirement benets and compensation

resulting from Health Care Reform. ese factors were partially oset

by increased net interest expense due to higher average borrowings

outstanding in 2011.

Corporate’s segment loss and adjusted loss from operations were higher

in 2010 compared with 2009 primarily reecting:

•

higher net interest expense, primarily driven by a higher long-term

debt balance;

•

tax adjustments related to postretirement benets and compensation

resulting from health care reform;

•

pension expense related to the Company’s frozen pension plans which

was reported in Corporate beginning in 2010; and

•

for the segment loss, the after-tax loss on early extinguishment of

debt of $39million.

ese unfavorable eects were partially oset by lower spending on

strategic initiatives and lower directors’ deferred compensation expense.

Liquidity and Capital Resources

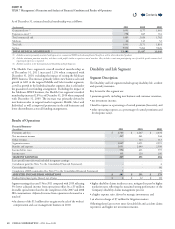

Financial Summary

(In millions)

2011 2010 2009

Short-term investments $ 225 $ 174 $ 493

Cash and cash equivalents $ 4,690 $ 1,605 $ 924

Short-term debt $ 104 $ 552 $ 104

Long-term debt $ 4,990 $ 2,288 $ 2,436

Shareholders’ equity $ 8,344 $ 6,645 $ 5,417

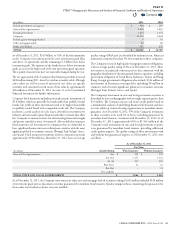

Liquidity

e Company maintains liquidity at two levels: the subsidiary level

and the parent company level.

Liquidity requirements at the subsidiary level generally consist of:

•claim and benet payments to policyholders;

•

operating expense requirements, primarily for employee compensation

and benets; and

•

federal tax payments to the parent company under an intercompany

tax sharing agreement.

e Company’s subsidiaries normally meet their operating requirements by:

•

maintaining appropriate levels of cash, cash equivalents and short-

terminvestments;

•using cash ows from operating activities;

•selling investments;

•

matching investment durations to those estimated for the related

insurance and contractholder liabilities; and

•borrowing from its parent company.

Liquidity requirements at the parent level generally consist of:

•debt service and dividend payments to shareholders;

•pension plan funding; and

•federal tax payments.

e parent normally meets its liquidity requirements by:

•

maintaining appropriate levels of cash, cash equivalents and short-

terminvestments;

•collecting dividends and federal tax payments from its subsidiaries;

•using proceeds from issuance of debt and equity securities; and

•borrowing from its subsidiaries.

Contents

Q