Cigna 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29CIGNA CORPORATION2011 Form10K

PARTI

ITEM 1A Risk Factors

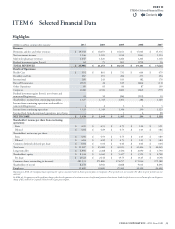

As of February23,2012, the insurance nancial strength ratings were as follows for the Cigna subsidiaries, CGLIC and Life Insurance Company

of North America (“LINA”):

CGLIC

Insurance Ratings(1)

LINA

Insurance Ratings(1)

A.M. Best A

(“Excellent,” 3rd of 16)

A

(“Excellent,” 3rd of 16)

Moody’s A2

(“Good,” 6th of 21)

A2

(“Good,” 6th of 21)

S&P A

(“Strong,” 6th of 21) (Not Rated)

Fitch A

(“Strong,” 6th of 24)

A

(“Strong,” 6th of 24)

(1) Includes the rating assigned, the agency’s characterization of the rating and the position of the rating in the agency’s rating scale (e.g., CGLIC’s rating by A.M. Best is the 3rdhighest

rating awarded in its scale of16).

Global market, economic and geopolitical conditions

may cause fluctuations in equity market prices, interest

rates and credit spreads, which could impact the

Company’s ability to raise or deploy capital as well

as affect the Company’s overall liquidity.

If the equity markets and credit market experience extreme volatility

and disruption, there could be downward pressure on stock prices

and credit capacity for certain issuers without regard to those issuers’

underlying nancial strength. Extreme disruption in the credit markets

could adversely impact the Company’s availability and cost of credit in

the future. In addition, unpredictable or unstable market conditions

or continued pressure in the global or U.S. economy could result in

reduced opportunities to nd suitable opportunities to raise capital.

In November2011, Cigna issued $2.1billion in aggregate principal

amount of senior notes to nance part of the cost for the HealthSpring

acquisition, which increased the Company’s long-term debt to $5.0billion

as of December31,2011. Cigna’s increased debt obligations could make

the Company more vulnerable to general adverse economic and industry

conditions and require the Company to dedicate increased cash ow

from operations to the payment of principal and interest on its debt,

thereby reducing the funds it has available for other purposes, such as

investments in ongoing businesses, acquisitions, dividends and stock

repurchases. In these circumstances, the Company’s ability to execute

on its strategy may be limited, its exibility in planning for or reacting

to changes in its business and market conditions may be reduced, or

its access to capital markets may be limited such that additional capital

may not be available or may only be available on unfavorable terms.

Contents

Q