Cigna 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

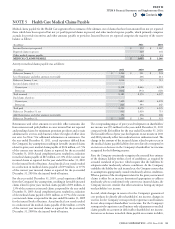

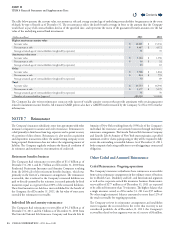

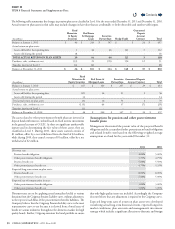

In accordance with GAAP, the total purchase price has been allocated to the tangible and intangible net assets acquired based on management’s

estimates of their fair values. Accordingly, approximately $210million was allocated to intangible assets, primarily customer relationships. e

weighted average amortization period is 15 years. e condensed balance sheet at the acquisition date was as follows:

(In millions)

Investments $ 39

Cash and cash equivalents 73

Premiums, accounts and notes receivable 22

Property and equipment 1

Deferred income taxes (71)

Goodwill 229

Other assets, including other intangibles 220

Total assets acquired 513

Accounts payable, accrued expenses and other liabilities 101

Total liabilities acquired 101

Net assets acquired $ 412

Goodwill was allocated to the International segment. For foreign tax

purposes, the acquisition of Vanbreda International was treated as a

stock purchase. Accordingly, goodwill and other intangible assets will

not be amortized for foreign tax purposes but may reduce the taxability

of earnings repatriated to the U.S. by Vanbreda International.

e results of Vanbreda International are included in the Company’s

Consolidated Financial Statements from the date of acquisition.

e pro forma eect on total revenues and net income assuming the

acquisition had occurred as of January1,2009 was not material to the

Company’s total revenues and shareholders’ net income for the years

ended December31,2010 or 2009.

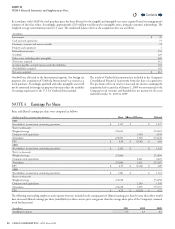

NOTE 4 Earnings Per Share

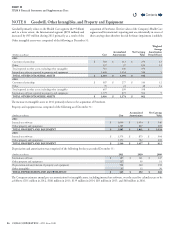

Basic and diluted earnings per share were computed as follows:

(Dollars in millions, except per share amounts)

Basic Eect of Dilution Diluted

2011

Shareholders’ income from continuing operations $ 1,327 $ - $ 1,327

Shares (in thousands):

Weighted average 270,691 - 270,691

Common stock equivalents 3,558 3,558

Total shares 270,691 3,558 274,249

EPS $ 4.90 $ (0.06) $ 4.84

2010

Shareholders’ income from continuing operations $ 1,345 $ - $ 1,345

Shares (in thousands):

Weighted average 272,866 - 272,866

Common stock equivalents 2,421 2,421

Total shares 272,866 2,421 275,287

EPS $ 4.93 $ (0.04) $ 4.89

2009

Shareholders’ income from continuing operations $ 1,301 $ - $ 1,301

Shares (in thousands):

Weighted average 274,058 - 274,058

Common stock equivalents 1,299 1,299

Total shares 274,058 1,299 275,357

EPS $ 4.75 $ (0.02) $ 4.73

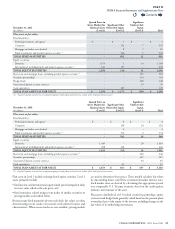

e following outstanding employee stock options were not included in the computation of diluted earnings per share because their eect would

have increased diluted earnings per share (antidilutive) as their exercise price was greater than the average share price of the Company’s common

stock for the period.

(In millions)

2011 2010 2009

Antidilutive options 3.7 6.3 8.8

Contents

Q