Cigna 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 CIGNA CORPORATION2011 Form10K

PART II

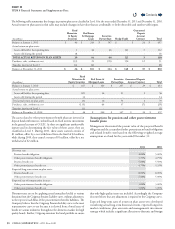

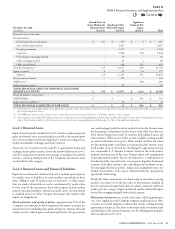

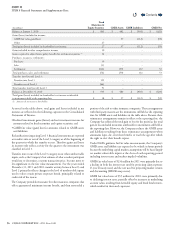

ITEM 8 Financial Statements and Supplementary Data

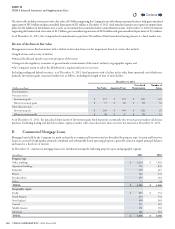

pricing statistics and trends. ese reviews are also designed to ensure

prices do not become stale, have reasonable explanations as to why

they have changed from prior valuations, or require additional review

of other anomalies. e Company also performs sample testing of sales

values to conrm the accuracy of prior fair value estimates. Exceptions

identied during these processes indicate that adjustments to prices

are infrequent and result in immaterial adjustments to valuations.

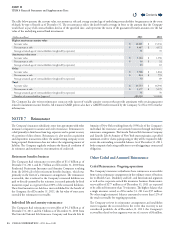

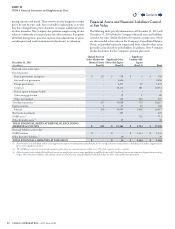

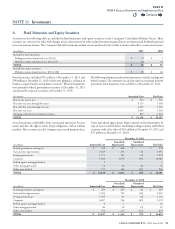

Financial Assets and Financial Liabilities Carried

at Fair Value

e following tables provide information as of December31,2011 and

December31,2010 about the Company’s nancial assets and liabilities

carried at fair value. Similar disclosures for separate account assets, which

are also recorded at fair value on the Company’s Consolidated Balance

Sheets, are provided separately as gains and losses related to these assets

generally accrue directly to policyholders. In addition, Note9 contains

similar disclosures for the Company’s pension plan assets.

December31,2011

(In millions)

Quoted Prices in

Active Markets for

Identical Assets

(Level1)

Signicant Other

Observable Inputs

(Level2)

Signicant

Unobservable

Inputs

(Level3) Total

Financial assets at fair value:

Fixed maturities:

Federal government and agency $ 217 $ 738 $ 3 $ 958

State and local government - 2,456 - 2,456

Foreign government - 1,251 23 1,274

Corporate - 10,132 381 10,513

Federal agency mortgage-backed - 9 - 9

Other mortgage-backed - 79 1 80

Other asset-backed - 363 564 927

Total xed maturities(1) 217 15,028 972 16,217

Equity securities 3 67 30 100

Subtotal 220 15,095 1,002 16,317

Short-term investments - 225 - 225

GMIB assets(2) - - 712 712

Other derivative assets(3) - 45 - 45

TOTAL FINANCIAL ASSETS AT FAIR VALUE, EXCLUDING

SEPARATE ACCOUNTS $ 220 $ 15,365 $ 1,714 $ 17,299

Financial liabilities at fair value:

GMIB liabilities $ - $ - $ 1,333 $ 1,333

Other derivative liabilities(3) - 30 - 30

TOTAL FINANCIAL LIABILITIES AT FAIR VALUE $ $ 30 $ 1,333 $ 1,363

(1) Fixed maturities include $826million of net appreciation required to adjust future policy benefits for the run-off settlement annuity business including $115million of appreciation

for securities classified in Level3.

(2) The GMIB assets represent retrocessional contracts in place from two external reinsurers which cover 55% of the exposures on these contracts.

(3) Other derivative assets include $10million of interest rate and foreign currency swaps qualifying as cash flow hedges and $35million of interest rate swaps not designated as accounting

hedges. Other derivative liabilities reflect foreign currency and interest rate swaps qualifying as cash flow hedges. See Note12 for additional information.

Contents

Q