Cigna 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

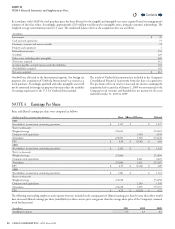

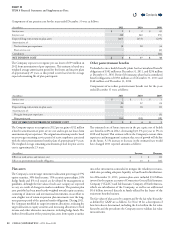

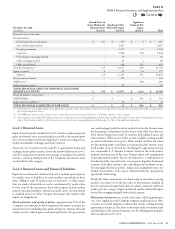

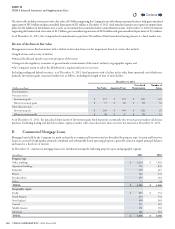

e following table summarizes the changes in pension plan assets classied in Level3 for the years ended December31,2011 and December31,2010.

Actual return on plan assets in this table may include changes in fair value that are attributable to both observable and unobservable inputs.

(In millions)

Fixed

Maturities

&Equity

Securities

Real Estate

& Mortgage

Loans

Securities

Partnerships Hedge Funds

Guaranteed

Deposit

Account

Contract Total

Balance at January 1, 2011 $ 46 $ 240 $ 347 $ - $ 24 $ 657

Actual return on plan assets:

Assets still held at the reporting date 1 44 66 (2) 3 112

Assets sold during the period 18 - - - - 18

TOTAL ACTUAL RETURN ONPLAN ASSETS 19 44 66 2 3 130

Purchases, sales, settlements, net (33) 21 (99) 150 12 51

Transfers into/out of Level 3 (6) (2) - - - (8)

Balance at December 31, 2011 $ 26 $ 303 $ 314 $ 148 $ 39 $ 830

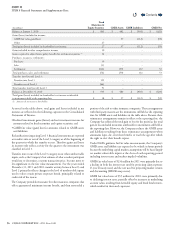

(In millions)

Fixed

Maturities&

Equity Securities

Real Estate&

Mortgage Loans

Securities

Partnerships

Guaranteed Deposit

Account Contract Total

Balance at January1,2010 $ 167 $ 160 $ 257 $ 29 $ 613

Actual return on plan assets:

Assets still held at the reporting date (15) 16 53 2 56

Assets sold during the period 14 - - - 14

Total actual return on plan assets (1) 16 53 2 70

Purchases, sales, settlements, net (119) 64 37 (7) (25)

Transfers into/out of Level3 (1) - - - (1)

Balance at December31,2010 $ 46 $ 240 $ 347 $ 24 $ 657

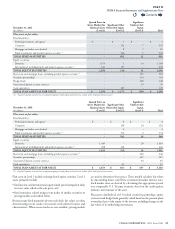

e assets related to other postretirement benet plans are invested in

deposit funds with interest credited based on xed income investments

in the general account of CGLIC. As there are signicant unobservable

inputs used in determining the fair value of these assets, they are

classied as Level3. During 2011, these assets earned a return of

$1million, oset by a net withdrawal from the fund of $2million,

while during 2010, they earned a return of $1million, oset by a net

withdrawal of $2million.

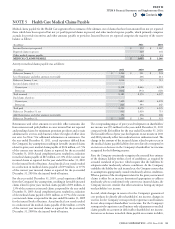

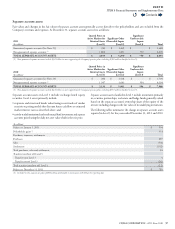

Assumptions for pension and other postretirement

benefit plans

Management determined the present value of the projected benet

obligation and the accumulated other postretirement benet obligation

and related benet costs based on the following weighted average

assumptions as of and for the years ended December31:

2011 2010

Discount rate:

Pension benet obligation 4.00% 5.00%

Other postretirement benet obligation 3.75% 4.75%

Pension benet cost 5.00% 5.50%

Other postretirement benet cost 4.75% 5.25%

Expected long-term return on plan assets:

Pension benet cost 8.00% 8.00%

Other postretirement benet cost 5.00% 5.00%

Expected rate of compensation increase:

Other postretirement benet obligation 3.00% 3.00%

Other postretirement benet cost 3.00% 3.00%

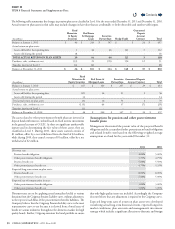

Discount rates are set by applying actual annualized yields at various

durations from the Citigroup Pension Liability curve, without adjustment,

to the expected cash ows of the postretirement benets liabilities. e

Company believes that the Citigroup Pension Liability curve is the most

representative curve to use because it is derived from a broad array of

bonds in various industries throughout the domestic market for high

quality bonds. Further, Citigroup monitors the bond portfolio to ensure

that only high quality issues are included. Accordingly, the Company

does not believe that any adjustment is required to the Citigroup curve.

Expected long-term rates of return on plan assets were developed

considering actual long-term historical returns, expected long-term

market conditions, plan asset mix and management’s investment

strategy, which includes a signicant allocation to domestic and foreign

Contents

Q