Cigna 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

Assumed and Ceded reinsurance: Run-off Reinsurance

segment

e Company’s Run-o Reinsurance operations assumed risks related

to GMDB contracts, GMIB contracts, workers’ compensation, and

personal accident business. e Run-o Reinsurance operations also

purchased retrocessional coverage to reduce the risk of loss on these

contracts. In December2010, the Company entered into reinsurance

arrangements to transfer the remaining liabilities and administration

of the workers’ compensation and personal accident businesses to a

subsidiary of Enstar Group Limited. Under this arrangement, the new

reinsurer also assumes the future risk of collection from prior reinsurers.

See Note3 for further details regarding this arrangement.

Liabilities related to GMDB, workers’ compensation and personal

accident are included in future policy benets and unpaid claims.

Because the GMIB contracts are treated as derivatives under GAAP,

the asset related to GMIB is recorded in the Other assets, including

other intangibles caption and the liability related to GMIB is recorded

in Accounts payable, accrued expenses, and other liabilities on the

Company’s Consolidated Balance Sheets (see Notes10 and 23 for

additional discussion of the GMIB assets and liabilities).

e reinsurance recoverables for GMDB, workers’ compensation,

and personal accident total $252million as of December31,2011.

Of this amount, approximately 93% are secured by assets in trust or

letters of credit.

e Company reviews its reinsurance arrangements and establishes

reserves against the recoverables in the event that recovery is not

considered probable. As of December31,2011, the Company’s

recoverables related to this segment were net of a reserve of $1million.

e Company’s payment obligations for underlying reinsurance

exposures assumed by the Company under these contracts are based on

the ceding companies’ claim payments. For GMDB, claim payments

vary because of changes in equity markets and interest rates, as well as

mortality and contractholder behavior. Any of these claim payments

can extend many years into the future, and the amount of the ceding

companies’ ultimate claims, and therefore, the amount ofthe Company’s

ultimate payment obligations and corresponding ultimate collection

from retrocessionaires, may not be known with certainty for some time.

Summary

e Company’s reserves for underlying reinsurance exposures assumed

by the Company, as well as for amounts recoverable from reinsurers/

retrocessionaires for both ongoing operations and the run-o reinsurance

operation, are considered appropriate as of December31,2011, based

on current information. However, it is possible that future developments

could have a material adverse eect on the Company’s consolidated results

of operations and, in certain situations, such as if actual experience diers

from the assumptions used in estimating reserves for GMDB, could

have a material adverse eect on the Company’s nancial condition.e

Company bears the risk of loss if its retrocessionaires do not meet or

are unable to meet their reinsurance obligations to the Company.

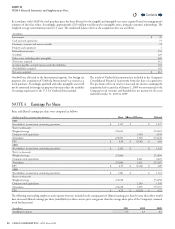

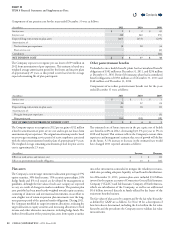

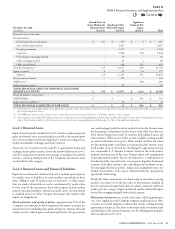

In the Company’s Consolidated Income Statements, Premiums and fees

were presented net of ceded premiums, and Total benets and expenses

were presented net of reinsurance recoveries, in the following amounts:

(In millions)

2011 2010 2009

Premiums and Fees

Short-duration contracts:

Direct $ 17,423 $ 16,611 $ 13,886

Assumed 158 496 1,076

Ceded (185) (187) (192)

17,396 16,920 14,770

Long-duration contracts:

Direct 1,919 1,687 1,499

Assumed 36 36 33

Ceded:

Individual life insurance and annuity business sold (203) (195) (209)

Other (59) (55) (52)

1,693 1,473 1,271

TOTAL $ 19,089 $ 18,393 $ 16,041

Reinsurance recoveries

Individual life insurance and annuity business sold $ 310 $ 321 $ 322

Other 213 156 178

TOTAL $ 523 $ 477 $ 500

e decrease in assumed premiums in 2011 as compared to 2010

primarily reects the eect of the Company’s exit from a large, low-

margin assumed government life insurance program. e decrease in

assumed premiums in 2010 as compared to 2009 primarily reects

the eect of the Company’s exit from two large, non-strategic assumed

government life insurance programs as well as the transfer of policies

assumed in the acquisition of Great-West Healthcare directly to one of

the Company’s insurance subsidiaries in 2010. e eects of reinsurance

on written premiums and fees for short-duration contracts were not

materially dierent from the recognized premium and fee amounts

shown in the table above.

Contents

Q