Cigna 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Segment Reporting

Operating segments generally reect groups of related products,

but the International segment is generally based on geography. e

Company measures the nancial results of its segments using “segment

earnings (loss)”, which is dened as shareholders’ income (loss) from

continuing operations excluding after-tax realized investment gains

and losses. “Adjusted income from operations” for each segment is

dened as segment earnings excluding special items and the results of

the Company’s GMIB business. Adjusted income from operations is

another measure of protability used by the Company’s management

because it presents the underlying results of operations of the segment

and permits analysis of trends. is measure is not determined in

accordance with GAAP and should not be viewed as a substitute for the

most directly comparable GAAP measure, which is segment earnings.

Each segment provides a reconciliation between segment earnings and

adjusted income from operations.

Beginning in 2010, the Company began reporting the expense associated

with its frozen pension plans in Corporate. Prior periods were not

restated; the eect on prior periods is not material.

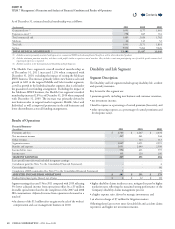

Health Care Segment

Segment Description

e Health Care segment oers insured and self-insured medical,

dental, behavioral health, vision, and prescription drug benet plans,

health advocacy programs and other products and services that may

be integrated to provide comprehensive health care benet programs.

Cigna HealthCare companies oer these products and services in

all 50 states, the District of Columbia and the U.S. Virgin Islands.

ese products and services are oered through a variety of funding

arrangements such as guaranteed cost, retrospectively experience-rated

and administrative services only (“ASO”) arrangements.

e Company measures the operating eectiveness of the Health Care

segment using the following key factors:

•segment earnings and adjusted income from operations;

•membership growth;

•sales of specialty products to core medical customers;

•

operating expenses as a percentage of segment revenues (operating

expense ratio);

•changes in operating expenses per member; and

•

medical expense as a percentage of premiums (medical care ratio) in

the guaranteed cost business.

Results of Operations

Financial Summary

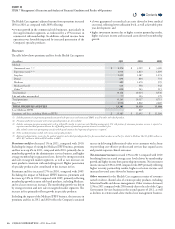

(In millions)

2011 2010 2009

Premiums and fees $ 13,181 $ 13,319 $ 11,384

Net investment income 274 243 181

Mail order pharmacy revenues 1,447 1,420 1,282

Other revenues 234 266 262

Segment revenues 15,136 15,248 13,109

Mail order pharmacy cost of goods sold 1,203 1,169 1,036

Benets and other operating expenses 12,386 12,742 10,943

Benets and expenses 13,589 13,911 11,979

Income before taxes 1,547 1,337 1,130

Income taxes 556 476 399

SEGMENT EARNINGS 991 861 731

Less: special items (after-tax) included in segment earnings:

Curtailment gain (See Note9 to the Consolidated Financial Statements) - - 25

Cost reduction charge - - (24)

Completion of IRS examination (See Note19 to the Consolidated Financial Statements) 1 - 1

ADJUSTED INCOME FROM OPERATIONS $ 990 $ 861 $ 729

Realized investment gains (losses), net of taxes $ 24 $ 26 $ (19)

e Health Care segment’s adjustedincome from operations increased

15% in 2011, as compared with 2010 reecting:

•

growth in premiums and fees of 6% in 2011, excluding the impact of

exiting the Medicare IPFFS business, primarily due to higher average

membership in the guaranteed cost and ASO businesses, particularly

in the targeted market segments: Middle, Select and Individual, and

growth in specialty revenues as well as rate increases on most products

consistent with underlying trend;

•

a lower guaranteed cost medical care ratio and higher experience-rated

margins driven by low medical services utilization trend, as well as

favorable prior year development, partially oset by the estimated

cost of premium rebates calculated under the minimum medical loss

ratio requirements of Health Care Reform; and

•higher net investment income of 13% in 2011, primarily reecting

increased average asset levels driven by membership growth, as well

as higher income from partnership investments.

Contents

Q