Cigna 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 CIGNA CORPORATION2011 Form10K

PART II

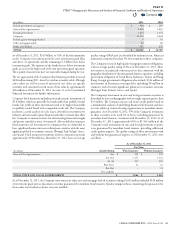

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities

Litigation Reform Act of 1995

Cigna Corporation and its subsidiaries (the “Company”) and its

representatives may from time to time make written and oral forward-

looking statements, including statements contained in press releases, in

the Company’s lings with the Securities and Exchange Commission, in

its reports to shareholders and in meetings with analysts and investors.

Forward-looking statements may contain information about nancial

prospects, economic conditions, trends and other uncertainties. ese

forward-looking statements are based on management’s beliefs and

assumptions and on information available to management at the time

the statements are or were made. Forward-looking statements include,

but are not limited to, the information concerning possible or assumed

future business strategies, nancing plans, competitive position, potential

growth opportunities, potential operating performance improvements,

trends and, in particular, the Company’s strategic initiatives, litigation

and other legal matters, operational improvement initiatives in the

health care operations, and the outlook for the Company’s full year

2012 and beyond results. Forward-looking statements include all

statements that are not historical facts and can be identied by the use

of forward-looking terminology such as the words “believe”, “expect”,

“plan”, “intend”, “anticipate”, “estimate”, “predict”, “potential”, “may”,

“should” or similar expressions.

By their nature, forward-looking statements: (i) speak only as of the

date they are made, (ii) are not guarantees of future performance or

results and (iii) are subject to risks, uncertainties and assumptions

that are dicult to predict or quantify. erefore, actual results could

dier materially and adversely from those forward-looking statements

as a result of a variety of factors. Some factors that could cause actual

results to dier materially from the forward-looking statements include:

1. increased medical costs that are higher than anticipated in

establishing premium rates in the Company’s Health Care

operations, including increased use and costs of medical services;

2. increased medical, administrative, technology or other costs

resulting from new legislative and regulatory requirements imposed

on the Company’s businesses;

3. challenges and risks associated with implementing operational

improvement initiatives and strategic actions in the ongoing

operations of the businesses, including those related to: (i) growth

in targeted geographies, product lines, buying segments and

distribution channels, (ii) oering products that meet emerging

market needs, (iii) strengthening underwriting and pricing

eectiveness, (iv) strengthening medical cost and medical

membership results, (v) delivering quality service to members

and health care professionals using eective technology solutions

and (vi) lowering administrative costs;

4. the ability to successfully complete the integration of acquired

businesses, including the acquired HealthSpring businesses by,

among other things, operating Medicare Advantage coordinated

care plans and HealthSpring’s prescription drug plan, retaining

and growing membership, realizing revenue, expense and other

synergies, renewing contracts on competitive terms, successfully

leveraging the information technology platform of the acquired

businesses, and retaining key personnel;

5. the ability of the Company to execute its growth plans by

successfully leveraging its capabilities and those of the businesses

acquired in serving the Seniors segment;

6. the possibility that the acquired HealthSpring business may be

adversely aected by economic, business and/or competitive

factors;

7. risks associated with pending and potential state and federal class

action lawsuits, disputes regarding reinsurance arrangements,

other litigation and regulatory actions challenging the Company’s

businesses, including disputes related to payments to health care

professionals, government investigations and proceedings, and

tax audits and related litigation;

8. heightened competition, particularly price competition, that could

reduce product margins and constrain growth in the Company’s

businesses, primarily the Health Care business;

9. risks associated with the Company’s mail order pharmacy business

that, among other things, include any potential operational

deciencies or service issues as well as loss or suspension of state

pharmacy licenses;

10. signicant changes in interest rates or sustained deterioration in

the commercial real estate markets;

11. downgrades in the nancial strength ratings of the Company’s

insurance subsidiaries, that could, among other things, adversely

aect new sales and retention of current business; downgrades in

nancial strength ratings of reinsurers, that could result in increased

statutory reserves or capital requirements of the Company’s

insurance subsidiaries;

12. limitations on the ability of the Company’s insurance subsidiaries

to dividend capital to the parent company as a result of downgrades

in the subsidiaries’ nancial strength ratings, changes in statutory

reserve or capital requirements or other nancial constraints;

13. inability of the hedge programs adopted by the Company to

substantially reduce equity market and certain interest rate risks

in the run-o reinsurance operations;

14. adjustments to the reserve assumptions (including lapse, partial

surrender, mortality, interest rates and volatility) used in estimating

the Company’s liabilities for reinsurance contracts covering

guaranteed minimum death benets under certain variable

annuities;

15. adjustments to the assumptions (including interest rates, annuity

election rates and amounts collectible from reinsurers) used in

estimating the Company’s assets and liabilities for reinsurance

contracts covering guaranteed minimum income benets under

certain variable annuities;

16. signicant stock market declines, that could, among other things,

result in increased expenses for guaranteed minimum income

benet contracts, guaranteed minimum death benet contracts

and the Company’s pension plans in future periods as well as the

recognition of additional pension obligations;

17. signicant deterioration in economic conditions and signicant

market volatility, that could have an adverse eect on the Company’s

operations,investments, liquidity and access to capital markets;

Contents

Q