Cigna 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FS-8 CIGNA CORPORATION2011 Form10K

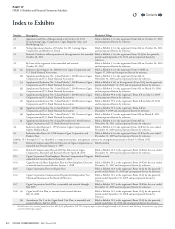

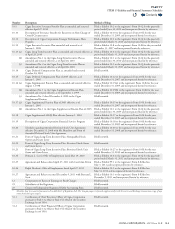

PART IV

ITEM 15 Exhibits and Financial Statement Schedules

e Company may redeem these Notes, at any time, in whole or in

part, at a redemption price equal to the greater of:

•100% of the principal amount of the Notesto be redeemed; or

•

the present value of the remaining principal and interest payments

on the Notesbeing redeemed discounted at the applicable Treasury

Rate plus 30 basis points (5-Year 2.75% Notesdue 2016), 35 basis

points (10-Year 4% Notesdue 2022), or 40 basis points (30-Year

5.375% Notesdue 2042).

In June2011, the Company entered into a new ve-year revolving

credit and letter of credit agreement for $1.5billion, which permits

up to $500million to be used for letters of credit. is agreement is

diversied among 16 banks, with 3 banks each having 12% of the

commitment and the remaining 13 banks with 64% of the commitment.

e credit agreement includes options that are subject to consent

by the administrative agent and the committing banks, to increase

the commitment amount to $2billion and to extend the term past

June2016. e credit agreement is available for general corporate

purposes, including as a commercial paper backstop and for the

issuance of letters of credit. is agreement includes certain covenants,

including a nancial covenant requiring the Company to maintain

a total debt to adjusted capital ratio at or below 0.50 to 1.00. As of

December31,2011, the Company had $4billion of borrowing capacity

within the maximum debt coverage covenant in the agreement in

addition to the $5.1billion of debt outstanding. ere were letters of

credit of $118million issued as of December31,2011.

In March2011, the Company issued $300million of 10-Year Notesdue

March15,2021 at a stated interest rate of 4.5% ($298million, net

of discount, with an eective interest rate of 4.683% per year) and

$300million of 30-Year Notesdue March15,2041 at a stated interest

rate of 5.875% ($298million, net of discount, with an eective

interest rate of 6.008% per year). Interest is payable on March15 and

September15 of each year beginning September15,2011. e proceeds

of this debt were used for general corporate purposes, including the

repayment of debt maturing in 2011.

e Company may redeem these Notes, at any time, in whole or in

part, at a redemption price equal to the greater of:

•100% of the principal amount of the Notesto be redeemed; or

•

the present value of the remaining principal and interest payments

on the Notesbeing redeemed discounted at the applicable Treasury

Rate plus 20 basis points (10-Year 4.5% Notesdue 2021) or 25 basis

points (30-Year 5.875% Notesdue 2041).

During 2011, the Company repaid $449million in maturing long-

term debt.

In the fourth quarter of 2010, the Company entered into the following

transactions related to its long-term debt:

•

In December2010 the Company oered to settle its 8.5% Notesdue

2019, including accrued interest from November1 through the

settlement date. e tender price equaled the present value of the

remaining principal and interest payments on the Notesbeing

redeemed, discounted at a rate equal to the 10-year Treasury Rate

plus a xed spread of 100 basis points. e tender oer priced at

a yield of 4.128% and principal of $99million was tendered, with

$251million remaining outstanding. e Company paid $130million,

including accrued interest and expenses, to settle the Notes, resulting

in an after-tax loss on early debt extinguishment of $21million.

•

In December2010 the Company oered to settle its 6.35% Notesdue

2018, including accrued interest from September16 through the

settlement date. e tender price equaled the present value of the

remaining principal and interest payments on the Notesbeing

redeemed, discounted at a rate equal to the 10-year Treasury Rate

plus a xed spread of 45 basis points. e tender oer priced at a

yield of 3.923% and principal of $169million was tendered, with

$131million remaining outstanding. e Company paid $198million,

including accrued interest and expenses, to settle the Notes, resulting

in an after-tax loss on early debt extinguishment of $18million.

•

In December2010, the Company issued $250million of 4.375%

Notes($249million net of debt discount, with an eective interest

rate of 5.1%). e dierence between the stated and eective interest

rates primarily reects the eect of treasury locks. Interest is payable on

June15 and December15 of each year beginning December15,2010.

ese Noteswill mature on December15,2020. e proceeds of this

debt were used to fund the tender oer for the 8.5% Senior Notesdue

2019 and the 6.35% Senior Notesdue 2018 described above.

In May2010, the Company issued $300million of 5.125%

Notes($299million, net of debt discount, with an eective interest

rate of 5.36% per year). Interest is payable on June15 and December15

of each year beginning December15,2010. ese Noteswill mature

on June15,2020. e proceeds of this debt were used for general

corporate purposes.

Contents

Q