Cigna 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

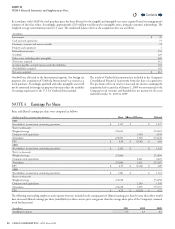

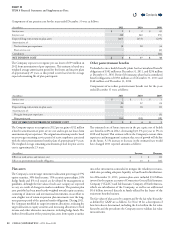

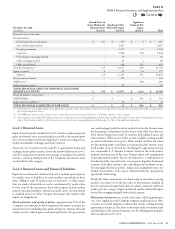

Components of net pension cost for the years ended December31 were as follows:

(In millions)

2011 2010 2009

Service cost $ 2 $ 2 $ 43

Interest cost 228 240 250

Expected long-term return on plan assets (267) (253) (239)

Amortization of:

Net loss from past experience 38 28 34

Prior service cost - - (4)

Curtailment - - (46)

NET PENSION COST $ 1 $ 17 $ 38

e Company expects to recognize pre-tax losses of $59million in

2012 from amortization of past experience. is estimate is based on a

weighted average amortization period for the frozen and inactive plans

of approximately 29 years, as this period is now based on the average

expected remaining life of plan participants.

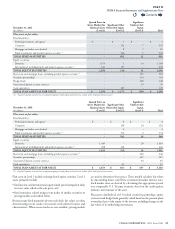

Other postretirement benefits

Unfunded retiree health benet plans had accumulated benet

obligations of $302million at December31,2011, and $296million

at December31,2010. Retiree life insurance plans had accumulated

benet obligations of $150million as of December31,2011 and

$148million as of December31,2010.

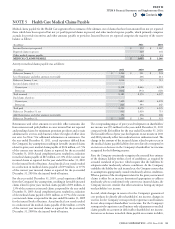

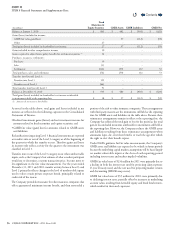

Components of net other postretirement benet cost for the years

ended December31 were as follows:

(In millions)

2011 2010 2009

Service cost $ 2 $ 1 $ 1

Interest cost 20 22 24

Expected long-term return on plan assets (1) (1) (1)

Amortization of:

Net gain from past experience - - (5)

Prior service cost (16) (18) (18)

NET OTHER POSTRETIREMENT BENEFIT COST $ 5 $ 4 $ 1

e Company expects to recognize in 2012 pre-tax gains of $12million

related to amortization of prior service cost and no pre-tax losses from

amortization of past experience. e original amortization period is based

on an average remaining service period of active employees associated

with the other postretirement benet plans of approximately 9 years.

e weighted average remaining amortization period for prior service

cost is approximately 2.5 years.

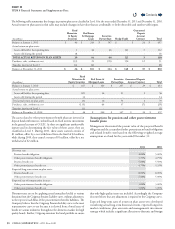

e estimated rate of future increases in the per capita cost of health

care benets is 8% in 2012, decreasing by 0.5% per year to 5% in

2018 and beyond. is estimate reects the Company’s current claim

experience and management’s estimate that rates of growth will decline

in the future. A 1% increase or decrease in the estimated rate would

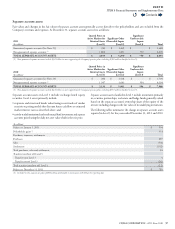

have changed 2011 reported amounts as follows:

(In millions)

Increase Decrease

Eect on total service and interest cost $ 1 $ (1)

Eect on postretirement benet obligation $ 13 $ (11)

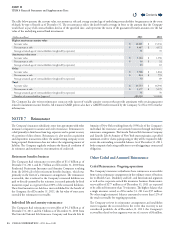

Plan assets

e Company’s current target investment allocation percentages (37%

equity securities, 30% xed income, 15% securities partnerships, 10%

hedge funds and 8% real estate) are developed by management as

guidelines, although the fair values of each asset category are expected

to vary as a result of changes in market conditions. e pension plan

asset portfolio has been most heavily weighted towards equity securities,

consisting of domestic and international investments, in an eort to

earn a higher rate of return on pension plan investments over the long-

term payout period of the pension benet obligations. During 2011,

the Company modied its target investment allocations, reducing the

target allocation to equity securities and increasing allocations to xed

income and other alternative investments, including hedge funds. e

further diversication of the pension plan assets from equity securities

into other investments is intended to mitigate the volatility in returns,

while also providing adequate liquidity to fund benet distributions.

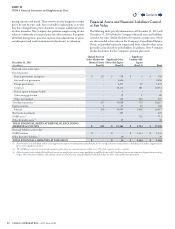

As of December31,2011, pension plan assets included $3.0billion

invested in the separate accounts of Connecticut General Life Insurance

Company (“CGLIC”) and Life Insurance Company of North America,

which are subsidiaries of the Company, as well as an additional

$0.4billion invested directly in funds oered by the buyer of the

retirement benets business.

e fair values of plan assets by category and by the fair value hierarchy

as dened by GAAP are as follows. See Note10 for a description of

how fair value is determined, including the level within the fair value

hierarchy and the procedures the Company uses to validate fair value

measurements.

Contents

Q