Cigna 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

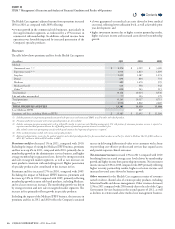

Cash ows for the years ended December31, were as follows:

(In millions)

2011 2010 2009

Operating activities $ 1,491 $ 1,743 $ 745

Investing activities $ (1,270) $ (1,342) $ (1,485)

Financing activities $ 2,867 $ 274 $ 307

Cash ows from operating activities consist of cash receipts and

disbursements for premiums and fees, mail order pharmacy and other

revenues, gains (losses) recognized in connection with the Company’s

GMDB equity hedge program, investment income, taxes, and benets

and expenses.

Because certain income and expense transactions do not generate cash,

and because cash transactions related to revenue and expenses may

occur in periods dierent from when those revenues and expenses are

recognized in shareholders’ net income, cash ows from operating

activities can be signicantly dierent from shareholders’ net income.

Cash ows from investing activities generally consist of net investment

purchases or sales and net purchases of property and equipment, which

includes capitalized software, as well as cash used to acquire businesses.

Cash ows from nancing activities are generally comprised of issuances

and re-payment of debt at the parent level, proceeds on the issuance

of common stock in the open market and resulting from stock option

exercises, and stock repurchases. In addition, the subsidiaries report

net deposits/withdrawals to/from investment contract liabilities (that

include universal life insurance liabilities) because such liabilities are

considered nancing activities with policyholders.

2011:

Operating activities

For the year ended December31,2011, cash ows from operating

activities were greater than net income by $163million. Net income

contains certain pre-tax income and expense items that neither provide

nor use operating cash ow, including:

•GMIB fair value loss of $ 234million;

•net charges related to special items of $40million;

•

tax benets related to resolution of a federal tax matter of $33million;

•depreciation and amortization charges of $ 345million; and

•realized investment gains of $ 62million.

Cash ows from operating activities were lower than net income

excluding the items noted above by $361million. Excluding cash

outows of $45million associated with the GMDB equity hedge

program (which did not aect shareholders’ net income), cash ows

from operating activities were lower than net income by $316million.

is result primarily reects domestic qualied pension contributions

of $250million as well as signicant claim run-out from the Medicare

IPFFS business, that the Company exited in 2011.

Cash ows from operating activities decreased by $252million in 2011

compared with 2010. Excluding the results of the GMDB equity hedge

program (that did not aect net income), cash ows from operating

activities decreased by $364million. is decrease in 2011 primarily

reects higher management compensation, income tax and pension

payments in 2011 compared with 2010 and unfavorable operating

cash ows in the Medicare IPFFS business in 2011 due to signicant

claim run-out compared to signicant favorable operating cash ows

from the growth of this business in 2010. Operating cash ows were

favorably aected in 2010 because paid claims on this business growth

lagged premium collections.

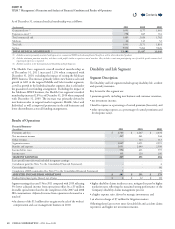

Investing activities

Cash used in investing activities was $1.3billion. is use of cash

primarily consisted of net purchases of investments of $746million,

cash used to fund acquisitions (net of cash acquired) of $114million,

and net purchases of property and equipment of $422million.

Financing activities

Cash provided from nancing activities primarily consisted of net

proceeds from the issuance of long-term debt of $2.7billion and

proceeds on issuances of common stock of $734million, primarily used

to fund the acquisition of Healthspring,Inc. See the Capital Resources

section for further information. Financing activities also included net

deposits to contractholder deposit funds of $145million. ese inows

were partially oset by scheduled payments of debt of $451million

and common stock repurchases of $225million.

2010:

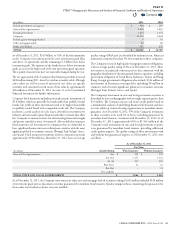

Operating activities

For the year ended December31,2010, cash ows from operating

activities were greater than net income by $394million. Net income

contains certain income and expense items that neither provide nor

use operating cash ow, including:

•GMIB fair value loss of $ 55million;

•

a pre-tax loss on the transfer of the workers’ compensation and

personal accident business of $31million;

•

tax benets related to the resolution of a federal tax matter of

$101million;

•depreciation and amortization charges of $ 292million; and

•realized investment gains of $ 75million.

Cash ows from operating activities were greater than net income

excluding the items noted above by $192million. Excluding cash

outows of $157million associated with the GMDB equity hedge

program, (that did not aect shareholders’ net income) cash ows from

operating activities were higher than net income by $349million. is

result primarily reects premium growth in the Health Care segment’s

risk businesses due to signicant new business in 2010 and tax payments

lower than expense due to favorable eects of benet plans (primarily

pension) and deferred foreign earnings, partially oset by pension

contributions of $212million.

Contents

Q