CarMax 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CarMax 2011 7

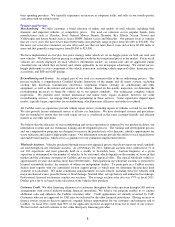

CARMAX MARKETS

DISCOVERING EFFICIENCIES

Despite our return to measured store growth in fi scal

2011, we maintained the momentum we achieved when

we temporarily suspended growth by continuing our focus

on BUILDING A BETTER CARMAX and putting in place a

multi-year process for becoming a leaner company.

Our process engineering and service operations groups

partnered to ELIMINATE WASTE through a greater focus

on problem solving and the systemwide standardiza-

tion of processes, while still MAINTAINING OUR QUALITY

standard. As of the end of fi scal 2011, we estimate our

efforts over recent years have allowed us to achieve a

sustainable reduction in average reconditioning costs

of approximately $250 per vehicle, on a cumulative

basis. We believe that further application of what we’ve

learned will allow us to continue identifying opportuni-

ties to streamline our systems and reduce waste.

Since its establishment in late 2008, the CarMax

OPERATIONAL EXCELLENCE TEAM has led over 700

associates in approximately 100 kaizen problem-

solving events that have contributed to our collective

EFFICIENCY GAINS and signifi cant OVERHEAD SAVINGS.

We expect that these events will continue to identify

opportunities and develop solutions for process improve-

ments that not only could result in time and cost savings

but also enhance the experience of our customers, our

associates and our other partners. And as we grow,

we will further leverage these improvements and effi -

ciencies, and we believe they will have an even greater

positive effect on the way we run our business.

As a result of these events and successful cost

man age ment, and despite our return to store growth,

we were able to achieve modest selling, general and

administrative (SG&A) leverage during fi scal 2011.

We were especially pleased with this performance

given the fact that commissions and other variable

costs rise as sales grow. We also increased our

advertising along with sales growth and added back

some previously delayed initiatives we believe will

support the LONG-TERM HEALTH AND COMPETITIVENESS

of CarMax.

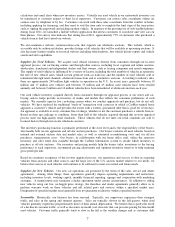

Existing Markets

Opening in Fiscal 2012

ALABAMA

Birmingham

Huntsville

ARIZONA

Tucson

Phoenix (2)

CALIFORNIA

Fresno

Los Angeles (9)

Sacramento (2)

San Diego (2)*

COLORADO

Colorado Springs

CONNECTICUT

Hartford /

New Haven (2)

FLORIDA

Jacksonville

Miami (5)

Orlando (2)

Tampa (2)

CARMAX USED CAR SUPERSTORES

GEORGIA

Atlanta (5)

Augusta

ILLINOIS

Chicago (8)

INDIANA

Indianapolis

KANSAS

Kansas City (2)

Wichita

KENTUCKY

Lexington*

Louisville

LOUISIANA

Baton Rouge*

MASSACHUSETTS

North Attleborough*

MISSISSIPPI

Jackson

NEBRASKA

Omaha

NEVADA

Las Vegas (2)

NEW MEXICO

Albuquerque

NORTH

CAROLINA

Charlotte (4)

Greensboro (2)

Raleigh (2)

OHIO

Cincinnati

Columbus (2)

Dayton

OKLAHOMA

Oklahoma City

Tulsa

SOUTH

CAROLINA

Charleston

Columbia

Greenville

TENNESSEE

Chattanooga*

Knoxville

Memphis

Nashville (2)

TEXAS

Austin (2)

Dallas /

Fort Worth (4)

Houston (4)

San Antonio (2)

UTAH

Salt Lake City

VIRGINIA

Charlottesville

Norfolk / Virginia

Beach (2)

Richmond (2)

WASHINGTON, D.C./

BALTIMORE (7)

WISCONSIN

Milwaukee (2)

*Opening in fi scal 2012 (including one store in San Diego)