CarMax 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

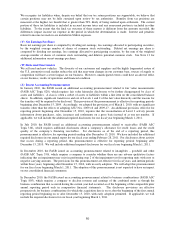

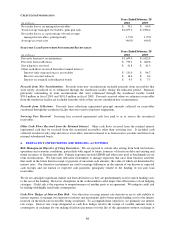

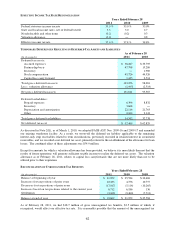

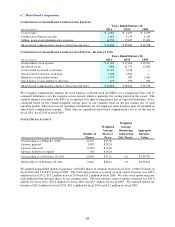

DERIVATIVES NOT DESIGNATED AS ACCOUNTING HEDGES

(In thousands) Location

Gain (loss) on interest rate swaps (1) CAF Income 3,661$ (8,547)$ (15,214)$

Net periodic settlements and accrued interest CAF Income (7,969) (20,128) (16,127)

Total (4,308)$ (28,675)$ (31,341)$

Years Ended February 28

2011

2009

2010

(1) Prior to March 1, 2010, substantially all of the changes in the fair value of derivatives were offset by changes in fair value of

our retained interest in the related securitized receivables, which were also recorded in CAF Income.

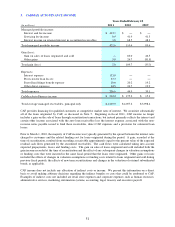

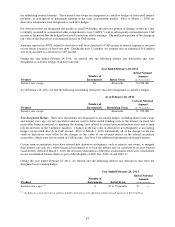

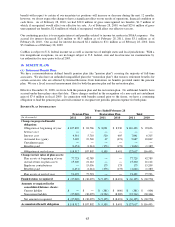

7. FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants in the principal market or, if none exists, the most advantageous market, for

the specific asset or liability at the measurement date (referred to as the “exit price”). The fair value should be based

on assumptions that market participants would use, including a consideration of nonperformance risk.

We assess the inputs used to measure fair value using the three-tier hierarchy. The hierarchy indicates the extent to

which inputs used in measuring fair value are observable in the market.

Level 1 Inputs include unadjusted quoted prices in active markets for identical assets or liabilities that

we can access at the measurement date.

Level 2 Inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly or indirectly, including quoted prices for similar assets in active

markets, quoted prices from identical or similar assets in inactive markets and observable

inputs such as interest rates and yield curves.

Level 3 Inputs that are significant to the measurement that are not observable in the market and include

management's judgments about the assumptions market participants would use in pricing the

asset or liability (including assumptions about risk).

Our fair value processes include controls that are designed to ensure that fair values are appropriate. Such controls

include model validation, review of key model inputs, analysis of period-over-period fluctuations and reviews by

senior management.

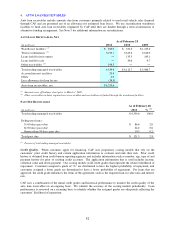

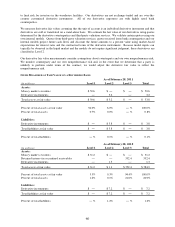

VALUATION METHODOLOGIES

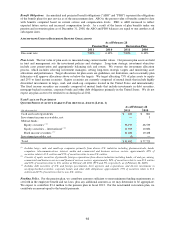

Money market securities. Money market securities are cash equivalents, which are included in either cash and cash

equivalents or other assets, and consist of highly liquid investments with original maturities of three months or less.

We use quoted market prices for identical assets to measure fair value. Therefore, all money market securities are

classified as Level 1.

Retained Interest in Securitized Receivables. Prior to March 1, 2010, the retained interest in securitized receivables

included interest-only strip receivables, various reserve accounts, required excess receivables and retained

subordinated bonds. Excluding the retained subordinated bonds, we estimated the fair value of the retained interest

using internal valuation models. These models included a combination of market inputs and our own assumptions.

As the valuation models included significant unobservable inputs, we classified the retained interest as Level 3.

For the retained subordinated bonds, we based our valuation on observable market prices for similar assets when

available. Otherwise, our valuations were based on input from independent third parties and internal valuation

models. As the key assumption used in the valuation was based on unobservable inputs, we classified the retained

subordinated bonds as Level 3. As described in Note 5, there was no retained interest as of February 28, 2011.

Derivative Instruments. The fair values of our derivative instruments are included in either other current assets or

accounts payable. As described in Note 6, as part of our risk management strategy, we utilize derivative instruments

to manage differences in the amount of our known or expected cash receipts and our known or expected cash

payments principally related to the funding of our auto loan receivables. Interest rate swaps are used to manage our

exposure to interest rate movements, to better match funding costs to the interest on the fixed-rate receivables being

securitized and to minimize the funding costs related to certain term securitization trusts. Interest rate caps are used