CarMax 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

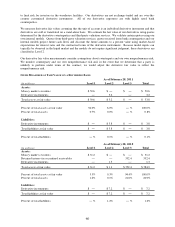

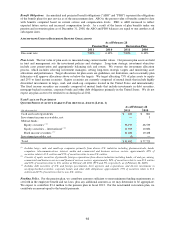

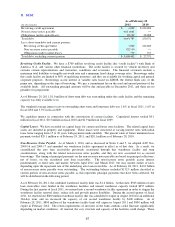

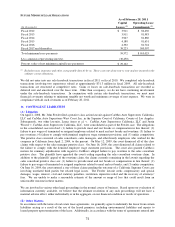

changes could have a significant impact on our funding costs. See Notes 4 and 5 for additional information on the

related securitized auto loan receivables.

12. STOCK AND STOCK-BASED INCENTIVE PLANS

(A) Shareholder Rights Plan and Undesignated Preferred Stock

In conjunction with our shareholder rights plan, shareholders received preferred stock purchase rights as a dividend

at the rate of one right for each share of CarMax, Inc. common stock owned. The rights are exercisable only upon

the attainment of, or the commencement of a tender offer to attain, a 15% or greater ownership interest in the

company by a person or group. When exercisable, and as adjusted for our March 2007 2-for-1 stock split, each right

would entitle the holder to buy one half of one one-thousandth of a share of Cumulative Participating Preferred

Stock, Series A, $20 par value, at an exercise price of $140 per share, subject to adjustment. A total of 300,000

shares of such preferred stock, which has preferential dividend and liquidation rights, have been authorized and

designated. No such shares are outstanding. In the event that an acquiring person or group acquires the specified

ownership percentage of CarMax, Inc. common stock (except pursuant to a cash tender offer for all outstanding

shares determined to be fair by the board of directors) or engages in certain transactions with the company after the

rights become exercisable, each right will be converted into a right to purchase, for half the current market price at

that time, shares of CarMax, Inc. common stock valued at two times the exercise price. We also have an additional

19,700,000 authorized shares of undesignated preferred stock of which no shares are outstanding.

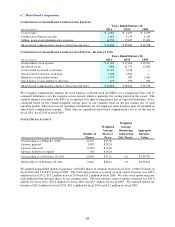

(B) Stock Incentive Plans

We maintain long-term incentive plans for management, key employees and the nonemployee members of our board

of directors. The plans allow for the grant of equity-based compensation awards, including nonqualified stock

options, incentive stock options, stock appreciation rights, restricted stock awards, stock- and cash-settled restricted

stock units, stock grants or a combination of awards. To date, we have not awarded any incentive stock options.

Prior to fiscal 2007, the majority of associates who received share-based compensation awards primarily received

nonqualified stock options. From fiscal 2007 through fiscal 2009, these associates primarily received restricted

stock instead of stock options, and beginning in fiscal 2010, these associates primarily received cash-settled

restricted stock units instead of restricted stock awards. Senior management and other key associates continue to

receive awards of nonqualified stock options and, starting in fiscal 2010, stock-settled restricted stock units.

Nonemployee directors continue to receive awards of nonqualified stock options and stock grants.

Nonqualified Stock Options. Nonqualified stock options are awards that allow the recipient to purchase shares of

our common stock at a fixed price. Stock options are granted at an exercise price equal to the fair market value of

our common stock on the grant date. Substantially all of the stock options vest annually in equal amounts over

periods of three to four years. These options are subject to forfeiture and expire no later than ten years after the date

of the grant.

Restricted Stock. Restricted stock awards are awards of our common stock that are subject to specified restrictions

and a risk of forfeiture. The restrictions typically lapse three years from the grant date. Participants holding

restricted stock are entitled to vote on matters submitted to holders of our common stock for a vote.

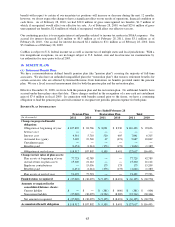

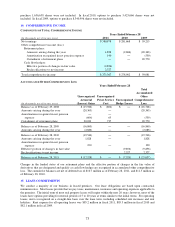

Stock-Settled Restricted Stock Units. Also referred to as market stock units, or MSUs, these are awards to eligible

key associates that are converted into between zero and two shares of common stock for each unit granted at the end

of a three-year vesting period. The conversion ratio is calculated by dividing the average closing price of our stock

during the final forty trading days of the three-year vesting period by our stock price on the grant date, with the

resulting quotient capped at two. This quotient is then multiplied by the number of MSUs granted to yield the

number of shares awarded. MSUs are subject to forfeiture and do not have voting rights.

Cash-Settled Restricted Stock Units. Also referred to as restricted stock units, or RSUs, these are awards that entitle

the holder to a cash payment equal to the fair market value of a share of our common stock for each unit granted at

the end of a three-year vesting period. However, the cash payment per RSU will not be greater than 200% or less

than 75% of the fair market value of a share of our common stock on the grant date. RSUs are liability awards that

are subject to forfeiture and do not have voting rights.

As of February 28, 2011, a total of 39,200,000 shares of our common stock have been authorized to be issued under

the long-term incentive plans. The number of unissued common shares reserved for future grants under the long-

term incentive plans was 5,815,552 as of February 28, 2011.