CarMax 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

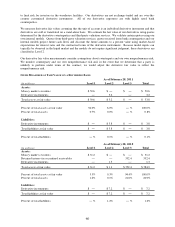

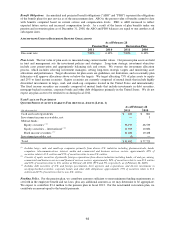

(C) Share-Based Compensation

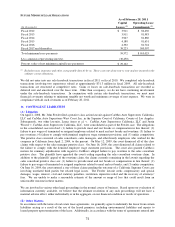

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

(In thousands)

Cost of sales 2,081$ 2,103$ 2,136$

CarMax Auto Finance income 1,603 1,334 1,181

Selling, general and administrative expenses 40,996 35,407 33,201

Share-based compensation expense, before income taxes 44,680$ 38,844$ 36,518$

Years Ended February 28

2011

2010

2009

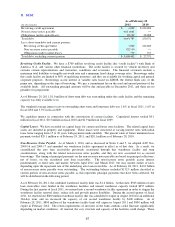

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE – BY GRANT TYPE

(In thousands)

Nonqualified stock options 17,302$ 17,404$ 19,031$

Restricted stock 5,964 11,571 15,823

Cash-settled restricted stock units 13,917 5,718 ―

Stock-settled restricted stock units 5,948 2,614 ―

Employee stock purchase plan 1,074 987 1,081

Stock grants to non-employee directors 475 550 583

Share-based compensation expense, before income taxes 44,680$ 38,844$ 36,518$

2011

2010

2009

Years Ended February 28

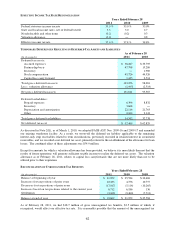

We recognize compensation expense for stock options, restricted stock and MSUs on a straight-line basis (net of

estimated forfeitures) over the requisite service period, which is generally the vesting period of the award. The

variable expense associated with RSUs is recognized over their vesting period (net of expected forfeitures) and is

calculated based on the volume-weighted average price of our common stock on the last trading day of each

reporting period. The total costs for matching contributions for our employee stock purchase plan are included in

share-based compensation expense. There were no capitalized share-based compensation costs as of the end of

fiscal 2011, fiscal 2010 or fiscal 2009.

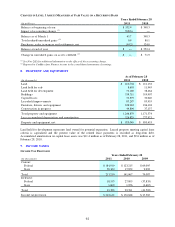

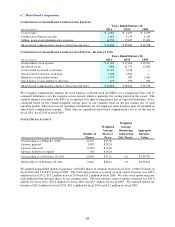

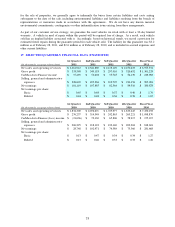

STOCK OPTION ACTIVITY

Outstanding as of March 1, 2010 13,741 15.58$

Options granted 1,893 25.29$

Options exercised (3,125) 14.60$

Options forfeited or expired (65) 14.24$

Outstanding as of February 28, 2011 12,444 17.31$ 4.2

$ 224,720

Exercisable as of February 28, 2011 6,922 16.12$ 3.4

$ 133,232

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

(Shares and intrinsic value in thousands)

Number of

Shares

Aggregate

Intrinsic

Value

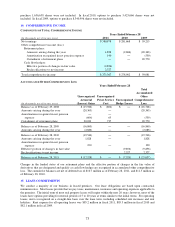

We granted nonqualified options to purchase 1,892,867 shares of common stock in fiscal 2011, 2,948,150 shares in

fiscal 2010 and 2,219,857 in fiscal 2009. The total cash received as a result of stock option exercises was $45.6

million in fiscal 2011, $35.2 million in fiscal 2010 and $10.2 million in fiscal 2009. We settle stock option exercises

with authorized but unissued shares of our common stock. The total intrinsic value of options exercised was $41.6

million for fiscal 2011, $25.8 million for fiscal 2010 and $5.7 million for fiscal 2009. We realized related tax

benefits of $16.5 million for fiscal 2011, $10.1 million for fiscal 2010 and $2.2 million for fiscal 2009.