CarMax 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

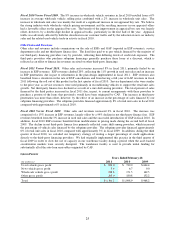

Income Taxes

The effective income tax rate was 37.9% in fiscal 2011, 37.8% in fiscal 2010 and 38.8% in fiscal 2009. The fiscal

2011 effective tax rate benefited from favorable adjustments relating to prior years’ tax items. The fiscal 2010

effective tax rate was slightly reduced by the favorable settlement of prior year tax audits.

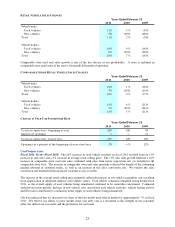

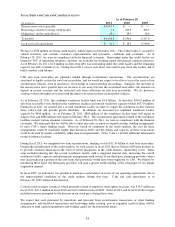

FISCAL 2012 PLANNED SUPERSTORE OPENINGS

Location Television Market Market Status Planned Opening Date

Baton Rouge, Louisiana Baton Rouge New Q1 fiscal 2012

Lexington, Kentucky Lexington New Q1 fiscal 2012

Escondido, California San Diego Existing Q2 fiscal 2012

North Attleborough, Massachusetts Providence New Q3 fiscal 2012

Chattanooga, Tennessee Chattanooga New Q4 fiscal 2012

We estimate capital expenditures will total approximately $225.0 million in fiscal 2012. Compared with the

$76.6 million of capital spending in fiscal 2011, the increase in planned fiscal 2012 expenditures primarily reflects

real estate acquisitions and construction costs associated with store growth. We incurred no material construction

costs in fiscal 2011 related to the three stores opened in that year. These stores were built in fiscal 2009, but we

chose not to open them until economic conditions improved. We expect fiscal 2012 capital spending will include

some costs for stores planned to be opened in the first half of fiscal 2013. We expect to open between eight and ten

stores in fiscal 2013.

RECENT ACCOUNTING PRONOUNCEMENTS

See Note 2(X) for information on recent accounting pronouncements applicable to CarMax.

FINANCIAL CONDITION

Liquidity and Capital Resources

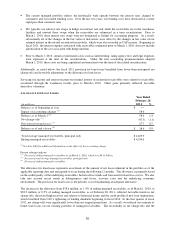

The combined effects of the adoption of ASU Nos. 2009-16 and 2009-17 and the March 1, 2010, amendment to our

then existing warehouse facility agreement represent non-cash transactions, and thus the reported cash flow

information for fiscal 2011 takes into account the effect of these and other related reclassifications and adjustments.

See Note 2(E) for additional information on the effects of the accounting change.

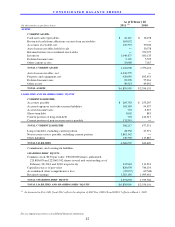

Operating Activities. In fiscal 2011, net cash used in operating activities totaled $17.2 million, while in fiscal 2010

and fiscal 2009, net cash provided by operating activities totaled $50.3 million and $264.6 million, respectively. In

fiscal 2011, a $304.7 million increase in auto loan receivables more than offset the net cash generated by all other

operating activities, resulting in the net use of cash. As discussed in Note 2(E), auto loan receivables and the related

cash flows were not reported in the consolidated financial statements prior to fiscal 2011. The increase in auto loan

receivables primarily reflected the amount by which CAF net loan originations exceeded loan repayments during the

year. CAF auto loan receivables are funded through securitization transactions. As a result, the majority of the

increases in auto loan receivables are accompanied by increases in non-recourse notes payable, which are reflected

as cash provided by financing activities and not included in cash provided by operations.

Compared with the prior year, the $214.3 million decline in cash from operating activities in fiscal 2010 occurred

despite the significant increase in net income. It primarily reflected the use of cash for increases in the retained

interest in securitized receivables and inventory in fiscal 2010, while the prior year benefited from the generation of

cash from a significant reduction in inventory.

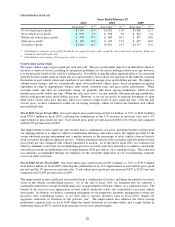

After taking into account the effect of the change in accounting for securitized receivables, the $43.7 million of

retained interest as of the end of fiscal 2010 was related to amounts securitized in the warehouse facility as of

February 28, 2010, and this amount was either reclassified or eliminated during the first quarter of fiscal 2011 in

conjunction with resecuritization activity. The $204.1 million increase in the retained interest in fiscal 2010

primarily resulted from retaining subordinated bonds in an April 2009 term securitization and favorable mark-to-

market adjustments recognized during that fiscal year.