CarMax 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

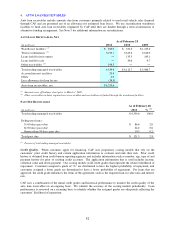

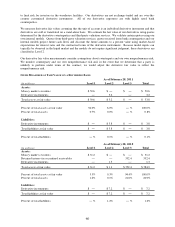

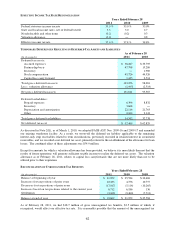

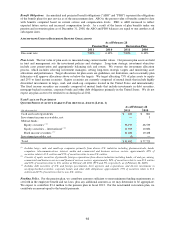

EFFECTIVE INCOME TAX RATE RECONCILIATION

Federal statutory income tax rate 35.0 % 35.0 % 35.0%

State and local income taxes, net of federal benefit 3.3 3.0 2.7

Nondeductible and other items (0.2) (0.2) 0.3

Valuation allowance (0.2) ―0.8

Effective income tax rate 37.9 % 37.8 % 38.8%

2011

2010

2009

Years Ended February 28

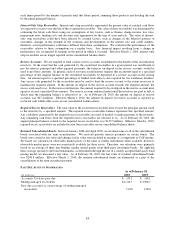

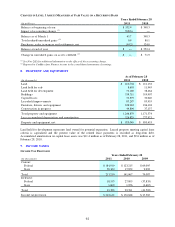

TEMPORARY DIFFERENCES RESULTING IN DEFERRED TAX ASSETS AND LIABILITIES

(In thousands)

Deferred tax assets:

Accrued expenses 38,287$ 33,795$

Partnership basis 47,798 15,286

Inventory ― 1,960

Stock compensation 45,726 44,526

Capital loss carry forward 1,445 2,514

Total gross deferred tax assets 133,256 98,081

Less: valuation allowance (1,445) (2,514)

Net gross deferred tax assets 131,811 95,567

Deferred tax liabilities:

Prepaid expenses 6,394 8,832

Inventory 3,668 ―

Depreciation and amortization 22,116 21,763

Other 2,164 2,143

Total gross deferred tax liabilities 34,342 32,738

Net deferred tax asset 97,469$ 62,829$

As of February 28

2011

2010

As discussed in Note 2(E), as of March 1, 2010, we adopted FASB ASU Nos. 2009-16 and 2009-17 and amended

our existing warehouse facility. As a result, we wrote-off the deferred tax liability applicable to the remaining

interest-only strip receivables related to term securitizations, previously recorded in retained interest in securitized

receivables, and we recorded a net deferred tax asset, primarily related to the establishment of the allowance for loan

losses. The combined effect of these adjustments was $54.9 million.

Except for amounts for which a valuation allowance has been provided, we believe it is more likely than not that the

results of future operations will generate sufficient taxable income to realize the deferred tax assets. The valuation

allowance as of February 28, 2011, relates to capital loss carryforwards that are not more likely than not to be

utilized prior to their expiration.

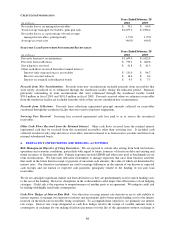

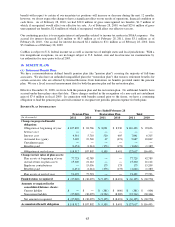

RECONCILIATION OF UNRECOGNIZED TAX BENEFITS

(In thousands)

Balance at beginning of year 21,952$ 25,584$ 32,669$

Increases for tax positions of prior years 10,183 4,756 10,757

Decreases for tax positions of prior years (17,017) (5,114) (10,265)

Increases based on tax positions related to the current year 6,712 6,186 136

Settlements (3,168) (9,460) (7,713)

Balance at end of year 18,662$ 21,952$ 25,584$

Years Ended February 28

2011

2010

2009

As of February 28, 2011, we had $18.7 million of gross unrecognized tax benefits, $3.5 million of which, if

recognized, would affect our effective tax rate. It is reasonably possible that the amount of the unrecognized tax