CarMax 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

litigation settlement, which increased earnings by $0.02 per share. SG&A expenses as a percent of net sales

and operating revenues (the “SG&A ratio”), fell to 10.1% from 11.0% in fiscal 2010 due to the leverage

associated with the increases in unit sales and average selling prices.

In fiscal 2011, $17.2 million of cash was used in operating activities, while in fiscal 2010, $50.3 million of cash

was provided by operating activities. In fiscal 2011, a $304.7 million increase in auto loan receivables more

than offset the net cash generated by all other operating activities, resulting in the net use of cash. As discussed

in Note 2(E), auto loan receivables and the related cash flows were not reported in the consolidated financial

statements prior to fiscal 2011. The increase in auto loan receivables primarily reflected the amount by which

CAF net loan originations exceeded loan repayments during the year. CAF auto loan receivables are funded

through securitization transactions. As a result, the majority of the increases in auto loan receivables are

accompanied by increases in non-recourse notes payable, which are reflected as cash provided by financing

activities and not included in cash provided by operations.

CRITICAL ACCOUNTING POLICIES

Our results of operations and financial condition as reflected in the consolidated financial statements have been

prepared in accordance with U.S. generally accepted accounting principles. Preparation of financial statements

requires management to make estimates and assumptions affecting the reported amounts of assets, liabilities,

revenues, expenses and the disclosures of contingent assets and liabilities. We use our historical experience and

other relevant factors when developing our estimates and assumptions. We continually evaluate these estimates and

assumptions. Note 2 includes a discussion of significant accounting policies. The accounting policies discussed

below are the ones we consider critical to an understanding of our consolidated financial statements because their

application places the most significant demands on our judgment. Our financial results might have been different if

different assumptions had been used or other conditions had prevailed.

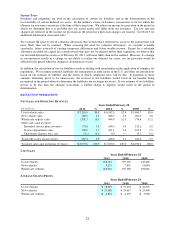

Financing and Securitization Transactions

We maintain a revolving securitization program comprised of two warehouse facilities (“warehouse facilities”) to

fund substantially all of the auto loan receivables originated by CAF until they can be funded through a term

securitization or alternative funding arrangement. As of March 1, 2010, we adopted Accounting Standards Update

(“ASU”) Nos. 2009-16 and 2009-17 on a prospective basis. Pursuant to these pronouncements, we now recognize

all transfers of auto loan receivables into either our warehouse facilities or term securitizations as secured

borrowings, which results in recording the auto loan receivables and the related non-recourse notes payable on our

consolidated balance sheets. Also pursuant to these pronouncements, beginning in fiscal 2011, CAF income

included in the consolidated statements of earnings no longer includes a gain on the sale of loans through

securitization transactions, but instead primarily reflects the interest and fee income associated with the auto loan

receivables less the interest expense associated with the non-recourse notes payable issued to fund these receivables,

direct CAF expenses and a provision for estimated loan losses.

Auto loan receivables include amounts due from customers primarily related to used retail vehicle sales financed

through CAF and are presented net of an allowance for estimated loan losses. The allowance for loan losses

represents an estimate of the amount of net losses inherent in the portfolio as of the applicable reporting date and

anticipated to occur during the following 12 months. The allowance is primarily based on the credit quality of the

underlying receivables, historical loss trends and forecasted forward loss curves. We also take into account recent

trends in delinquencies and losses, recovery rates and the underlying economic environment. The provision for loan

losses is the periodic cost of maintaining an adequate allowance.

See Notes 2(E), 2(H), 4 and 5 for additional information on auto loan receivables and securitizations.

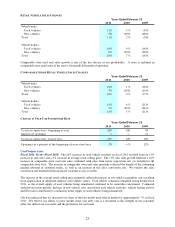

Revenue Recognition

We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or

upon delivery to a customer. We recognize used vehicle revenue when a sales contract has been executed and the

vehicle has been delivered, net of a reserve for returns under our 5-day, money-back guarantee. A reserve for

vehicle returns is recorded based on historical experience and trends, and results could be affected if future vehicle

returns differ from historical averages.

We also sell ESPs and GAP on behalf of unrelated third parties to customers who purchase a vehicle. Because we

are not the primary obligor under these plans, we recognize commission revenue at the time of sale, net of a reserve

for returns. The reserve for cancellations is recorded based on historical experience and trends, and results could be

affected if future cancellations differ from historical averages.