CarMax 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

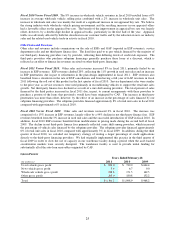

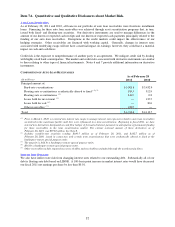

TOTAL DEBT AND CASH AND CASH EQUIVALENTS

(In millions)

Non-recourse notes payable 4,013.7$ ―$ ―$

Borrowings under revolving credit facility 1.0 122.5 308.5

Obligations under capital leases 29.1 28.1 28.6

Total debt 4,043.8$ 150.6$ 337.0$

Cash and cash equivalents 41.1$ 18.3$ 140.6$

2010

2009

2011

As of February 28

We have a $700 million revolving credit facility, which expires in December 2011. The credit facility is secured by

vehicle inventory and contains customary representations and warranties, conditions and covenants. As of

February 28, 2011, we were in compliance with the financial covenants. Borrowings under this credit facility are

limited to 80% of qualifying inventory, and they are available for working capital and general corporate purposes.

As of February 28, 2011, $1.0 million of short-term debt was outstanding under the credit facility and the remaining

capacity was fully available to us. During fiscal 2011, excess cash flows were used to pay down this facility and to

build a modest cash balance.

CAF auto loan receivables are primarily funded through securitization transactions. Our securitizations are

structured to legally isolate the auto loan receivables, and we would not expect to be able to access the assets of our

securitization vehicles, even in insolvency, receivership or conservatorship proceedings. Similarly, the investors in

the non-recourse notes payable have no recourse to our assets beyond the securitized receivables, the amounts on

deposit in reserve accounts and the restricted cash from collections on auto loan receivables. We do, however,

continue to have the rights associated with the interest we retain in these securitization vehicles.

As of February 28, 2011, the combined warehouse facility limit was $1.6 billion. At that date, $943.0 million of

auto loan receivables were funded in the warehouse facilities and unused warehouse capacity totaled $657.0 million.

During fiscal 2011, we entered into a second warehouse facility in order to stagger the warehouse facility renewal

dates, reduce risk and provide greater flexibility. In addition, we increased our combined warehouse facility

capacity by $400 million. As of February 28, 2011, $800 million of the warehouse facility limit will expire in

August 2011 and $800 million will expire in February 2012. The securitization agreements related to the warehouse

facilities include various financial covenants. As of February 28, 2011, we were in compliance with the financial

covenants. We anticipate that we will be able to enter into new, or renew or expand existing, funding arrangements

to meet CAF’s future funding needs. However, based on conditions in the credit markets, the cost for these

arrangements could be materially higher than historical levels and the timing and capacity of these transactions

could be dictated by market availability rather than our requirements. Notes 5 and 11 include additional information

on the warehouse facilities.

During fiscal 2011, we completed two term securitizations, funding a total of $1.30 billion of auto loan receivables.

Despite the normalization of the credit markets, we took actions in fiscal 2011 that we believe will better position us

to provide consumer financing in the event of future disruptions in the credit markets, should they occur. These

steps included entering into the second warehouse facility with a staggered renewal date, increasing the overall

warehouse facility capacity and entering into arrangements with several of our third-party financing providers where

they are purchasing a portion of the auto loans that previously would have been originated by CAF. We believe by

purchasing these loans, the third-party providers will gain a greater understanding of the advantages of our unique

origination channel.

In fiscal 2009, we believed it was prudent to maintain a cash balance in excess of our operating requirements due to

the unprecedented conditions in the credit markets during that time. Cash and cash equivalents as of

February 28, 2009, reflected this decision.

Cash received on equity issuances, which primarily related to employee stock option exercises, was $38.3 million in

fiscal 2011, $31.3 million in fiscal 2010 and $10.2 million in fiscal 2009. In fiscal 2011 and fiscal 2010 the receipts

included exercises prompted by the increase in our stock price during those years.

We expect that cash generated by operations and proceeds from securitization transactions or other funding

arrangements, sale-leaseback transactions and borrowings under existing, new or expanded credit facilities will be

sufficient to fund capital expenditures and working capital for the foreseeable future.