CarMax 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

purchase 1,656,658 shares were not included. In fiscal 2010, options to purchase 5,425,666 shares were not

included. In fiscal 2009, options to purchase 8,340,996 shares were not included.

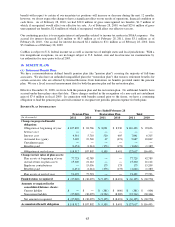

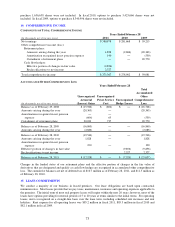

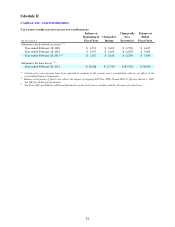

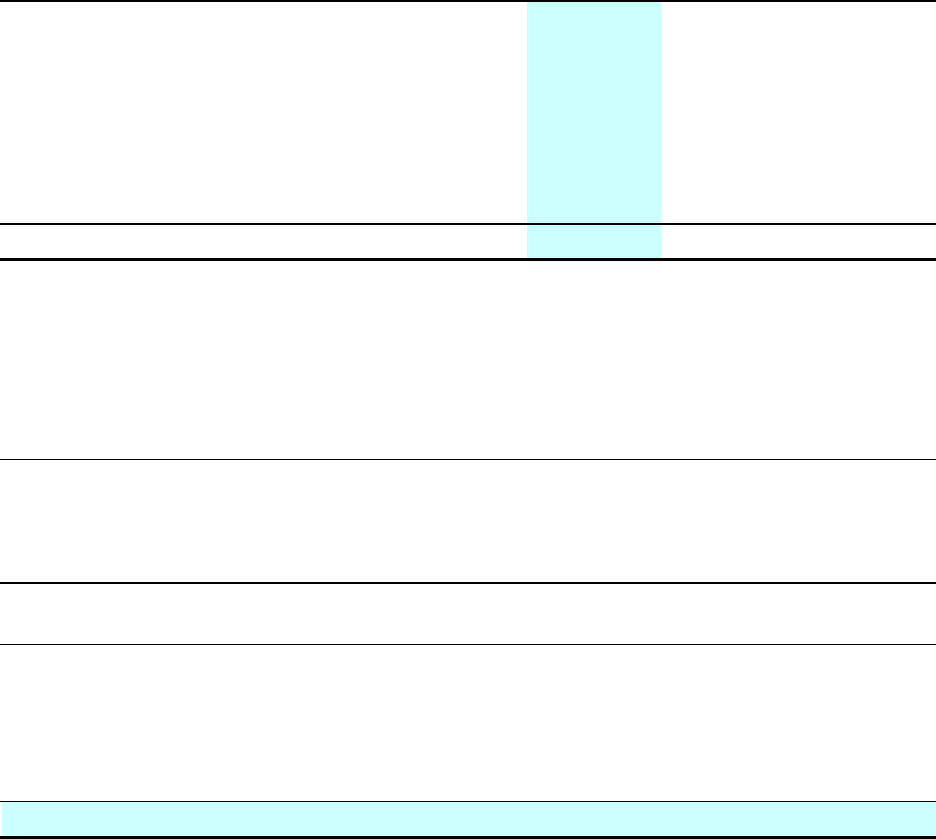

14. COMPREHENSIVE INCOME

COMPONENTS OF TOTAL COMPREHENSIVE INCOME

(In thousands, net of income taxes)

Net earnings 380,878$ 281,668$ 59,213$

Other comprehensive income (loss):

Retirement plans:

Amounts arising during the year 1,828 (2,686) (20,363)

Amortization recognized in net pension expense 190 ― (539)

Curtailment of retirement plans ― ― 20,770

Cash flow hedges:

Effective portion of changes in fair value (9,856)

Reclassifications to net income 2,327

Total comprehensive income 375,367$ 278,982$ 59,081$

Years Ended February 28

2011

2010

2009

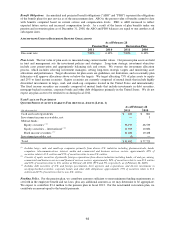

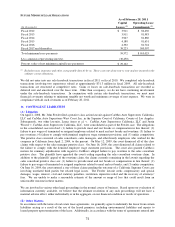

ACCUMULATED OTHER COMPREHENSIVE LOSS

Balance as of February 29, 2008 (15,926)$ (802)$ ―$ (16,728)$

Amounts arising during the year (20,363) ― (20,363)

― ―

(604) 65 (539)

Curtailment of retirement plans 20,033 737 20,770

Balance as of February 28, 2009 (16,860) ― ― (16,860)

Amounts arising during the year (2,686) ― (2,686)

Balance as of February 28, 2010 (19,546) ― ― (19,546)

Amounts arising during the year 1,828 ― 1,828

190 ― 190

Effective portion of changes in fair value (9,856) (9,856)

Reclassifications to net income 2,327 2,327

Balance as of February 28, 2011 (17,528)$ ―$ (7,529)$ (25,057)$

Amortization recognized in net pension

expense

Amortization recognized in net pension

expense

(In thousands, net of income taxes)

Unrecognized

Prior Service

Cost

Unrecognized

Hedge Losses

Total

Accumulated

Other

Comprehensive

Loss

Years Ended February 28

Unrecognized

Actuarial

(Losses) Gains

Changes in the funded status of our retirement plans and the effective portion of changes in the fair value of

derivatives that are designated and qualify as cash flow hedges are recognized in accumulated other comprehensive

loss. The cumulative balances are net of deferred tax of $10.7 million as of February 28, 2011, and $11.5 million as

of February 28, 2010.

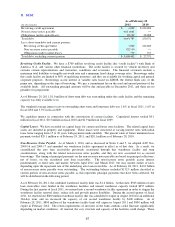

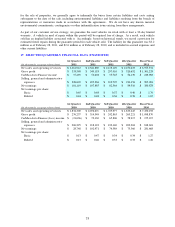

15. LEASE COMMITMENTS

We conduct a majority of our business in leased premises. Our lease obligations are based upon contractual

minimum rates. Most leases provide that we pay taxes, maintenance, insurance and operating expenses applicable to

the premises. The initial term of most real property leases will expire within the next 20 years; however, most of the

leases have options providing for renewal periods of 5 to 20 years at terms similar to the initial terms. For operating

leases, rent is recognized on a straight-line basis over the lease term, including scheduled rent increases and rent

holidays. Rent expense for all operating leases was $85.2 million in fiscal 2011, $85.3 million in fiscal 2010 and

$82.1 million in fiscal 2009.