CarMax 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

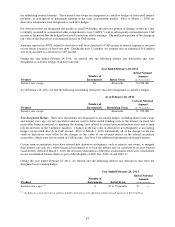

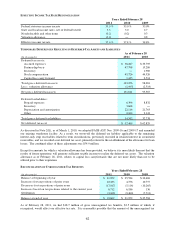

the underlying notional amount. These interest rate swaps are designated as cash flow hedges of forecasted interest

payments in anticipation of permanent funding in the term securitization market. Prior to March 1, 2010, no

derivative instruments were designated as cash flow hedges.

For derivatives that are designated and qualify as cash flow hedges, the effective portion of changes in the fair value

is initially recorded in accumulated other comprehensive loss (“AOCL”) and is subsequently reclassified into CAF

income in the period that the hedged forecasted transaction affects earnings. The ineffective portion of the change in

fair value of the derivatives is recognized directly in CAF income.

Amounts reported in AOCL related to derivatives will be reclassified to CAF income as interest expense is incurred

on our future issuances of fixed-rate debt. During the next 12 months, we estimate that an additional $5.8 million

will be reclassified as a decrease to CAF income.

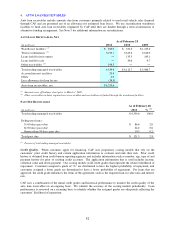

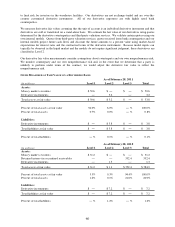

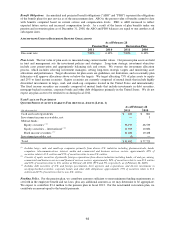

During the year ended February 28, 2011, we entered into the following interest rate derivatives that were

designated as cash flow hedges of interest rate risk:

Interest rate swaps 16 46 months $ 1,936,000

Product

Number of

Instruments

Initial Term

Year Ended February 28, 2011

Initial Notional

Amount

(in thousands)

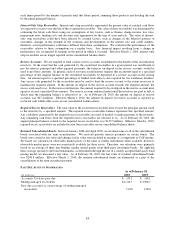

As of February 28, 2011, we had the following outstanding derivatives that were designated as cash flow hedges:

Interest rate swaps 8 46 months 972,000$

Product

Number of

Instruments

Remaining Term

As of February 28, 2011

Current Notional

Amount

(in thousands)

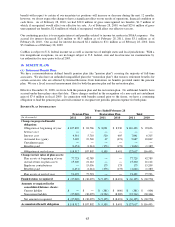

Non-designated Hedges. Derivative instruments not designated as accounting hedges, including interest rate swaps

and interest rate caps, are not speculative and are used to better match funding costs to the interest on fixed-rate

receivables being securitized, to minimize the funding costs related to certain term securitization trusts and to limit

risk for investors in the warehouse facilities. Changes in the fair value of derivatives not designated as accounting

hedges are recorded directly in CAF income. Prior to March 1, 2010, substantially all of the changes in the fair

value of derivatives were offset by the changes in fair value of our retained interest in the related securitized

receivables, which were also recorded in CAF income. See Note 5 for additional information on retained interest.

Certain term securitization trusts have entered into derivative instruments, such as interest rate swaps, to mitigate

their interest rate risk on a related financial instrument or to lock the interest rate on a portion of its asset-backed

variable debt. Effective March 1, 2010, the derivative instruments of the term securitization trusts were consolidated

on our consolidated balance sheets as part of the adoption of ASU Nos. 2009-16 and 2009-17.

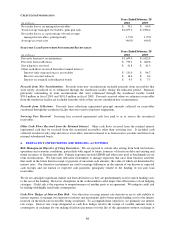

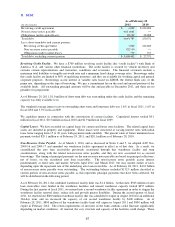

During the year ended February 28, 2011, we entered into the following interest rate derivatives that were not

designated as accounting hedges:

Interest rate caps (1) 4 47 to 53 months ―$

Product

Number of

Instruments

Initial Term

Year Ended February 28, 2011

Initial Notional

Amount

(in thousands)

(1) Includes two asset derivatives and two liability derivatives with offsetting initial notional amounts of $31.6 million.