CarMax 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

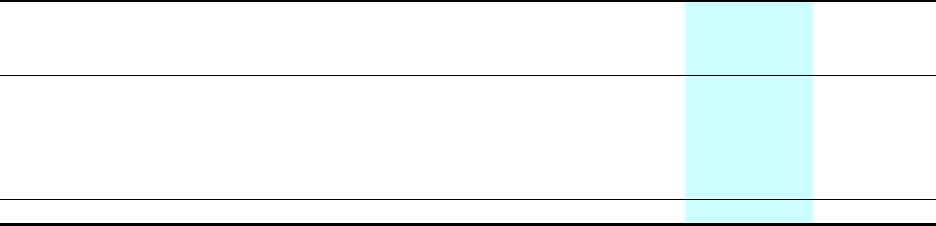

67

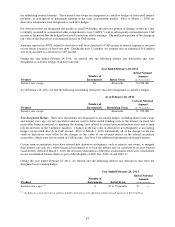

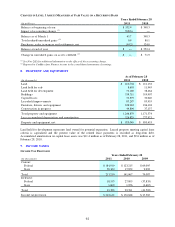

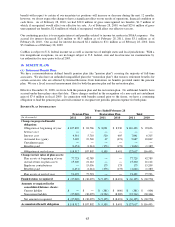

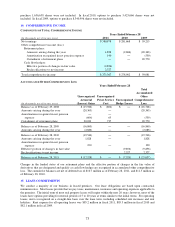

11. DEBT

(In thousands)

Revolving credit agreement 1,002$ 122,483$

Non-recourse notes payable 4,013,661 ―

Obligations under capital leases 29,122 28,088

Total debt 4,043,785 150,571

Less short-term debt and current portion:

Revolving credit agreement 1,002 122,483

Non-recourse notes payable 132,519 ―

Obligations under capital leases 772 717

Total debt, excluding current portion 3,909,492$ 27,371$

As of February 28

2011

2010

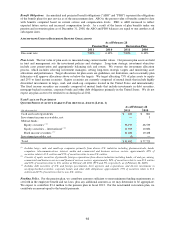

Revolving Credit Facility. We have a $700 million revolving credit facility (the “credit facility”) with Bank of

America, N.A. and various other financial institutions. The credit facility is secured by vehicle inventory and

contains certain representations and warranties, conditions and covenants. The financial covenants include a

maximum total liabilities to tangible net worth ratio and a minimum fixed charge coverage ratio. Borrowings under

this credit facility are limited to 80% of qualifying inventory, and they are available for working capital and general

corporate purposes. Borrowings accrue interest at variable rates based on LIBOR, the federal funds rate, or the

prime rate, depending on the type of borrowing. We pay a commitment fee on the used and unused portions of the

available funds. All outstanding principal amounts will be due and payable in December 2011, and there are no

penalties for prepayment.

As of February 28, 2011, $1.0 million of short-term debt was outstanding under the credit facility and the remaining

capacity was fully available to us.

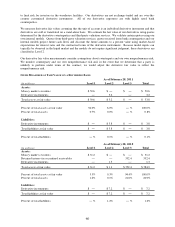

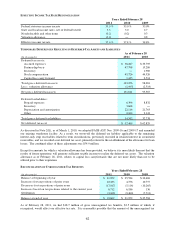

The weighted average interest rate on outstanding short-term and long-term debt was 1.6% in fiscal 2011, 1.6% in

fiscal 2010 and 3.5% in fiscal 2009.

We capitalize interest in connection with the construction of certain facilities. Capitalized interest totaled $0.1

million in fiscal 2011, $0.3 million in fiscal 2010 and $1.9 million in fiscal 2009.

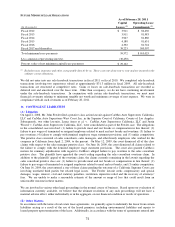

Capital Leases. We have recorded six capital leases for current and future store facilities. The related capital lease

assets are included in property and equipment. These leases were structured at varying interest rates with initial

lease terms ranging from 15 to 20 years with payments made monthly. The present value of future minimum lease

payments totaled $29.1 million as of February 28, 2011, and $28.1 million as of February 28, 2010.

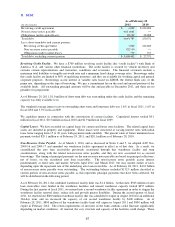

Non-Recourse Notes Payable. As of March 1, 2010, and as discussed in Notes 2 and 5, we adopted ASU Nos.

2009-16 and 2009-17 and amended our warehouse facility agreement in effect as of that date. As a result, we

consolidated the auto loan receivables previously securitized through that warehouse facility and term

securitizations, along with the related non-recourse notes payable, and they are now accounted for as secured

borrowings. The timing of principal payments on the non-recourse notes payable are based on principal collections,

net of losses, on the securitized auto loan receivables. The non-recourse notes payable accrue interest

predominantly at fixed rates and mature between April 2011 and March 2017, but may mature earlier or later,

depending upon the repayment rate of the underlying auto loan receivables. As of February 28, 2011, $4.01 billion

of non-recourse notes payable were outstanding. The outstanding balance included $132.5 million classified as

current portion of non-recourse notes payable, as this represents principal payments that have been collected, but

will be distributed in the following period.

As of February 28, 2011, the combined warehouse facility limit was $1.6 billion. At that date, $943 million of auto

loan receivables were funded in the warehouse facilities and unused warehouse capacity totaled $657 million.

During the first quarter of fiscal 2011, we entered into a second warehouse facility agreement in order to stagger the

warehouse facility renewal dates, reduce risk and provide greater flexibility. During the second quarter of fiscal

2011, we renewed our $800 million warehouse facility that was scheduled to expire in August 2010 for an additional

364-day term, and we increased the capacity of our second warehouse facility by $400 million. As of

February 28, 2011, $800 million of the warehouse facility limit will expire in August 2011 and $800 million will

expire in February 2012. The return requirements of investors in the bank conduits could fluctuate significantly

depending on market conditions. At renewal, the cost, structure and capacity of the facilities could change. These