CarMax 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

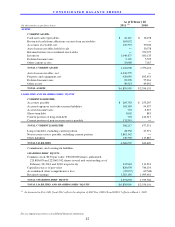

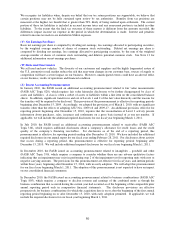

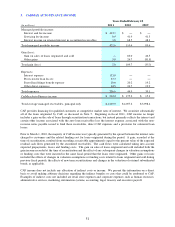

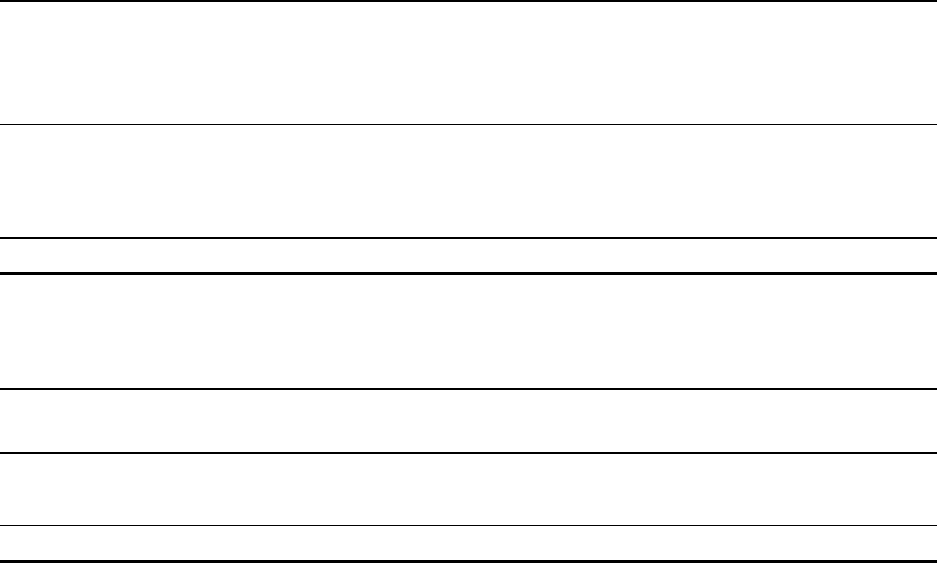

The table below shows the combined effects of the adoption of ASU Nos. 2009-16 and 2009-17 and the

March 1, 2010, amendment to our existing warehouse facility agreement on our February 28, 2010, consolidated

balance sheets:

(In thousands)

Current Assets:

Restricted cash from collections on auto loan receivables

$ 162,608

Accounts receivable, net (20,375)

Auto loan receivables held for sale (30,578)

Retained interest in securitized receivables (508,631)

Total Current Assets (396,976)

Auto loan receivables, net (1)(2) 4,043,595

Deferred income taxes 54,850

Other assets 43,835

TOTAL ASSETS $ 3,745,304

Current Liabilities:

Accounts payable $ 6,544

Accrued expenses and other current liabilities 5,584

Current portion of non-recourse notes payable (1) 134,798

Total Current Liabilities 146,926

Non-recourse notes payable (1)(2) 3,691,612

TOTAL LIABILITIES 3,838,538

TOTAL SHAREHOLDERS’ EQUITY (3) (93,234)

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 3,745,304

Increase

(Decrease)

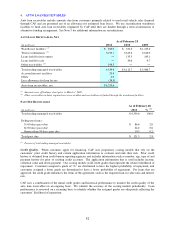

(1) The assets and liabilities of the term securitization trusts are separately presented on the face of the consolidated balance

sheets, as required by ASU No. 2009-17.

(2) In addition to the accounting change, this line includes the impact from the amendment to our existing warehouse facility

agreement resulting in $331.0 million of receivables, along with the related non-recourse notes payable, being consolidated.

(3) This solely represents the net effect of adopting ASU Nos. 2009-16 and 2007-17.

The adjustments in the above table include the following items:

Consolidation of the auto loan receivables and the related non-recourse notes payable funded in existing term

securitizations.

Consolidation of the auto loan receivables and the related non-recourse notes payable funded in the existing

warehouse facility.

Recognition of an allowance for loan losses on the consolidated auto loan receivables.

Consolidation of customer loan payments received but not yet distributed by the term securitization trusts.

These payments are included in restricted cash from collections on auto loan receivables.

Reclassification of auto loan receivables held for sale to auto loan receivables.

Reclassification of certain balances previously included in retained interest in securitized receivables that relate

to existing term securitizations.

Write-off of the remaining interest-only strip receivables related to term securitizations, previously recorded in

retained interest in securitized receivables, and the related deferred tax liability. These write-offs were charged

against retained earnings.

Recording of a net deferred tax asset, primarily related to the establishment of the allowance for loan losses.

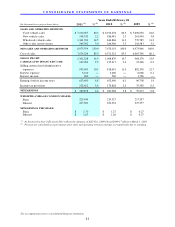

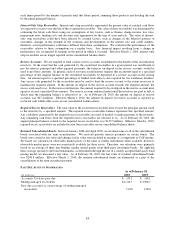

Beginning in fiscal 2011, CAF income no longer includes a gain on the sale of loans through securitization

transactions, but instead primarily reflects the interest and certain other income associated with the auto loan

receivables less the interest expense associated with the non-recourse notes payable issued to fund these receivables,

direct CAF expenses and a provision for estimated loan losses. See Notes 3 and 5 for additional information on

securitizations.