CarMax 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Income Taxes

Estimates and judgments are used in the calculation of certain tax liabilities and in the determination of the

recoverability of certain deferred tax assets. In the ordinary course of business, transactions occur for which the

ultimate tax outcome is uncertain at the time of the transactions. We adjust our income tax provision in the period in

which we determine that it is probable that our actual results will differ from our estimates. Tax law and rate

changes are reflected in the income tax provision in the period in which such changes are enacted. See Note 9 for

additional information on income taxes.

We evaluate the need to record valuation allowances that would reduce deferred tax assets to the amount that will

more likely than not be realized. When assessing the need for valuation allowances, we consider available

carrybacks, future reversals of existing temporary differences and future taxable income. Except for a valuation

allowance recorded for capital loss carryforwards that may not be utilized before their expiration, we believe that

our recorded deferred tax assets as of February 28, 2011, will more likely than not be realized. However, if a change

in circumstances results in a change in our ability to realize our deferred tax assets, our tax provision would be

affected in the period when the change in circumstances occurs.

In addition, the calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax

regulations. We recognize potential liabilities for anticipated tax audit issues in the U.S. and other tax jurisdictions

based on our estimate of whether, and the extent to which, additional taxes will be due. If payments of these

amounts ultimately prove to be unnecessary, the reversal of the liabilities would result in tax benefits being

recognized in the period when we determine the liabilities are no longer necessary. If our estimate of tax liabilities

proves to be less than the ultimate assessment, a further charge to expense would result in the period of

determination.

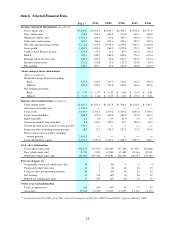

RESULTS OF OPERATIONS

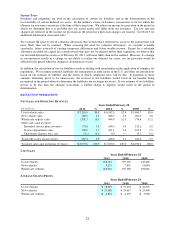

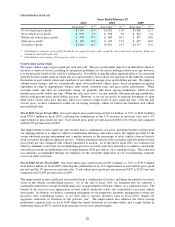

NET SALES AND OPERATING REVENUES

(In millions)

% % %

Used vehicle sales 7,210.0$ 80.3 6,192.3$ 82.9 5,690.7$ 81.6

New vehicle sales 198.5 2.2 186.5 2.5 261.9 3.8

Wholesale vehicle sales 1,301.7 14.5 844.9 11.3 779.8 11.2

Other sales and revenues:

Extended service plan revenues 173.8 1.9 144.5 1.9 125.2 1.8

Service department sales 100.6 1.1 101.1 1.4 101.2 1.5

Third-party finance fees, net (9.1) (0.1) 0.9 ― 15.3 0.2

Total other sales and revenues 265.3 3.0 246.6 3.3 241.6 3.5

Total net sales and operating revenues 8,975.6$ 100.0 7,470.2$ 100.0 6,974.0$ 100.0

2011

2010

2009

Years Ended February 28

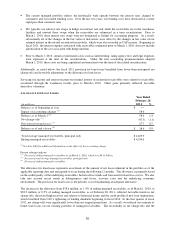

UNIT SALES

Used vehicles 396,181 357,129 345,465

New vehicles 8,231 7,851 11,084

Wholesale vehicles 263,061 197,382 194,081

2011

2010

2009

Years Ended February 28

AVERAGE SELLING PRICES

Used vehicles 18,019$ 17,152$ 16,291$

New vehicles 23,989$ 23,617$ 23,490$

Wholesale vehicles 4,816$ 4,155$ 3,902$

Years Ended February 28

2011

2010

2009