CarMax 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

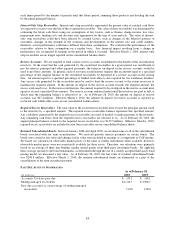

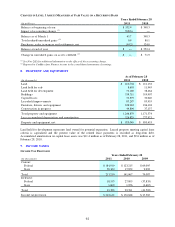

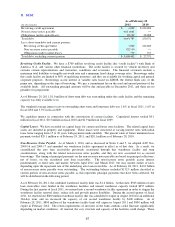

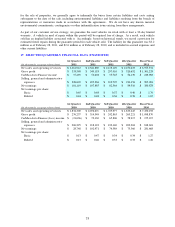

ESTIMATED FUTURE BENEFIT PAYMENTS

(In thousands)

Fiscal 2012 1,365$ 381$

Fiscal 2013 1,649$ 429$

Fiscal 2014 1,972$ 465$

Fiscal 2015 2,297$ 473$

2,638$ 482$

18,936$ 2,628$

Plan

Plan

Pension

Restoration

Fiscal 2016

Fiscal 2017 to 2021

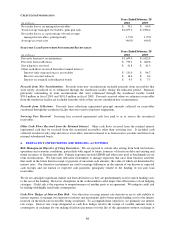

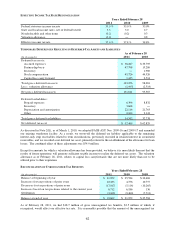

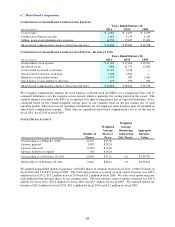

COMPONENTS OF NET PENSION EXPENSE

(In thousands)

2011 2010 2009 2011 2010 2009 2011 2010 2009

Service cost ―$ ―$ 10,548$ ―$ ―$ 832$ ―$ ―$ 11,380$

Interest cost 6,541 5,710 6,343 520 605 739 7,061 6,315 7,082

Expected return on plan

assets (6,580) (6,487) (5,572) ― ― ― (6,580) (6,487) (5,572)

Amortization of prior

service cost ― ― 23 ― ― 74 ― ― 97

Recognized actuarial

loss (gain) 280 ― (1,244) ― ― 247 280 ― (997)

Pension expense

(benefit) 241 (777) 10,098 520 605 1,892 761 (172) 11,990

Curtailment (gain) loss ― ― (8,229) ― ― 800 ― ― (7,429)

Net pension expense

(benefit) 241$ (777)$ 1,869$ 520$ 605$ 2,692$ 761$ (172)$ 4,561$

Years Ended February 28

Pension Plan

Restoration Plan

Total

CHANGES NOT RECOGNIZED IN NET PENSION EXPENSE BUT

RECOGNIZED IN OTHER COMPREHENSIVE INCOME

(In thousands)

Net actuarial (gain) loss (3,020)$ 4,914$ 68$ (671)$ (2,952)$ 4,243$

Years Ended February 28

Pension Plan

Restoration Plan

Total

2011

2010

2011

2010

2011

2010

In fiscal 2012, we anticipate that $0.5 million in estimated actuarial losses of the pension plan will be amortized

from accumulated other comprehensive loss. We do not anticipate that any estimated actuarial losses will be

amortized from accumulated other comprehensive loss for the restoration plan.

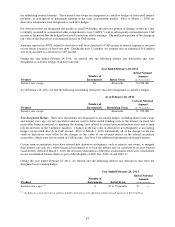

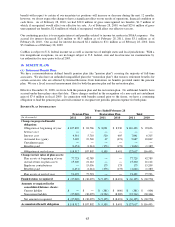

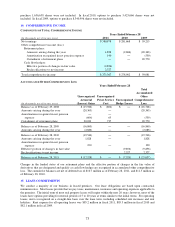

ASSUMPTIONS USED TO DETERMINE NET PENSION EXPENSE

2011 2010 2009 2011 2010 2009

Discount rate (1) 6.10% 6.85% 6.85% 6.10% 6.85% 6.85%

Expected rate of return on plan assets 7.75% 7.75% 8.00% ― ― ―

Rate of compensation increase ― ― 5.00% ― ― 7.00%

Years Ended February 28 or 29

Pension Plan

Restoration Plan

(1) For fiscal 2009, a discount rate of 7.70% was used to determine the effects of the curtailment at October 21, 2008.

Assumptions. Underlying both the calculation of the PBO and the net pension expense are actuarial calculations of

each plan's liability. These calculations use participant-specific information such as salary, age and years of service,

as well as certain assumptions, the most significant being the discount rate, rate of return on plan assets and

mortality rate. We evaluate these assumptions at least once a year and make changes as necessary.