CarMax 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

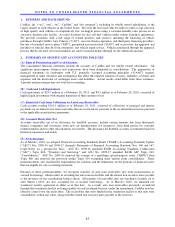

We recognize tax liabilities when, despite our belief that our tax return positions are supportable, we believe that

certain positions may not be fully sustained upon review by tax authorities. Benefits from tax positions are

measured at the highest tax benefit that is greater than 50% likely of being realized upon settlement. The current

portion of these tax liabilities is included in accrued income taxes and any noncurrent portion is included in other

liabilities. To the extent that the final tax outcome of these matters is different from the amounts recorded, the

differences impact income tax expense in the period in which the determination is made. Interest and penalties

related to income tax matters are included in SG&A expenses.

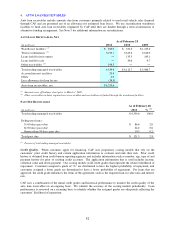

(V) Net Earnings Per Share

Basic net earnings per share is computed by dividing net earnings, less earnings allocated to participating securities,

by the weighted average number of shares of common stock outstanding. Diluted net earnings per share is

computed by dividing net earnings, less earnings allocated to participating securities, by the sum of the weighted

average number of shares of common stock outstanding and dilutive potential common stock. See Note 13 for

additional information on net earnings per share.

(W) Risks and Uncertainties

We sell used and new vehicles. The diversity of our customers and suppliers and the highly fragmented nature of

the U.S. automotive retail market reduce the risk that near-term changes in our customer base, sources of supply or

competition will have a severe impact on our business. However, unanticipated events could have an adverse effect

on our business, results of operations and financial condition.

(X) Recent Accounting Pronouncements

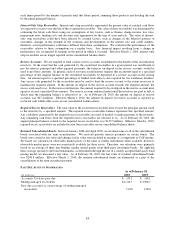

In January 2010, the FASB issued an additional accounting pronouncement related to fair value measurements

(FASB ASC Topic 820), which requires fair value hierarchy disclosures to be further disaggregated by class of

assets and liabilities. A class is often a subset of assets or liabilities within a line item on the consolidated balance

sheets. In addition, significant transfers in and out of Levels 1 and 2 of the fair value hierarchy and the reasons for

the transfers will be required to be disclosed. This provision of the pronouncement is effective for reporting periods

beginning after December 15, 2009. Accordingly, we adopted the provision as of March 1, 2010, with no significant

transfers other than the effects of adopting ASU Nos. 2009-16 and 2009-17. An additional provision, effective for

reporting periods beginning after December 15, 2010, requires that the reconciliation of Level 3 activity present

information about purchases, sales, issuances and settlements on a gross basis instead of as one net number. If

applicable, we will include the additional required disclosures for our fiscal year beginning March 1, 2011.

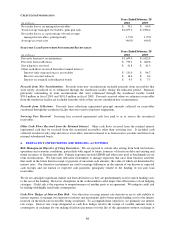

In July 2010, the FASB issued an additional accounting pronouncement related to receivables (FASB ASC

Topic 310), which requires additional disclosures about a company’s allowance for credit losses and the credit

quality of the company’s financing receivables. For disclosures as of the end of a reporting period, this

pronouncement is effective for reporting periods ending after December 15, 2010. We have included the additional

required disclosures in our annual report for our fiscal year ending February 28, 2011. For disclosures about activity

that occurs during a reporting period, this pronouncement is effective for reporting periods beginning after

December 15, 2010. We will include additional required disclosures for our fiscal year beginning March 1, 2011.

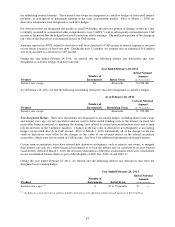

In December 2010, the FASB issued an accounting pronouncement related to intangibles – goodwill and other

(FASB ASC Topic 350), which requires a company to consider whether there are any adverse qualitative factors

indicating that an impairment may exist in performing step 2 of the impairment test for reporting units with zero or

negative carrying amounts. The provisions for this pronouncement are effective for fiscal years, and interim periods

within those years, beginning after December 15, 2010, with no early adoption. We will adopt this pronouncement

for our fiscal year beginning March 1, 2011. The adoption of this pronouncement is not expected to have an impact

on our consolidated financial statements.

In December 2010, the FASB issued an accounting pronouncement related to business combinations (FASB ASC

Topic 805), which requires a company to disclose revenue and earnings of the combined entity as though the

business combination that occurred during the current year had occurred as of the beginning of the comparable prior

annual reporting period only in comparative financial statements. The disclosure provisions are effective

prospectively for business combinations for which the acquisition date is on or after the beginning of the first annual

reporting period beginning on or after December 15, 2010, with early adoption permitted. If applicable, we will

include the required disclosures for our fiscal year beginning March 1, 2011.