CarMax 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

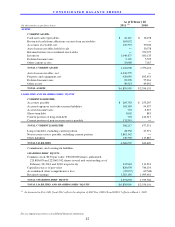

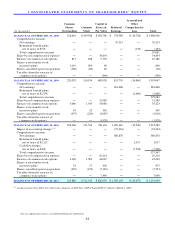

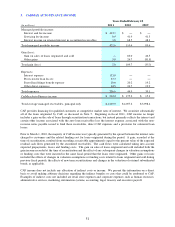

C O N S O L I D A T E D S T A T E M E N T S O F S H A R E H O L D E R S ’ E Q U I T Y

See accompanying notes to consolidated financial statements.

44

(In thousands)

BALANCE AS OF FEBRUARY 29, 2008 218,616 109,308$ 641,766$ 754,580$ (16,728)$ 1,488,926$

Comprehensive income:

Net earnings ― ― ― 59,213 ― 59,213

Retirement benefit plans,

net of taxes of $176 ― ― ― ― (132) (132)

Total comprehensive income 59,081

Share-based compensation expense ― ― 34,854 ― ― 34,854

Exercise of common stock options 817 408 9,778 ― ― 10,186

Shares issued under stock

incentive plans 1,119 560 40 ― ― 600

Shares cancelled upon reacquisition

(160) (80) 40 ― ― (40)

Tax effect from the exercise of

common stock options ― ― (540) ― ― (540)

BALANCE AS OF FEBRUARY 28, 2009 220,392 110,196 685,938 813,793 (16,860) 1,593,067

Comprehensive income:

Net earnings ― ― ― 281,668 ― 281,668

Retirement benefit plans,

net of taxes of $1,556 ― ― ― ― (2,686) (2,686)

Total comprehensive income 278,982

Share-based compensation expense ― ― 31,589 ― ― 31,589

Exercise of common stock options 3,086 1,543 33,680 ― ― 35,223

Shares issued under stock

incentive plans 45 23 542 ― ― 565

Shares cancelled upon reacquisition

(457) (229) (3,687) ― ― (3,916)

Tax effect from the exercise of

common stock options ― ― (1,928) ― ― (1,928)

BALANCE AS OF FEBRUARY 28, 2010 223,066 111,533 746,134 1,095,461 (19,546) 1,933,582

Impact of accounting change (1) ― ― ― (93,234) ― (93,234)

Comprehensive income:

Net earnings ― ― ― 380,878 ― 380,878

Retirement benefit plans,

net of taxes of $1,215 ― ― ― ― 2,017 2,017

Cash flow hedges,

net of taxes of $398 ― ― ― ― (7,528) (7,528)

Total comprehensive income 375,367

Share-based compensation expense ― ― 29,214 ― ― 29,214

Exercise of common stock options 3,126 1,563 44,067 ― ― 45,630

Shares issued under stock

incentive plans 33 17 458 ― ― 475

Shares cancelled upon reacquisition

(339) (170) (7,183) ― ― (7,353)

Tax effect from the exercise of

common stock options ― ― 7,949 ― ― 7,949

BALANCE AS OF FEBRUARY 28, 2011 225,886 112,943$ 820,639$ 1,383,105$ (25,057)$ 2,291,630$

Total

Accumulated

Common

Capital in

Other

Shares

Common

Excess of

Retained

Comprehensive

Outstanding

Stock

Par Value

Earnings

Loss

(1) As discussed in Note 2(E), this reflects the adoption of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010