CarMax 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

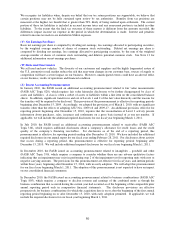

agreements to the warehouse facility agents. As of February 28, 2011, we were in compliance with the financial

covenants and the securitized receivables were in compliance with the performance triggers.

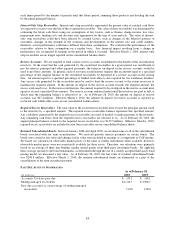

Continuing Involvement with Securitized Receivables. We continue to manage the auto loan receivables that we

securitize. We receive servicing fees of approximately 1% of the outstanding principal balance of the securitized

receivables. We believe that the servicing fees specified in the securitization agreements adequately compensate us

for servicing the securitized receivables. No servicing asset or liability has been recorded.

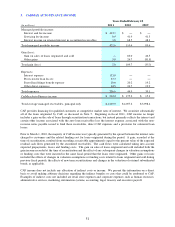

Transition. Effective March 1, 2010, all transfers of auto loan receivables related to the warehouse facilities are

accounted for as secured borrowings. These transfers represent only a portion of the auto loan receivables and this

portion does not meet the definition of a participating interest because our interest in the transferred receivables is

subordinate to the interest of the investors in the bank conduits.

As of March 1, 2010, we amended our warehouse facility agreement in effect as of that date. As a result, auto loan

receivables previously securitized through that warehouse facility no longer qualify for sale treatment because,

under the amendment, CarMax now has effective control over the receivables. The receivables that were funded in

the warehouse facility at that date were consolidated, at their fair value, along with the related non-recourse notes

payable to the investors.

With the removal of the QSPE consolidation exemption from FASB ASC Topic 810, effective March 1, 2010, we

are required to evaluate existing and future term securitization trusts for consolidation. In our capacity as servicer,

we have the power to direct the activities of the trusts that most significantly impact the economic performance of

the receivables. In addition, we have the obligation to absorb losses (subject to limitations) and the rights to receive

any returns of the trusts, which could be significant. Accordingly, we are the primary beneficiary of the trusts and

are required to consolidate them, effective March 1, 2010. The auto loan receivables securitized through the term

securitization trusts were consolidated at their unpaid principal balances as of that date, net of an allowance for loan

losses, along with the related non-recourse notes payable to the investors.

See Note 2(E) for a summary of the combined effects of the adoption of ASU Nos. 2009-16 and 2009-17 and the

March 1, 2010, amendment to our existing warehouse facility agreement.

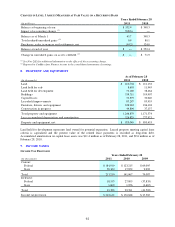

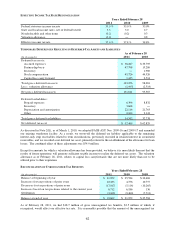

As of February 28, 2011, $4.33 billion in ending managed receivables were reported in accordance with FASB ASC

Topic 810. This amount serves as collateral for the related non-recourse notes payable of $4.01 billion as of the

same date. See Notes 4 and 11 for additional information on auto loan receivables and non-recourse notes payable.

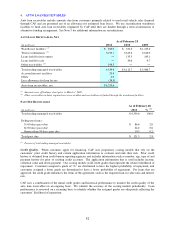

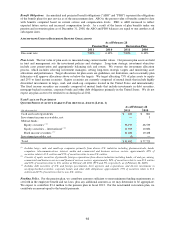

Retained Interest. Prior to March 1, 2010, all transfers of auto loan receivables were accounted for as sales. When

the receivables were securitized, we recognized a gain on the sale and retained an interest in the receivables that

were securitized. The retained interest included the present value of the expected residual cash flows generated by

the securitized receivables, or “interest-only strip receivables,” various reserve accounts, required excess receivables

and retained subordinated bonds. As of February 28, 2011, there was no retained interest, as all transfers of auto

loan receivables were accounted for as secured borrowings.

As part of the adoption of ASU Nos. 2009-16 and 2009-17, as of March 1, 2010, any retained interest related to term

securitizations was either eliminated or reclassified, generally to auto loan receivables, accrued interest receivable or

restricted cash. On March 1, 2010, we also amended our existing warehouse facility agreement. However, this did

not result in the elimination or reclassification of the retained interest related to the receivables that were funded in

the warehouse facility as of that date. In May 2010, we repurchased the remaining portion of those receivables and

resecuritized them through our second warehouse facility established in the first quarter of fiscal 2011. As a result,

the retained interest related to these receivables was either eliminated or reclassified at that time. See Note 11 for

additional information on our warehouse facilities.

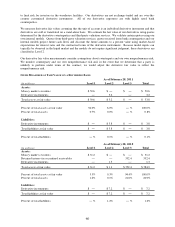

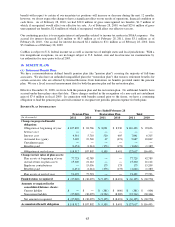

Fiscal 2010 Securitization Information

Except as noted, the following disclosures apply to our securitization activities prior to March 1, 2010, when

transfers of auto loan receivables were accounted for as sales.

The fair value of the retained interest was $552.4 million as of February 28, 2010, and the receivables underlying the

retained interest had a weighted average life of 1.5 years as of that date. The weighted average life in periods (for

example, months or years) of prepayable assets was calculated by multiplying the principal collections expected in