CarMax 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

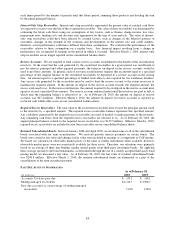

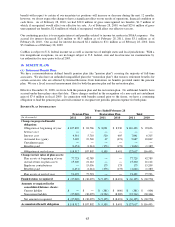

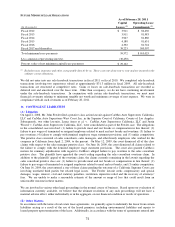

Benefit Obligations. Accumulated and projected benefit obligations (“ABO” and “PBO”) represent the obligations

of the benefit plans for past service as of the measurement date. ABO is the present value of benefits earned to date

with benefits computed based on current service and compensation levels. PBO is ABO increased to reflect

expected future service and increased compensation levels. As a result of the freeze of plan benefits under our

pension and restoration plans as of December 31, 2008, the ABO and PBO balances are equal to one another at all

subsequent dates.

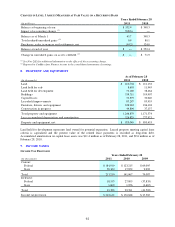

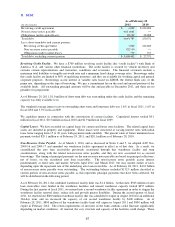

ASSUMPTIONS USED TO DETERMINE BENEFIT OBLIGATIONS

2011 2010

Discount rate 5.80% 6.10% 5.80% 6.10%

As of February 28

Pension Plan

Restoration Plan

2011

2010

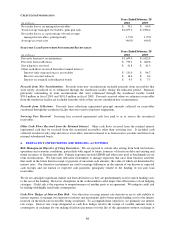

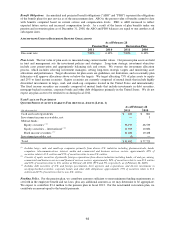

Plan Assets. The fair value of plan assets is measured using current market values. Our pension plan assets are held

in trust and management sets the investment policies and strategies. Long-term strategic investment objectives

include asset preservation and appropriately balancing risk and return. We oversee the investment allocation

process, which includes selecting investment managers, setting long-term strategic targets and monitoring asset

allocations and performance. Target allocations for plan assets are guidelines, not limitations, and occasionally plan

fiduciaries will approve allocations above or below the targets. We target allocating 75% of plan assets to equity

and 25% to fixed income securities. Equity securities are currently composed of mutual funds that include highly

diversified investments in large-, mid- and small-cap companies located in the United States and internationally.

The fixed income securities are currently composed of mutual funds that include investments in debt securities,

mortgage-backed securities, corporate bonds and other debt obligations primarily in the United States. We do not

expect any plan assets to be returned to us during fiscal 2012.

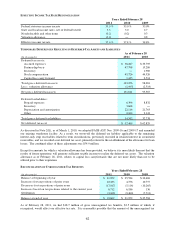

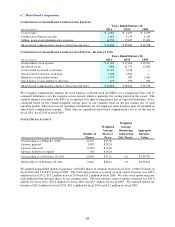

FAIR VALUE OF PLAN ASSETS

QUOTED PRICES IN ACTIVE MARKETS FOR IDENTICAL ASSETS (LEVEL 1)

(In thousands)

Cash and cash equivalents 421$ 861$

Investment income receivables, net ― 3

Mutual funds:

Equity securities (1) 58,197 46,539

Equity securities – international (2) 11,395 10,882

Fixed income securities (3) 21,482 19,438

Investment payables, net (3) ―

Total 91,492$ 77,723$

2011

2010

As of February 28

(1) Includes large-, mid- and small-cap companies primarily from diverse U.S. industries including pharmaceuticals, banks,

computers, telecommunications, internet, media and commercial and business services sectors; approximately 85% of

securities relate to U.S. entities and 15% of securities relate to non-U.S. entities.

(2) Consists of equity securities of primarily foreign corporations from diverse industries including banks, oil and gas, mining,

commercial and business services and financial services sectors; approximately 90% of securities relate to non-U.S. entities

and 10% of securities relate to U.S. entities as February 28, 2011 (95% and 5%, respectively, as of February 28, 2010).

(3) Includes debt securities of U.S. and foreign governments, their agencies and corporations, and diverse investments in

mortgage-backed securities, corporate bonds, and other debt obligations; approximately 75% of securities relate to U.S.

entities and 25% of securities relate to non-U.S. entities.

Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements as

set forth in the employee benefit and tax laws, plus any additional amounts as we may determine to be appropriate.

We expect to contribute $3.4 million to the pension plan in fiscal 2012. For the non-funded restoration plan, we

contribute an amount equal to the benefit payments.