CarMax 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

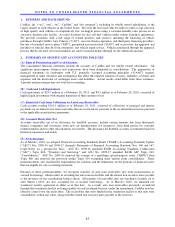

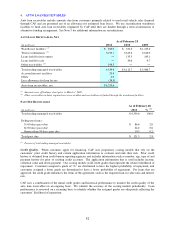

(J) Other Assets

Computer Software Costs. We capitalize external direct costs of materials and services used in, and payroll and

related costs for employees directly involved in the development of, internal-use software. We amortize amounts

capitalized on a straight-line basis over five years.

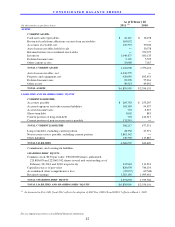

Goodwill and Intangible Assets. Goodwill and other intangibles had a carrying value of $10.1 million as of

February 28, 2011 and 2010. We review goodwill and intangible assets for impairment annually or when

circumstances indicate the carrying amount may not be recoverable. No impairment of goodwill or intangible assets

resulted from our annual impairment tests in fiscal 2011, fiscal 2010 or fiscal 2009.

Restricted Cash on Deposit in Reserve Accounts. The restricted cash on deposit in reserve accounts is for the

benefit of the securitization investors. In the event that the cash generated by the securitized receivables in a given

period was insufficient to pay the interest, principal and other required payments, the balances on deposit in the

reserve accounts would be used to pay those amounts. These funds are restricted for the benefit of holders of non-

recourse notes payable and are not expected to be available to the company or its creditors. Restricted cash on

deposit in reserve accounts was $45.0 million as of February 28, 2011. Prior to March 1, 2010, the amount on

deposit in reserve accounts was a component of retained interest in securitized receivables. See Note 5 for

additional information on securitizations.

Restricted Investments. Restricted investments consist of money market securities associated with certain insurance

programs. Due to the short-term nature and/or variable rates associated with these financial instruments, the

carrying value approximates fair value. Restricted investments included $26.7 million in money market securities as

of February 28, 2011, and $30.7 million as of February 28, 2010. For fiscal 2011, there were no proceeds from the

sales of other debt securities. For fiscal 2010, proceeds from the sales of other debt securities totaled $2.2 million.

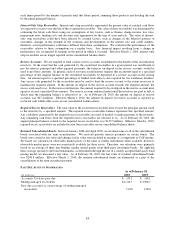

(K) Other Accrued Expenses

As of February 28, 2011 and 2010, accrued expenses and other current liabilities included accrued compensation

and benefits of $65.9 million and $62.1 million, respectively, and loss reserves for general liability and workers’

compensation insurance of $21.6 million and $23.9 million, respectively.

(L) Defined Benefit Plan Obligations

The recognized funded status of defined benefit retirement plan obligations is included both in accrued expenses and

other current liabilities and in other liabilities. The current portion represents benefits expected to be paid from our

benefit restoration plan over the next 12 months. The defined benefit retirement plan obligations are determined by

independent actuaries using a number of assumptions provided by CarMax. Key assumptions used in measuring the

plan obligations include the discount rate, rate of return on plan assets and mortality rate.

(M) Insurance Liabilities

Insurance liabilities are included in accrued expenses and other current liabilities. We use a combination of

insurance and self-insurance for a number of risks including workers' compensation, general liability and employee-

related health care costs, a portion of which is paid by associates. Estimated insurance liabilities are determined by

considering historical claims experience, demographic factors and other actuarial assumptions.

(N) Revenue Recognition

We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or

upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a

5-day, money-back guarantee. If a customer returns the vehicle purchased within the parameters of the guarantee,

we will refund the customer's money. We record a reserve for returns based on historical experience and trends.

We sell ESPs and GAP on behalf of unrelated third parties. The ESPs we offer on all used vehicles provide

coverage up to 72 months (subject to mileage limitations), while GAP covers the customer for the term of their

finance contract. Because we are not the primary obligor under these plans, we recognize commission revenue at

the time of sale, net of a reserve for estimated customer returns. The reserve for returns is based on historical

experience and trends.

We collect sales taxes and other taxes from customers on behalf of governmental authorities at the time of sale.

These taxes are accounted for on a net basis and are not included in net sales and operating revenues or cost of sales.