Berkshire Hathaway 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.An old Wall Street joke gets close to our experience:

Customer: Thanks for putting me in XYZ stock at 5. I hear it’s up to 18.

Broker: Yes, and that’s just the beginning. In fact, the company is doing so well now,

that it’s an even better buy at 18 than it was when you made your purchase.

Customer: Damn, I knew I should have waited.

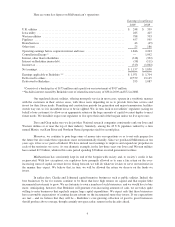

GEICO’s growth may slow in 2010. U.S. vehicle registrations are actually down because of slumping

auto sales. Moreover, high unemployment is causing a growing number of drivers to go uninsured. (That’s illegal

almost everywhere, but if you’ve lost your job and still want to drive . . .) Our “low-cost producer” status,

however, is sure to give us significant gains in the future. In 1995, GEICO was the country’s sixth largest auto

insurer; now we are number three. The company’s float has grown from $2.7 billion to $9.6 billion. Equally

important, GEICO has operated at an underwriting profit in 13 of the 14 years Berkshire has owned it.

I became excited about GEICO in January 1951, when I first visited the company as a 20-year-old

student. Thanks to Tony, I’m even more excited today.

************

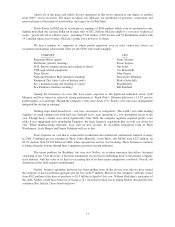

A hugely important event in Berkshire’s history occurred on a Saturday in 1985. Ajit Jain came into

our office in Omaha – and I immediately knew we had found a superstar. (He had been discovered by Mike

Goldberg, now elevated to St. Mike.)

We immediately put Ajit in charge of National Indemnity’s small and struggling reinsurance operation.

Over the years, he has built this business into a one-of-a-kind giant in the insurance world.

Staffed today by only 30 people, Ajit’s operation has set records for transaction size in several areas of

insurance. Ajit writes billion-dollar limits – and then keeps every dime of the risk instead of laying it off with

other insurers. Three years ago, he took over huge liabilities from Lloyds, allowing it to clean up its relationship

with 27,972 participants (“names”) who had written problem-ridden policies that at one point threatened the

survival of this 322-year-old institution. The premium for that single contract was $7.1 billion. During 2009, he

negotiated a life reinsurance contract that could produce $50 billion of premium for us over the next 50 or so

years.

Ajit’s business is just the opposite of GEICO’s. At that company, we have millions of small policies

that largely renew year after year. Ajit writes relatively few policies, and the mix changes significantly from year

to year. Throughout the world, he is known as the man to call when something both very large and unusual needs

to be insured.

If Charlie, I and Ajit are ever in a sinking boat – and you can only save one of us – swim to Ajit.

************

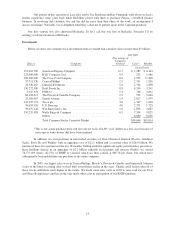

Our third insurance powerhouse is General Re. Some years back this operation was troubled; now it is

a gleaming jewel in our insurance crown.

Under the leadership of Tad Montross, General Re had an outstanding underwriting year in 2009, while

also delivering us unusually large amounts of float per dollar of premium volume. Alongside General Re’s P/C

business, Tad and his associates have developed a major life reinsurance operation that has grown increasingly

valuable.

Last year General Re finally attained 100% ownership of Cologne Re, which since 1995 has been a

key – though only partially-owned – part of our presence around the world. Tad and I will be visiting Cologne in

September to thank its managers for their important contribution to Berkshire.

7