Berkshire Hathaway 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

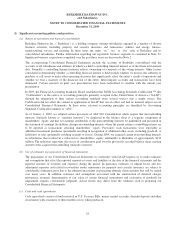

Notes to Consolidated Financial Statements (Continued)

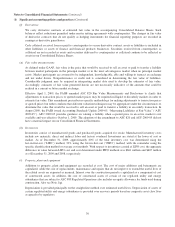

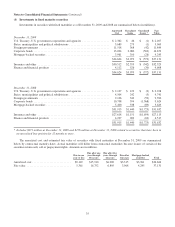

(5) Investments in equity securities

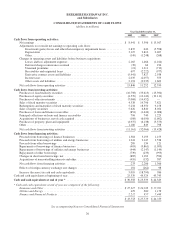

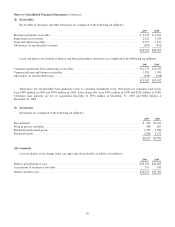

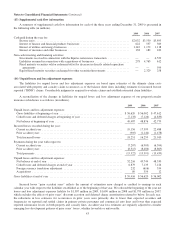

Investments in equity securities as of December 31, 2009 and December 31, 2008 are summarized below (in millions).

Cost Basis

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2009

American Express Company ........................................... $ 1,287 $ 4,856 $ — $ 6,143

The Coca-Cola Company .............................................. 1,299 10,101 — 11,400

Kraft Foods Inc. ..................................................... 4,330 — (789) 3,541

The Procter & Gamble Company ........................................ 4,962 78 — 5,040

Wells Fargo & Company .............................................. 7,394 2,721 (1,094) 9,021

Other .............................................................. 17,935 7,118 (1,164) 23,889

$37,207 $24,874 $(3,047) $59,034

Insurance and other .................................................. $36,538 $23,070 $(3,046) $56,562

Utilities and energy * ................................................. 232 1,754 — 1,986

Finance and financial products * ........................................ 437 50 (1) 486

$37,207 $24,874 $(3,047) $59,034

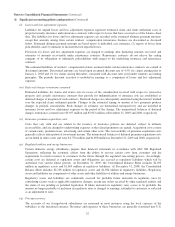

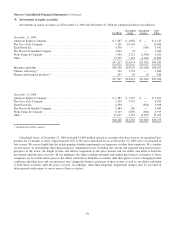

December 31, 2008

American Express Company ........................................... $ 1,287 $ 1,525 $ — $ 2,812

The Coca-Cola Company .............................................. 1,299 7,755 — 9,054

Kraft Foods Inc. ..................................................... 4,330 — (832) 3,498

The Procter & Gamble Company ........................................ 5,484 200 — 5,684

Wells Fargo & Company .............................................. 6,703 2,850 (580) 8,973

Other .............................................................. 21,037 2,452 (4,437) 19,052

$40,140 $14,782 $(5,849) $49,073

* Included in Other assets.

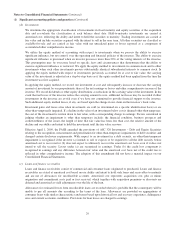

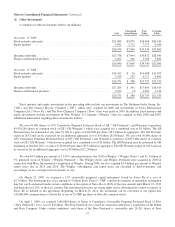

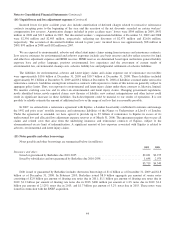

Unrealized losses at December 31, 2009 included $1,864 million related to securities that have been in an unrealized loss

position for 12 months or more. Approximately 90% of the gross unrealized losses at December 31, 2009 were concentrated in

four issuers. We use no bright-line test in determining whether impairments are temporary or other than temporary. We consider

several factors in determining other-than-temporary impairment losses including the current and expected long-term business

prospects of the issuer, the length of time and relative magnitude of the price decline and our ability and intent to hold the

investment until the price recovers. In our judgment, the future earnings potential and underlying business economics of these

companies are favorable and we possess the ability and intent to hold these securities until their prices recover. Changing market

conditions and other facts and circumstances may change the business prospects of these issuers as well as our ability and intent

to hold these securities until the prices recover. Accordingly, other-than-temporary impairment charges may be recorded in

future periods with respect to one or more of these securities.

36