Berkshire Hathaway 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We told you last year that very unusual conditions then existed in the corporate and municipal bond

markets and that these securities were ridiculously cheap relative to U.S. Treasuries. We backed this view with

some purchases, but I should have done far more. Big opportunities come infrequently. When it’s raining gold,

reach for a bucket, not a thimble.

We entered 2008 with $44.3 billion of cash-equivalents, and we have since retained operating earnings

of $17 billion. Nevertheless, at yearend 2009, our cash was down to $30.6 billion (with $8 billion earmarked for

the BNSF acquisition). We’ve put a lot of money to work during the chaos of the last two years. It’s been an

ideal period for investors: A climate of fear is their best friend. Those who invest only when commentators are

upbeat end up paying a heavy price for meaningless reassurance. In the end, what counts in investing is what you

pay for a business – through the purchase of a small piece of it in the stock market – and what that business earns

in the succeeding decade or two.

************

Last year I wrote extensively about our derivatives contracts, which were then the subject of both

controversy and misunderstanding. For that discussion, please go to www.berkshirehathaway.com.

We have since changed only a few of our positions. Some credit contracts have run off. The terms of

about 10% of our equity put contracts have also changed: Maturities have been shortened and strike prices

materially reduced. In these modifications, no money changed hands.

A few points from last year’s discussion are worth repeating:

(1) Though it’s no sure thing, I expect our contracts in aggregate to deliver us a profit over their lifetime,

even when investment income on the huge amount of float they provide us is excluded in the

calculation. Our derivatives float – which is not included in the $62 billion of insurance float I

described earlier – was about $6.3 billion at yearend.

(2) Only a handful of our contracts require us to post collateral under any circumstances. At last year’s low

point in the stock and credit markets, our posting requirement was $1.7 billion, a small fraction of the

derivatives-related float we held. When we do post collateral, let me add, the securities we put up

continue to earn money for our account.

(3) Finally, you should expect large swings in the carrying value of these contracts, items that can affect

our reported quarterly earnings in a huge way but that do not affect our cash or investment holdings.

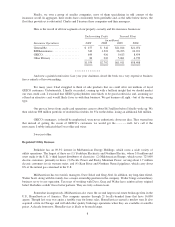

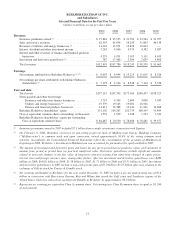

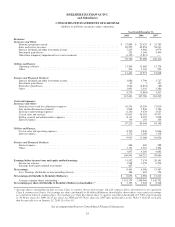

That thought certainly fit 2009’s circumstances. Here are the pre-tax quarterly gains and losses from

derivatives valuations that were part of our reported earnings last year:

Quarter $ Gain (Loss) in Billions

1 (1.517)

2 2.357

3 1.732

4 1.052

As we’ve explained, these wild swings neither cheer nor bother Charlie and me. When we report to

you, we will continue to separate out these figures (as we do realized investment gains and losses) so that you can

more clearly view the earnings of our operating businesses. We are delighted that we hold the derivatives

contracts that we do. To date we have significantly profited from the float they provide. We expect also to earn

further investment income over the life of our contracts.

15