Berkshire Hathaway 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

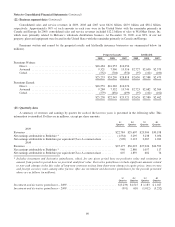

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

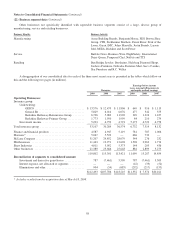

Berkshire Hathaway Reinsurance Group

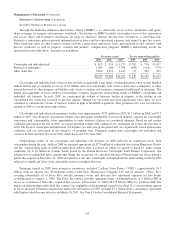

Through the Berkshire Hathaway Reinsurance Group (“BHRG”), we underwrite excess-of-loss reinsurance and quota-

share coverages for insurers and reinsurers worldwide. Our business in BHRG includes catastrophe excess-of-loss reinsurance

and excess direct and facultative reinsurance for large or otherwise unusual discrete risks referred to as individual risk.

Retroactive reinsurance policies provide indemnification of losses and loss adjustment expenses with respect to past loss events.

Other multi-line refers to other business written on both a quota-share and excess basis, participations in and contracts with

Lloyd’s syndicates as well as property, aviation and workers’ compensation programs. BHRG’s underwriting results are

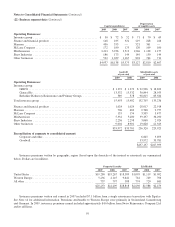

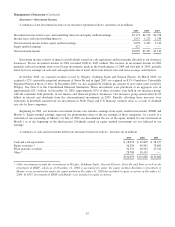

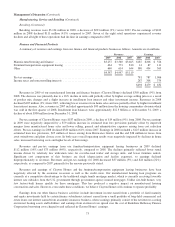

summarized in the table below. Amounts are in millions.

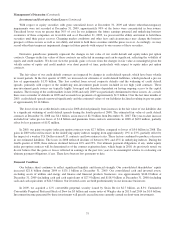

Premiums earned Pre-tax underwriting gain/loss

2009 2008 2007 2009 2008 2007

Catastrophe and individual risk ............................. $ 823 $ 955 $ 1,577 $ 782 $ 776 $1,477

Retroactive reinsurance ................................... 1,989 204 7,708 (448) (414) (375)

Other multi-line ......................................... 3,894 3,923 2,617 15 962 325

$6,706 $5,082 $11,902 $ 349 $1,324 $1,427

Catastrophe and individual risk contracts may provide exceptionally large limits of indemnification, often several hundred

million dollars and occasionally in excess of $1 billion, and cover catastrophe risks (such as hurricanes, earthquakes or other

natural disasters) or other property and liability risks (such as aviation and aerospace, commercial multi-peril or terrorism). The

timing and magnitude of losses produce extraordinary volatility in periodic underwriting results of BHRG’s catastrophe and

individual risk business. In early 2009, we constrained the volume of business written in response to the decline in our

consolidated net worth that occurred in the first quarter. Though our net worth recovered significantly since then, we have

continued to constrain the volume of business written in light of the BNSF acquisition. Also, premium rates were not attractive

enough in 2009 to warrant increasing volume.

Catastrophe and individual risk premiums written were approximately $725 million in 2009, $1.1 billion in 2008 and $1.2

billion in 2007. The decreases in premium volume were principally attributable to increased industry capacity for catastrophe

reinsurance and, consequently, fewer opportunities to write business at prices we considered adequate. Based on soft market

conditions prevailing at the end of 2009, we expect premium volume will continue to be constrained for at least the first half of

2010. The level of catastrophe and individual risk business we write in a given period will vary significantly based upon market

conditions and our assessment of the adequacy of premium rates. Premiums earned from catastrophe and individual risk

contracts in 2009 declined 14% from 2008, which decreased 39% from 2007.

Underwriting results of our catastrophe and individual risk business in 2009 reflected no significant losses from

catastrophes during the year, while in 2008 we incurred approximately $270 million of estimated losses from Hurricanes Gustav

and Ike. Underwriting gains in 2008 included $224 million from a contract in which we agreed to purchase, under certain

conditions, up to $4 billion of revenue bonds issued by the Florida Hurricane Catastrophe Fund Finance Corporation. Our

obligation was conditioned upon, among other things, the occurrence of a specified amount of Florida hurricane losses during a

period that expired on December 31, 2008 and which was not met. Catastrophe and individual risk underwriting results in 2007

reflected no significant losses from catastrophe events occurring in that year.

Premiums earned in 2009 from retroactive reinsurance included 2 billion Swiss Francs (“CHF”) (approximately $1.7

billion) from an adverse loss development contract with Swiss Reinsurance Company Ltd. and its affiliates (“Swiss Re”)

covering substantially all of Swiss Re’s non-life insurance losses and allocated loss adjustment expenses for loss events

occurring prior to January 1, 2009. The Swiss Re contract provides aggregate limits of indemnification of 5 billion CHF in

excess of a retention of Swiss Re’s reported loss reserves at December 31, 2008 (58.725 billion CHF) less 2 billion CHF. The

impact on underwriting results from this contract was negligible as the premiums earned were offset by a corresponding amount

of losses incurred. Premiums earned from retroactive reinsurance in 2007 included $7.1 billion from a reinsurance agreement

with Equitas which became effective on March 30, 2007. See Note 14 to the Consolidated Financial Statements.

65