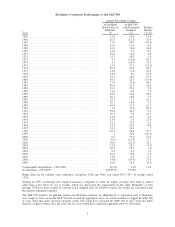

Berkshire Hathaway 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

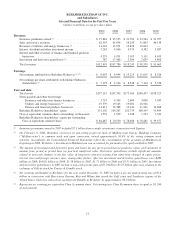

Almost all of the many and widely-diverse operations in this sector suffered to one degree or another

from 2009’s severe recession. The major exception was McLane, our distributor of groceries, confections and

non-food items to thousands of retail outlets, the largest by far Wal-Mart.

Grady Rosier led McLane to record pre-tax earnings of $344 million, which even so amounted to only

slightly more than one cent per dollar on its huge sales of $31.2 billion. McLane employs a vast array of physical

assets – practically all of which it owns – including 3,242 trailers, 2,309 tractors and 55 distribution centers with

15.2 million square feet of space. McLane’s prime asset, however, is Grady.

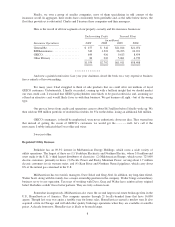

We had a number of companies at which profits improved even as sales contracted, always an

exceptional managerial achievement. Here are the CEOs who made it happen:

COMPANY CEO

Benjamin Moore (paint) Denis Abrams

Borsheims (jewelry retailing) Susan Jacques

H. H. Brown (manufacturing and retailing of shoes) Jim Issler

CTB (agricultural equipment) Vic Mancinelli

Dairy Queen John Gainor

Nebraska Furniture Mart (furniture retailing) Ron and Irv Blumkin

Pampered Chef (direct sales of kitchen tools) Marla Gottschalk

See’s (manufacturing and retailing of candy) Brad Kinstler

Star Furniture (furniture retailing) Bill Kimbrell

Among the businesses we own that have major exposure to the depressed industrial sector, both

Marmon and Iscar turned in relatively strong performances. Frank Ptak’s Marmon delivered a 13.5% pre-tax

profit margin, a record high. Though the company’s sales were down 27%, Frank’s cost-conscious management

mitigated the decline in earnings.

Nothing stops Israel-based Iscar – not wars, recessions or competitors. The world’s two other leading

suppliers of small cutting tools both had very difficult years, each operating at a loss throughout much of the

year. Though Iscar’s results were down significantly from 2008, the company regularly reported profits, even

while it was integrating and rationalizing Tungaloy, the large Japanese acquisition that we told you about last

year. When manufacturing rebounds, Iscar will set new records. Its incredible managerial team of Eitan

Wertheimer, Jacob Harpaz and Danny Goldman will see to that.

Every business we own that is connected to residential and commercial construction suffered severely

in 2009. Combined pre-tax earnings of Shaw, Johns Manville, Acme Brick, and MiTek were $227 million, an

82.5% decline from $1.295 billion in 2006, when construction activity was booming. These businesses continue

to bump along the bottom, though their competitive positions remain undented.

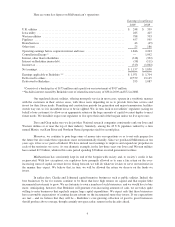

The major problem for Berkshire last year was NetJets, an aviation operation that offers fractional

ownership of jets. Over the years, it has been enormously successful in establishing itself as the premier company

in its industry, with the value of its fleet far exceeding that of its three major competitors combined. Overall, our

dominance in the field remains unchallenged.

NetJets’ business operation, however, has been another story. In the eleven years that we have owned

the company, it has recorded an aggregate pre-tax loss of $157 million. Moreover, the company’s debt has soared

from $102 million at the time of purchase to $1.9 billion in April of last year. Without Berkshire’s guarantee of

this debt, NetJets would have been out of business. It’s clear that I failed you in letting NetJets descend into this

condition. But, luckily, I have been bailed out.

11